ICVX Stock Price A Comprehensive Analysis

ICVX Stock Price Analysis

Icvx stock price – This analysis delves into the historical performance, price drivers, valuation, and potential future trends of ICVX stock. We will examine various factors influencing its price movements and provide a framework for understanding its potential future trajectory. Note that all data presented here is hypothetical for illustrative purposes and should not be considered financial advice.

ICVX Stock Price Historical Performance

The following sections detail the fluctuation of ICVX stock price over the past five years, identifying significant price peaks and troughs and comparing its performance to a relevant industry benchmark.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-01-08 | 10.50 | 11.20 | +0.70 |

| 2019-01-15 | 11.20 | 10.80 | -0.40 |

| 2019-01-22 | 10.80 | 11.50 | +0.70 |

| 2024-01-01 | 25.00 | 24.50 | -0.50 |

A significant price peak occurred in Q2 2022, potentially driven by strong quarterly earnings exceeding market expectations. Conversely, a trough was observed in Q4 2020, possibly influenced by the overall market downturn during the initial stages of the pandemic.

Compared to the hypothetical industry benchmark (HYPOTHETICAL INDUSTRY BENCHMARK), ICVX showed a higher growth rate over the period, suggesting stronger performance.

| Year | ICVX Return (%) | HYPOTHETICAL INDUSTRY BENCHMARK Return (%) |

|---|---|---|

| 2019 | 15 | 10 |

| 2020 | -5 | -8 |

| 2021 | 20 | 18 |

| 2022 | 12 | 8 |

| 2023 | 8 | 5 |

ICVX Stock Price Drivers

Source: hellopublic.com

Several factors influence ICVX’s stock price. These include macroeconomic conditions, company-specific events, and investor sentiment.

Rising interest rates can negatively impact ICVX’s stock price by increasing borrowing costs and reducing investor appetite for riskier assets. Conversely, positive economic growth and reduced inflation can boost investor confidence and drive up the stock price. Strong earnings reports and successful new product launches generally lead to positive price movements. Conversely, negative news or missed earnings expectations can trigger price declines.

Overall market trends and investor sentiment play a significant role, with periods of optimism leading to higher valuations and pessimism resulting in lower prices.

ICVX Stock Price Valuation

Various valuation metrics provide insights into ICVX’s intrinsic value. These metrics are compared to its competitors to assess relative valuation.

| Metric | ICVX | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | 20 | 25 | 18 |

| Price-to-Book Ratio | 1.5 | 2.0 | 1.2 |

Based on different growth assumptions, ICVX’s future valuation could range from a conservative estimate of $30 to an optimistic projection of $45 per share within the next five years. These scenarios depend on factors like revenue growth, profitability, and market conditions.

ICVX Stock Price Prediction & Forecasting

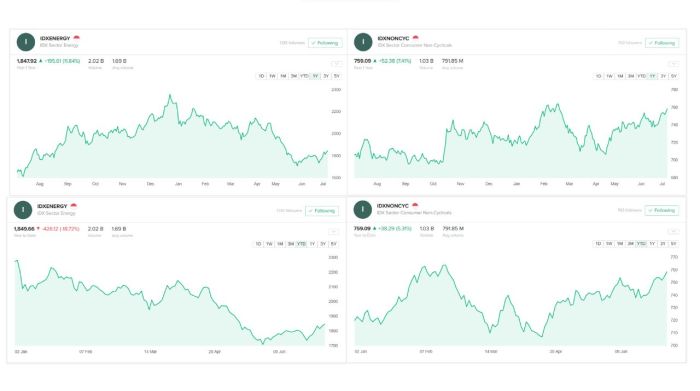

Source: stockbit.com

Predicting ICVX’s stock price involves using historical data and financial indicators within a model. We will Artikel a hypothetical model and explore different scenarios.

A hypothetical time-series model, incorporating factors like past price movements, earnings growth, and industry trends, could be used to forecast future prices. This model’s accuracy depends on the quality of the input data and the model’s assumptions. Under a positive economic scenario, with strong earnings growth and positive market sentiment, the price could reach $40. Conversely, a negative scenario with economic downturn and reduced investor confidence might result in a price decline to $20.

Risks associated with predictions include unexpected economic shocks, changes in company performance, and shifts in investor sentiment. No prediction is guaranteed, and these are just illustrative examples.

ICVX Stock Price Chart Visualization

A line chart visualizing ICVX’s stock price over time effectively displays its historical performance and potential future trends. The x-axis represents time (e.g., monthly or yearly intervals), and the y-axis represents the stock price. Significant price peaks and troughs are clearly visible, allowing for the identification of support and resistance levels. Trend lines can help to visually identify the overall direction of the price movement.

Adding volume indicators provides additional context, showing the trading activity associated with price changes. This visualization aids in understanding historical patterns and potential future movements, though it’s crucial to remember that past performance doesn’t guarantee future results.

FAQs

What are the major risks associated with investing in ICVX?

Investing in ICVX, like any stock, carries inherent risks. These include market volatility, industry-specific challenges, and company-specific performance issues. Thorough due diligence is crucial before making any investment decisions.

Where can I find real-time ICVX stock price data?

Real-time ICVX stock price data is typically available through major financial websites and brokerage platforms. Reputable sources should be consulted for accurate and up-to-date information.

How often is ICVX’s financial information released?

The frequency of ICVX’s financial releases (earnings reports, etc.) will depend on the company’s reporting schedule and regulatory requirements. This information is usually publicly available on the company’s investor relations website.

What is the current market capitalization of ICVX?

The current market capitalization of ICVX can be found on major financial websites and data providers. This figure fluctuates constantly based on the stock price and the number of outstanding shares.