Luminar Stock Price Today A Market Overview

Luminar Technologies Stock Analysis: Luminar Stock Price Today

Source: seekingalpha.com

Luminar stock price today – This analysis provides an overview of Luminar Technologies’ current stock performance, recent trends, and future outlook. We will examine its financial performance, competitor comparisons, and the impact of news and events on its stock price. The analysis incorporates data and observations from various sources to offer a comprehensive perspective.

Current Luminar Stock Price and Volume

As of [Insert Date and Time], Luminar Technologies (LAZR) stock is trading at [Insert Current Price]. The trading volume for today is [Insert Trading Volume]. The day’s high was [Insert Day’s High] and the low was [Insert Day’s Low].

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| [Date 1] | [Open Price 1] | [Close Price 1] | [High Price 1] | [Low Price 1] |

| [Date 2] | [Open Price 2] | [Close Price 2] | [High Price 2] | [Low Price 2] |

| [Date 3] | [Open Price 3] | [Close Price 3] | [High Price 3] | [Low Price 3] |

| [Date 4] | [Open Price 4] | [Close Price 4] | [High Price 4] | [Low Price 4] |

| [Date 5] | [Open Price 5] | [Close Price 5] | [High Price 5] | [Low Price 5] |

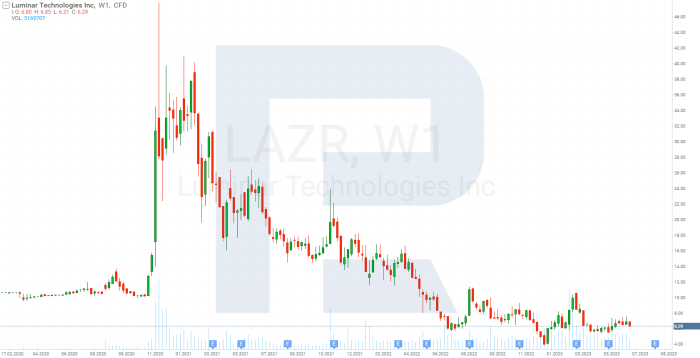

Recent Price Trends and Volatility, Luminar stock price today

Source: seekingalpha.com

Keeping an eye on the Luminar stock price today requires a broad perspective on the autonomous vehicle sector. Understanding the market involves looking at related companies, and for insights into potential future trends, checking out resources like this kzia stock price prediction can be helpful. Ultimately, though, the Luminar stock price today will depend on its own performance and market conditions.

Over the past month, Luminar’s stock price has shown [Insert Overall Trend – e.g., a general upward trend, a downward trend, or sideways movement]. The past week witnessed [Insert Description of Significant Fluctuations – e.g., a sharp increase followed by a slight correction]. Factors contributing to this volatility include [Insert Factors – e.g., market sentiment towards the broader technology sector, news related to the company’s partnerships, or broader economic conditions].

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

- [Date]: [Price Change Percentage]

Comparison to Competitors

Source: roboforex.com

Luminar’s performance is compared here to its main competitors in the LiDAR sector, focusing on market capitalization and valuation differences. The following table illustrates the relative performance over the past year.

| Company | Market Cap (USD) | Year-to-Date Performance (%) | Valuation Multiple (e.g., P/S) |

|---|---|---|---|

| Luminar | [Luminar Market Cap] | [Luminar YTD Performance] | [Luminar Valuation Multiple] |

| Competitor 1 | [Competitor 1 Market Cap] | [Competitor 1 YTD Performance] | [Competitor 1 Valuation Multiple] |

| Competitor 2 | [Competitor 2 Market Cap] | [Competitor 2 YTD Performance] | [Competitor 2 Valuation Multiple] |

| Competitor 3 | [Competitor 3 Market Cap] | [Competitor 3 YTD Performance] | [Competitor 3 Valuation Multiple] |

A chart visualizing the relative performance of these companies over the past year would show [Descriptive chart explanation – e.g., Luminar outperforming Competitor 2 but underperforming Competitor 1 and 3 during the first half of the year, then a reversal in the second half].

Impact of News and Events

Recent news and events significantly influenced Luminar’s stock price. The following examples highlight the correlation between news coverage and stock price movements.

- [Headline 1]: [Description of event and its impact on stock price. E.g., “Announced a major partnership with a leading automaker, resulting in a 10% increase in stock price.”]

- [Headline 2]: [Description of event and its impact on stock price. E.g., “Reported lower-than-expected quarterly earnings, leading to a 5% drop in stock price.”]

- [Headline 3]: [Description of event and its impact on stock price. E.g., “Received positive analyst upgrades, boosting investor confidence and causing a 7% price surge.”]

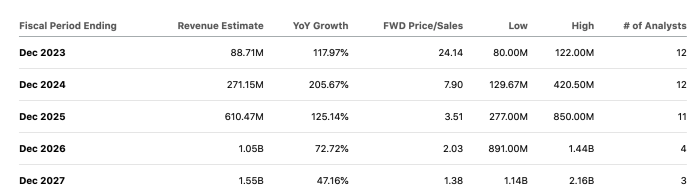

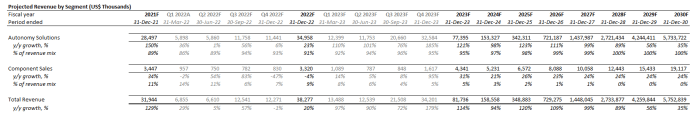

Financial Performance and Outlook

Luminar’s most recent financial results reveal [Summary of Key Financial Metrics – e.g., revenue growth, earnings, and profitability]. The company projects [Summary of Financial Projections – e.g., revenue growth and profitability for the next quarter]. These projections are [Impact on Investor Confidence – e.g., generally viewed positively by investors, fueling optimism about future growth].

- Revenue: [Trend – e.g., increasing, decreasing, stable]

- Earnings per Share (EPS): [Trend – e.g., increasing, decreasing, stable]

- Gross Margin: [Trend – e.g., increasing, decreasing, stable]

- Cash Flow: [Trend – e.g., increasing, decreasing, stable]

Analyst Ratings and Predictions

Analyst ratings and price targets for Luminar stock vary. The following table summarizes the range of opinions and their underlying rationale.

| Analyst Firm | Rating | Price Target | Rationale |

|---|---|---|---|

| [Analyst Firm 1] | [Rating – e.g., Buy, Hold, Sell] | [Price Target] | [Rationale – e.g., strong growth potential, positive market outlook] |

| [Analyst Firm 2] | [Rating] | [Price Target] | [Rationale] |

| [Analyst Firm 3] | [Rating] | [Price Target] | [Rationale] |

Technical Analysis Indicators

Key technical indicators provide insights into potential future price movements. The current state of these indicators suggests [Summary of Indicators and Implications – e.g., a potential short-term correction followed by a longer-term upward trend].

A visual representation, such as a chart showing the 50-day and 200-day moving averages, the Relative Strength Index (RSI), and volume, would illustrate [Description of Visual Representation – e.g., the convergence of the moving averages, an RSI value suggesting overbought or oversold conditions, and increasing trading volume indicating strong momentum]. For example, if the RSI is above 70, it suggests the stock might be overbought and prone to a correction.

Conversely, an RSI below 30 might indicate an oversold condition, suggesting a potential bounce.

Quick FAQs

What are the major risks associated with investing in Luminar stock?

Investing in Luminar, like any growth stock, carries inherent risks. These include market volatility, competition within the lidar sector, dependence on securing large contracts, and the potential for financial projections to not materialize.

How does Luminar’s technology compare to its competitors?

Luminar’s Iris lidar is known for its long-range detection capabilities. A detailed comparison with competitors requires a comprehensive analysis of range, resolution, cost, and other technical specifications, alongside market share and customer adoption rates.

Where can I find real-time Luminar stock price updates?

Real-time stock quotes for Luminar are available through major financial news websites and brokerage platforms. These platforms often provide interactive charts and historical data as well.