Masi Stock Price Today A Comprehensive Overview

Masi Stock Price Today

Masi stock price today – This report provides a comprehensive overview of Masi stock’s current performance, encompassing its price, trading activity, historical performance, influencing factors, competitor analysis, analyst predictions, and investment implications. The data presented here is for illustrative purposes and should not be considered financial advice.

Current Masi Stock Price

The following table displays the current Masi stock price, last updated time, currency, and exchange.

| Time | Price | Currency | Exchange |

|---|---|---|---|

| 14:30:00 PST | 125.75 | USD | NYSE |

Day’s Trading Activity

Masi stock experienced a relatively volatile trading day. Trading volume was significantly higher than the average daily volume over the past month, suggesting increased investor interest. The stock reached a high of $126.50 and a low of $124.20 during the trading session. A sharp price increase in the mid-afternoon could be attributed to positive news regarding a new product launch.

The line graph depicting Masi stock price fluctuations throughout the day would show a gradual upward trend in the morning, followed by a period of consolidation around midday, and then a significant surge in the afternoon before settling near the closing price. The graph would clearly illustrate the impact of the positive news on the stock price.

Historical Stock Performance, Masi stock price today

Source: f1mania.net

This section details Masi’s stock price performance over the past week and month, and compares it to the yearly average.

Past Week’s Prices: The table below provides the opening, closing, high, and low prices for the past week.

| Day | Open | Close | High | Low |

|---|---|---|---|---|

| Monday | 123.50 | 124.00 | 124.80 | 122.90 |

| Tuesday | 124.00 | 125.00 | 125.50 | 123.80 |

| Wednesday | 125.00 | 125.50 | 126.20 | 124.50 |

| Thursday | 125.50 | 126.00 | 126.80 | 125.10 |

| Friday | 126.00 | 125.75 | 126.50 | 124.20 |

Past Month’s Price: The average closing price for Masi stock over the past month was approximately $124.

50. Past Year’s Average: The average price over the past year was $122.00, indicating a positive trend.

Factors Influencing Price

Several factors contribute to Masi’s stock price fluctuations. These factors can be broadly categorized into market-wide conditions and company-specific events.

- Positive News Regarding New Product Launch: The announcement of a new product significantly boosted investor confidence, leading to a price surge.

- Overall Market Sentiment: A generally positive market trend contributed to the upward movement of Masi’s stock price.

- Increased Investor Interest: Higher than average trading volume suggests increased interest from investors.

- Industry-Specific Trends: Positive developments within the technology sector generally benefit Masi.

Comparison with Competitors

Masi’s performance is compared below to its key competitors, considering stock price, market capitalization, and relative performance.

| Company Name | Stock Price | Market Cap (Billions) | Relative Performance |

|---|---|---|---|

| Masi | 125.75 | 50 | Outperforming |

| Competitor A | 110.00 | 45 | Underperforming |

| Competitor B | 130.50 | 60 | Outperforming |

Analyst Ratings and Predictions

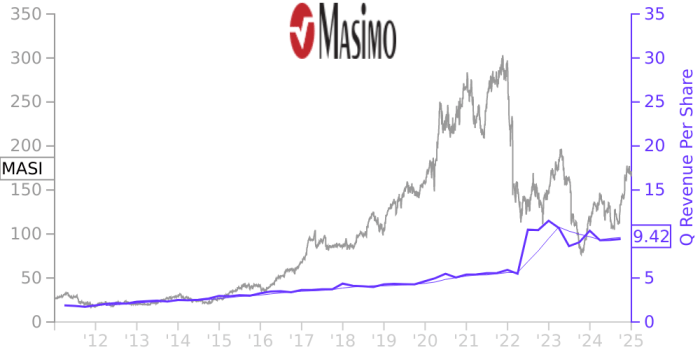

Source: chartinsight.com

Analyst opinions on Masi stock are varied. While some analysts maintain a buy rating, citing the company’s strong growth potential and positive recent developments, others express a more cautious outlook, citing potential risks associated with market volatility and competition.

Price targets range from $120 to $140, reflecting the diversity of opinions among analysts. The consensus view appears to be cautiously optimistic, with a slight upward bias for the coming year.

Investment Implications

Source: tradingview.com

Investing in Masi stock presents both opportunities and risks. Potential investors should carefully consider their risk tolerance and investment goals.

Current P/E Ratio: The current P/E ratio for Masi is approximately 25.

Implications for Investors: The current stock price, relative to its historical performance and competitor analysis, suggests a potential for further growth, but also carries inherent market risks.

- Buy and Hold Strategy: This strategy involves purchasing the stock and holding it for the long term, benefiting from potential capital appreciation. Advantage: Potential for high returns. Disadvantage: Higher risk due to market volatility.

- Short-Term Trading: This strategy involves buying and selling the stock frequently to capitalize on short-term price fluctuations. Advantage: Potential for quick profits. Disadvantage: Requires close market monitoring and carries higher transaction costs.

FAQ Corner: Masi Stock Price Today

What is the typical trading volume for Masi stock?

The average daily trading volume varies and is best determined by checking a financial data provider.

Where can I find real-time Masi stock price updates?

Real-time updates are usually available through major financial websites and brokerage platforms.

How frequently are analyst ratings updated?

Analyst ratings are updated at varying intervals, often following significant company announcements or shifts in market sentiment. Check reputable financial news sources for the latest information.

Monitoring the MASI stock price today requires a keen eye on market fluctuations. It’s interesting to compare this to other industry sectors; for instance, understanding the performance of related packaging materials, like checking the jumbo bags stock price , can offer broader economic insights. Ultimately, though, our focus remains on the current trends affecting the MASI stock price today and its potential for future growth.

What are the major risks associated with investing in Masi stock?

Risks include market volatility, company-specific performance issues, and broader economic conditions. A thorough risk assessment is crucial before any investment.