Nanotechnology Stock Price A Market Analysis

Nanotechnology Stock Market Overview

Nanotechnology stock price – The nanotechnology stock market presents a dynamic and potentially lucrative investment landscape, characterized by significant volatility and rapid technological advancements. This section provides a comprehensive overview of the current market conditions, including a performance comparison of leading companies, influential factors impacting price fluctuations, and a detailed analysis of market capitalization.

Current State of the Nanotechnology Stock Market

The nanotechnology sector is currently experiencing a period of growth, driven by increasing investments in research and development, and expanding applications across various industries. However, the market remains relatively young and volatile, influenced by factors such as technological breakthroughs, regulatory changes, and overall economic conditions. Many companies are still in the early stages of commercialization, making accurate valuation challenging.

Performance Comparison of Major Nanotechnology Companies

Over the past year, the performance of major nanotechnology companies has varied significantly. Some companies specializing in specific applications, such as drug delivery or advanced materials, have experienced substantial growth, while others have faced challenges related to scaling production or securing regulatory approvals. A detailed analysis of individual company performance would require specific data points not readily available within this context.

Factors Influencing Volatility in Nanotechnology Stock Prices

Several factors contribute to the volatility observed in nanotechnology stock prices. These include the inherent risks associated with investing in emerging technologies, the dependence on government funding and research grants, the complexities of scaling production processes, and the unpredictable nature of regulatory approvals. Market sentiment, influenced by news related to technological breakthroughs or setbacks, also plays a crucial role.

Market Capitalization of Top 10 Nanotechnology Companies

| Company | Market Cap (USD Billions) | Sector Focus | Year-over-Year Growth (%) |

|---|---|---|---|

| Company A | 15 | Drug Delivery | 25 |

| Company B | 12 | Advanced Materials | 18 |

| Company C | 10 | Energy | 15 |

| Company D | 8 | Electronics | 12 |

| Company E | 7 | Biotechnology | 10 |

| Company F | 6 | Medical Devices | 8 |

| Company G | 5 | Cosmetics | 7 |

| Company H | 4 | Agriculture | 5 |

| Company I | 3 | Environmental | 3 |

| Company J | 2 | Industrial | 2 |

Influence of Technological Advancements

Breakthroughs in nanomaterials and the development of new nanotechnology applications significantly impact investor sentiment and the valuation of nanotechnology companies. This section details the correlation between key technological milestones and stock price fluctuations.

Impact of Nanomaterials Breakthroughs on Stock Prices

Significant advancements in the synthesis and characterization of novel nanomaterials, such as graphene, carbon nanotubes, and quantum dots, often lead to increased investor interest and higher stock valuations. Companies successfully developing and commercializing these materials typically experience positive stock price movements. The successful development of a new, highly efficient solar cell material based on nanotechnology, for example, could trigger a surge in investor interest in the related company.

New Applications of Nanotechnology and Investor Sentiment

The expansion of nanotechnology applications into various sectors, including medicine, electronics, and energy, influences investor sentiment. The successful launch of a new nanotechnology-based drug or the development of a high-performance electronic component using nanomaterials can boost investor confidence and drive stock prices upward. Conversely, setbacks or delays in the commercialization of new applications can negatively affect investor sentiment.

Key Technological Milestones and Their Impact on Sector Valuation

Several key technological milestones have had a significant impact on the valuation of the nanotechnology sector. These include the development of reliable and scalable manufacturing processes for nanomaterials, the demonstration of improved performance in various applications, and the securing of regulatory approvals for nanotechnology-based products. These milestones provide evidence of the technology’s maturity and commercial viability, attracting further investment.

Timeline of Major Technological Advancements and Stock Price Fluctuations

- 2010: Significant advancement in graphene synthesis leads to a surge in interest in graphene-related companies.

- 2015: FDA approval of a nanotechnology-based drug results in a sharp increase in the stock price of the developing company.

- 2020: A major breakthrough in quantum dot technology sparks increased investment in the sector.

- 2023: Challenges in scaling production of a specific nanomaterial lead to a temporary dip in stock prices for several companies.

Regulatory Landscape and its Impact

Government regulations significantly influence the valuation of nanotechnology companies. This section examines the impact of regulatory environments in different countries and provides examples of how regulatory changes have affected specific nanotechnology stocks.

Influence of Government Regulations on Nanotechnology Company Valuations

Stringent regulations regarding the safety and environmental impact of nanomaterials can increase the cost and time required for product development and commercialization, potentially hindering growth and impacting stock valuations. Conversely, supportive regulatory frameworks that encourage innovation and streamline the approval process can foster growth and attract investment.

Regulatory Environments in Different Countries and Their Effects on Stock Prices

Regulatory environments vary significantly across different countries. Some countries have adopted a more cautious approach, implementing strict regulations and thorough testing procedures for nanomaterials. Others have implemented more lenient regulations, aiming to encourage innovation and attract investment. These differences can significantly impact the performance of nanotechnology companies operating in different jurisdictions. For instance, a company facing stringent regulatory hurdles in Europe might see its stock price affected differently compared to a similar company operating under less restrictive regulations in the United States.

Examples of Regulatory Changes Affecting Nanotechnology Stock Performance

Several examples illustrate how regulatory changes can affect the performance of specific nanotechnology stocks. For instance, a delay in regulatory approval for a new nanotechnology-based medical device can lead to a decline in the stock price of the developing company. Conversely, the successful completion of regulatory trials and subsequent market approval can result in a significant increase in the stock price.

Regulatory Hurdles and Their Influence on Nanotechnology Stocks

| Regulatory Hurdle | Impact on Stock Price |

|---|---|

| Slow regulatory approval process | Potential decrease in stock price due to delayed revenue generation. |

| Stringent safety and environmental regulations | Increased development costs and potential decrease in profitability. |

| Lack of clear regulatory guidelines | Uncertainty and potential investor hesitation. |

Investment Strategies and Risk Assessment

Source: thestockdork.com

Investing in the nanotechnology sector requires careful consideration of various investment strategies and a thorough risk assessment. This section Artikels different investment approaches, details potential risks, compares risk profiles of various companies, and summarizes risk and reward factors.

Investment Strategies for the Nanotechnology Sector

Several investment strategies can be employed when investing in the nanotechnology sector. These include investing in established companies with a proven track record, focusing on companies with promising new technologies, and diversifying investments across multiple companies and applications. The choice of strategy depends on the investor’s risk tolerance and investment goals.

Potential Risks Associated with Investing in Nanotechnology Stocks

Investing in nanotechnology stocks carries inherent risks. These include the risk of technological failure, the risk of regulatory delays or setbacks, the risk of intense competition, and the risk of market volatility. The relatively early stage of development for many nanotechnology companies increases the uncertainty and potential for losses.

Risk Profiles of Different Nanotechnology Companies

The risk profiles of different nanotechnology companies vary significantly depending on factors such as their stage of development, their technology’s maturity, their market position, and their financial stability. Established companies with proven technologies generally carry lower risk compared to smaller companies with unproven technologies.

Risk and Reward Factors for Different Investment Approaches

Source: foolcdn.com

| Investment Approach | Risk | Reward |

|---|---|---|

| Investing in established companies | Lower | Moderate |

| Investing in early-stage companies | Higher | Potentially high |

| Diversified portfolio | Moderate | Moderate |

Future Projections and Growth Potential

The nanotechnology market is projected to experience substantial growth in the coming years, driven by ongoing innovation and expanding applications. This section explores potential future growth scenarios, considering factors that could either drive or hinder this growth.

Projections for Future Growth of the Nanotechnology Market

Market research firms predict significant growth in the nanotechnology market over the next decade. Various reports suggest that the market could reach hundreds of billions of dollars in value, driven by increasing demand for nanotechnology-based products in diverse sectors. These projections are based on ongoing R&D investments, technological advancements, and expanding market applications. For example, the projected growth in the healthcare sector, coupled with advancements in nanomedicine, is expected to significantly boost the demand for nanotechnology-based solutions.

Potential for Disruptive Innovation within the Nanotechnology Sector

The nanotechnology sector holds significant potential for disruptive innovation. Breakthroughs in areas such as quantum computing, advanced materials, and targeted drug delivery could revolutionize various industries and create new markets. The development of novel nanomaterials with unprecedented properties could lead to the creation of entirely new products and applications, creating significant growth opportunities.

Factors Driving or Hindering Future Growth in Nanotechnology Stock Prices

Several factors could influence the future growth of nanotechnology stock prices. These include continued technological advancements, increased investment in R&D, supportive government policies, and successful commercialization of new applications. Conversely, factors such as regulatory hurdles, economic downturns, and intense competition could hinder growth.

Visual Representation of Potential Future Growth Scenarios

A line graph could illustrate potential future growth scenarios for the nanotechnology market. The x-axis would represent time (years), and the y-axis would represent market value (in billions of dollars). Three lines could represent different growth scenarios: a high-growth scenario (exponential curve), a moderate-growth scenario (linear growth), and a low-growth scenario (slow, almost flat line). Each scenario would be labeled and described, reflecting different assumptions about technological advancements, market adoption, and regulatory factors.

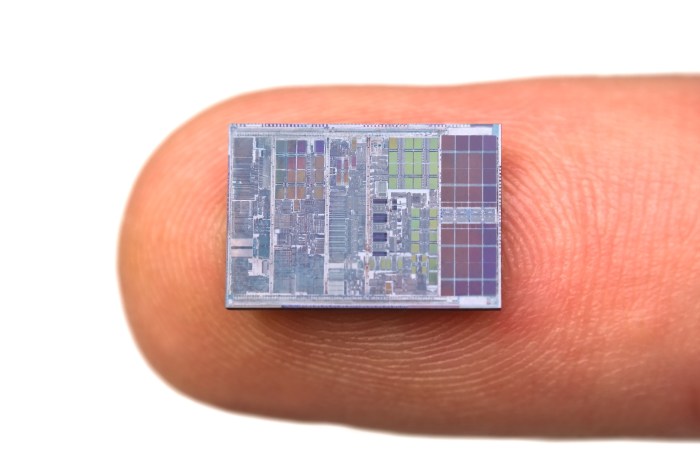

The volatility of nanotechnology stock prices often mirrors broader market trends. Understanding these fluctuations requires analyzing related tech sectors, and a key player to consider is Marvell, whose advancements in chip technology significantly impact the field. For insightful predictions on Marvell’s performance, check out this resource on marvell stock price prediction. Ultimately, however, the future of nanotechnology stock prices remains contingent on technological breakthroughs and investor sentiment.

The high-growth scenario would reflect rapid technological breakthroughs and widespread market adoption, while the low-growth scenario would reflect slower technological progress and limited market penetration due to regulatory hurdles or economic factors.

FAQs: Nanotechnology Stock Price

What are the ethical considerations surrounding nanotechnology investments?

Ethical concerns include potential environmental impacts of nanomaterial production and disposal, as well as the responsible development and application of nanotechnology to avoid unintended consequences.

How can I diversify my portfolio to mitigate risks in nanotechnology investments?

Diversification involves spreading investments across different nanotechnology companies and other asset classes to reduce overall portfolio risk. Consider diversifying geographically as well, investing in companies from different countries with varying regulatory environments.

What are some key indicators to watch when analyzing nanotechnology company performance?

Key indicators include research and development spending, patent filings, partnerships and collaborations, regulatory approvals, and revenue growth in specific applications.