NASDAQ Stock Price List A Comprehensive Guide

Understanding the NASDAQ Stock Price List

Source: investorplace.com

The NASDAQ stock price list is a dynamic, comprehensive record of the prices and trading activity of companies listed on the NASDAQ exchange. It’s a crucial resource for investors, analysts, and market participants seeking real-time and historical data to inform investment decisions.

Composition and Organization of the NASDAQ Stock Price List

The NASDAQ stock price list includes a wealth of information for each listed stock. This typically includes the stock’s current price, daily high and low, trading volume, change in price from the previous day’s closing price (often expressed as a percentage), and market capitalization. The list is organized primarily by stock symbol, allowing for quick and easy lookup.

Access is readily available through various online platforms, including the official NASDAQ website and numerous financial data providers. The data is updated in real-time throughout the trading day.

Comparison with Other Exchanges, Nasdaq stock price list

Compared to similar lists from other exchanges, such as the New York Stock Exchange (NYSE), the NASDAQ list often features a higher concentration of technology and growth-oriented companies. While both exchanges provide similar core data points (price, volume, change), the overall composition of listed companies differs significantly, reflecting the distinct focus and historical development of each exchange. The NYSE, with its longer history, tends to have a larger proportion of established, more mature companies, while the NASDAQ is known for its tech giants and newer, rapidly growing firms.

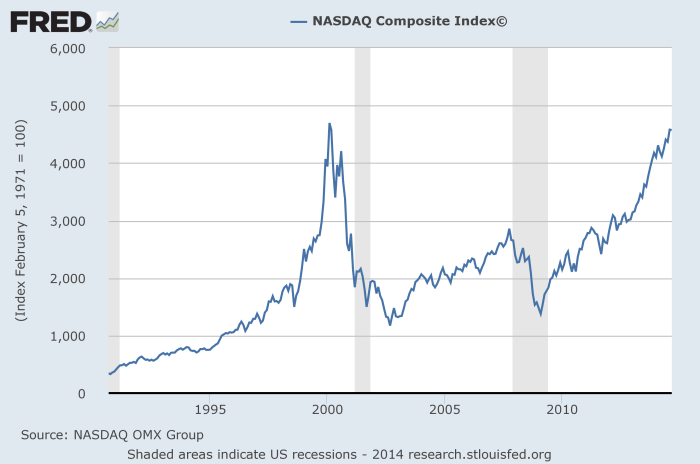

Historical Context and Evolution

The NASDAQ stock market’s origins trace back to 1971, initially focusing on over-the-counter (OTC) trading. Its evolution into a fully electronic exchange, with its associated price list, reflects the broader technological advancements in finance. The initial NASDAQ price list was far simpler than today’s, relying on less sophisticated data capture and dissemination methods. The ongoing development of technology has enabled the provision of richer, more granular, and readily accessible data.

Hypothetical Investment Scenario

Imagine Sarah, a prospective investor, is considering investing in a technology company. She accesses the NASDAQ stock price list through a reputable financial website. She observes that XYZ Corp (a hypothetical company), a software firm, has shown consistent growth in its stock price over the past quarter, coupled with increasing trading volume. After reviewing the company’s financial statements and industry reports, and noting the positive price trends on the NASDAQ list, Sarah decides to allocate a portion of her portfolio to XYZ Corp shares.

Data within the NASDAQ Stock Price List

The NASDAQ stock price list provides a multitude of data points, each crucial for comprehensive market analysis. Understanding these data points allows investors to make informed decisions.

Key Data Points and Their Significance

Each stock entry typically includes the following key data points: current price, daily high and low, opening price, closing price (previous day), trading volume, percentage change, and market capitalization. The current price reflects the most recent transaction price. Daily high and low show the price range for the day. Volume indicates the number of shares traded, suggesting market interest.

Percentage change highlights the price movement compared to the previous day’s close. Market capitalization represents the total market value of the company’s outstanding shares.

Interaction of Data Points

These data points interact to offer a holistic view of a stock’s performance. For example, a high trading volume coupled with a significant price increase suggests strong buying pressure. Conversely, a large volume with a price decrease indicates substantial selling pressure. Analyzing these interactions provides valuable insights into market sentiment and potential future price movements.

Example Stock Data

| Stock Symbol | Price | Volume | % Change |

|---|---|---|---|

| AAPL | $175.00 | 10,000,000 | +1.5% |

| MSFT | $350.00 | 8,000,000 | +0.8% |

| GOOG | $120.00 | 12,000,000 | -0.5% |

| AMZN | $3200.00 | 5,000,000 | +2.2% |

| TSLA | $250.00 | 15,000,000 | -1.0% |

Categorization of Data Points

Data points can be categorized into: Financial Metrics (Price, Market Cap, P/E Ratio); Trading Activity (Volume, Daily High/Low, Percentage Change); and Company Information (Stock Symbol, Company Name, Sector). This organized approach enhances understanding and facilitates efficient analysis.

Interpreting NASDAQ Stock Price Data

Understanding the factors that drive NASDAQ stock price fluctuations is crucial for successful investing. Several interconnected elements contribute to price movements.

Influences on Price Fluctuations

Numerous factors influence NASDAQ stock prices, including overall market sentiment, economic conditions (interest rates, inflation), company-specific news (earnings reports, product launches), industry trends, and geopolitical events. These factors can act individually or in combination to impact stock prices.

Comparison of Price Movements

Comparing the price movements of different NASDAQ-listed stocks over a period like the last month reveals varying patterns. Some stocks might exhibit consistent upward trends, while others may show volatility or decline. This comparison helps investors identify potential opportunities and assess risk.

Market Capitalization and its Relevance

Market capitalization is a crucial metric, representing the total value of a company’s outstanding shares. It provides context for understanding the scale and relative size of a company within the NASDAQ market. Larger market capitalization typically suggests greater stability, but not necessarily higher growth potential.

Calculating Basic Stock Metrics

The Price-to-Earnings (P/E) ratio is a fundamental metric calculated by dividing a company’s stock price by its earnings per share (EPS). This ratio indicates how much investors are willing to pay for each dollar of a company’s earnings. A high P/E ratio might suggest high growth expectations, while a low P/E ratio could indicate undervaluation or lower growth prospects.

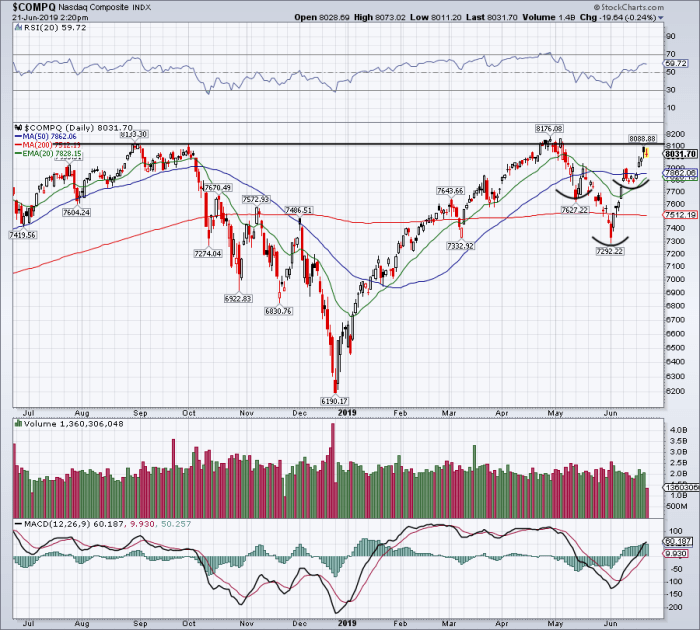

Hypothetical Stock Price Chart

Source: infiniteunknown.net

Imagine a hypothetical stock price chart showing a gradual upward trend over several months, punctuated by periods of consolidation (horizontal movement) and minor corrections (small price drops). The overall upward trend signifies positive market sentiment and increasing investor confidence. Consolidation periods represent pauses in price momentum, while corrections are normal adjustments within an upward trend. A sharp drop could signal negative news or broader market downturn.

Utilizing the NASDAQ Stock Price List for Investment Strategies

Source: businessinsider.com

The NASDAQ stock price list is a valuable tool for various investment strategies. Effective use requires a combination of fundamental and technical analysis.

Investment Strategies Utilizing the NASDAQ List

Investors utilize the NASDAQ list for various strategies, including value investing (identifying undervalued stocks), growth investing (focusing on companies with high growth potential), momentum investing (capitalizing on short-term price trends), and index fund investing (tracking the overall performance of the NASDAQ index).

Monitoring the Nasdaq stock price list requires a keen eye on various market indicators. Understanding individual stock performance within that list is crucial, and a good example is checking the current jagran stock price , which can offer insights into broader market trends. Returning to the Nasdaq, consistent tracking is key for effective investment strategies.

Role of Fundamental and Technical Analysis

Fundamental analysis involves assessing a company’s intrinsic value based on financial statements, industry trends, and management quality. Technical analysis focuses on chart patterns and other technical indicators to predict future price movements. Both approaches utilize data from the NASDAQ list, but with different focuses.

Risks and Rewards of Different Approaches

Value investing carries the risk of misjudging a company’s intrinsic value, while growth investing involves higher risk due to the inherent uncertainty of future growth. Momentum investing is susceptible to rapid market reversals. Index fund investing provides diversification but may offer lower returns compared to actively managed strategies.

Identifying Investment Opportunities

The NASDAQ list aids in identifying opportunities by allowing investors to screen stocks based on criteria such as market capitalization, sector, price-to-earnings ratio, and historical performance. This allows for focused research and portfolio construction.

Step-by-Step Stock Screening Guide

- Define Investment Criteria: Establish specific criteria, such as minimum market capitalization, desired sector, and acceptable P/E ratio.

- Utilize Screening Tools: Employ online brokerage platforms or financial data providers offering stock screening capabilities.

- Filter Stocks: Apply the defined criteria to filter the NASDAQ stock list, narrowing down the potential investment universe.

- Conduct Due Diligence: Perform thorough research on the shortlisted stocks, analyzing financial statements, industry trends, and competitive landscape.

- Make Investment Decisions: Based on the due diligence, allocate capital to selected stocks aligning with the overall investment strategy.

Helpful Answers

What is the difference between real-time and delayed NASDAQ data?

Real-time data reflects the current market price, while delayed data shows prices from a few minutes or even hours ago. Real-time data is typically available through paid subscriptions, while delayed data is often free.

Where can I find the most reliable NASDAQ stock price list?

The official NASDAQ website is the most reliable source. Many reputable financial news websites and brokerage platforms also provide access to NASDAQ stock data.

How frequently is the NASDAQ stock price list updated?

The NASDAQ stock price list is updated constantly throughout the trading day, reflecting real-time price changes.

What are some common mistakes investors make when using the NASDAQ stock price list?

Common mistakes include relying solely on price, ignoring fundamental analysis, and failing to diversify investments. Emotional decision-making based on short-term price fluctuations is also a frequent pitfall.