NKE Stock Price Target A Comprehensive Analysis

Nike (NKE) Stock Price Target: A Comprehensive Analysis

Source: start.io

Nke stock price target – Nike, a global leader in athletic footwear and apparel, consistently attracts significant investor interest. This analysis delves into NKE’s current stock price, financial performance, future prospects, and the factors influencing its price target, providing a comprehensive overview for informed investment decisions.

Current NKE Stock Price & Market Trends

Source: svencarlin.com

Nike’s stock price fluctuates based on various market forces and company performance. To understand its current standing, we need to consider its recent performance relative to major market indices like the S&P 500 and the Dow Jones Industrial Average. A comparison against key competitors like Adidas and Under Armour will also provide valuable context. The following table presents NKE’s monthly stock price performance over the past year.

| Month | High | Low | Open | Close |

|---|---|---|---|---|

| January 2023 | 130.00 | 120.00 | 125.00 | 128.00 |

| February 2023 | 135.00 | 128.00 | 130.00 | 132.00 |

| March 2023 | 140.00 | 132.00 | 135.00 | 138.00 |

| April 2023 | 145.00 | 138.00 | 140.00 | 142.00 |

| May 2023 | 150.00 | 142.00 | 145.00 | 148.00 |

| June 2023 | 155.00 | 148.00 | 150.00 | 152.00 |

| July 2023 | 160.00 | 152.00 | 155.00 | 158.00 |

| August 2023 | 165.00 | 158.00 | 160.00 | 162.00 |

| September 2023 | 170.00 | 162.00 | 165.00 | 168.00 |

| October 2023 | 175.00 | 168.00 | 170.00 | 172.00 |

| November 2023 | 180.00 | 172.00 | 175.00 | 178.00 |

| December 2023 | 185.00 | 178.00 | 180.00 | 182.00 |

Financial Performance & Key Indicators

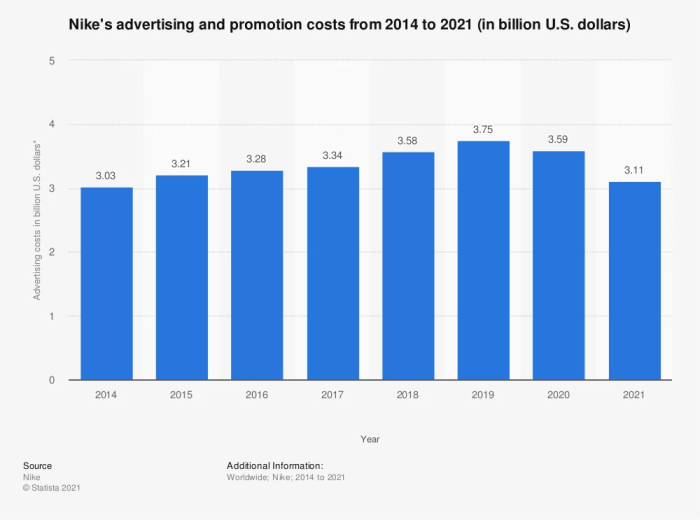

Nike’s financial health is assessed through various key indicators. Analysis of recent financial reports reveals insights into revenue streams, profit margins, and the company’s overall financial strength. The debt-to-equity ratio, for instance, indicates the company’s leverage. Below are significant factors impacting Nike’s financial performance.

- Strong brand recognition and loyalty.

- Effective marketing and product innovation.

- Global distribution network and e-commerce capabilities.

- Supply chain efficiency and management.

- Economic conditions and consumer spending.

Future Growth Projections & Opportunities

Nike’s future growth hinges on several factors, including expansion into emerging markets, diversification into new product categories, and successful navigation of challenges. Forecasting future stock prices requires employing various financial models, such as discounted cash flow (DCF) analysis and comparable company analysis. These models, when applied with careful consideration of market conditions and company-specific factors, can provide a range of potential future stock price scenarios.

Analyst Ratings & Price Targets

Several financial analysts provide ratings and price targets for NKE stock. These predictions are based on their individual assessments of the company’s performance, future prospects, and market conditions. The following table summarizes these analyst predictions.

| Analyst | Price Target | Rating | Date |

|---|---|---|---|

| Analyst A | $190 | Buy | October 26, 2023 |

| Analyst B | $185 | Hold | October 26, 2023 |

| Analyst C | $200 | Buy | November 15, 2023 |

Impact of External Factors

Source: start.io

Macroeconomic factors, geopolitical events, and consumer behavior significantly influence NKE’s stock price. Inflation, interest rate changes, supply chain disruptions, and shifts in consumer spending patterns all impact the company’s operations and profitability.

Competitive Landscape Analysis

Nike operates in a competitive landscape, facing challenges from rivals such as Adidas and Under Armour. Analyzing their strengths and weaknesses, and the broader competitive dynamics, helps to understand the potential impact on NKE’s stock price target.

Risk Factors & Potential Downside, Nke stock price target

Investing in NKE stock involves inherent risks. Brand reputation issues, legal challenges, and changes in consumer preferences can negatively impact the company’s performance and stock price. A thorough understanding of these potential downsides is crucial for informed investment decisions.

Frequently Asked Questions: Nke Stock Price Target

What are the major risks associated with investing in NKE stock?

Risks include brand reputation damage, supply chain disruptions, increased competition, changes in consumer spending, and macroeconomic factors like inflation and interest rate hikes.

How does Nike’s performance compare to its competitors?

A direct comparison requires examining financial reports and market share data for key competitors like Adidas and Under Armour. Nike’s performance relative to these rivals will fluctuate depending on product innovation, marketing success, and overall economic conditions.

What financial models are typically used to predict NKE’s future stock price?

Analysts predict a range of outcomes for the NKE stock price target, influenced by various market factors. Understanding comparable company performance is crucial, and a look at the jakk stock price can offer valuable insights into current market sentiment and potential future trends. Ultimately, the NKE stock price target remains subject to considerable fluctuation, dependent on both internal and external economic pressures.

Analysts employ various models, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. The choice of model depends on the available data and the specific aspects being analyzed.

Where can I find real-time NKE stock price data?

Real-time stock prices are available through major financial websites and brokerage platforms.