How Does Stock Price Change?

Stock Price Fluctuations: A Multifaceted Analysis: How Does Stock Price Change

How does stock price change – Stock prices, the lifeblood of the financial markets, are constantly in flux, driven by a complex interplay of factors. Understanding these forces is crucial for investors seeking to navigate the market effectively. This analysis delves into the key elements that contribute to stock price changes, offering a comprehensive overview of the dynamics at play.

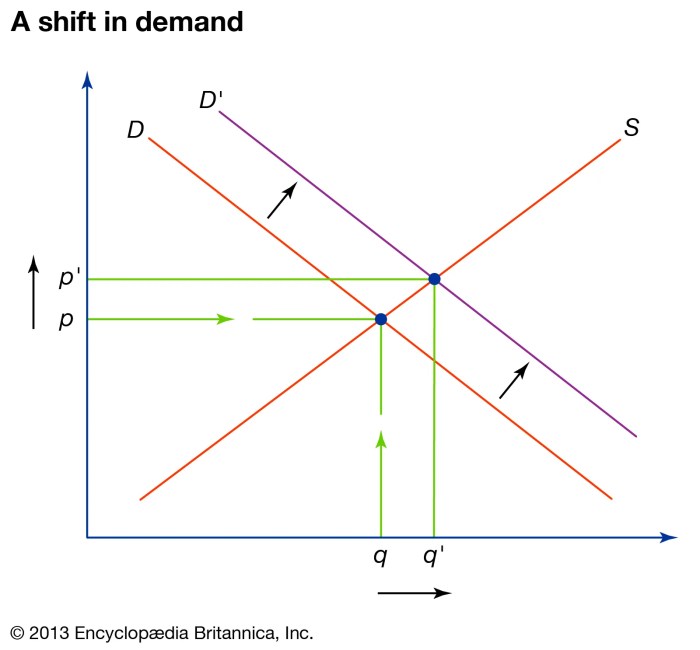

Supply and Demand Dynamics

The fundamental principle governing stock prices is the interaction of supply and demand. High demand coupled with limited supply pushes prices upward, while the opposite scenario leads to price declines. This dynamic is influenced by various factors, including investor sentiment, company performance, and broader economic conditions.

For example, a positive earnings report can significantly increase demand for a company’s stock, leading to a price surge. Conversely, negative news, such as a product recall or leadership scandal, can dampen demand, causing prices to fall. The following scenario illustrates this principle:

Scenario: Increased Demand Leading to a Price Surge

Imagine a tech company announces a groundbreaking new product. This positive news generates significant excitement among investors, leading to a surge in demand for the company’s stock. Simultaneously, the available supply of shares remains relatively constant, leading to a rapid increase in the stock price.

Scenario: Decreased Demand Leading to a Price Drop

Conversely, if the same tech company experiences a major security breach compromising user data, investor confidence plummets. This decrease in demand, coupled with an increase in the number of shares being sold (increased supply), results in a significant drop in the stock price.

| Scenario | Supply | Demand | Price Impact |

|---|---|---|---|

| Positive Earnings Report | Stable | Increased | Price Increase |

| Product Recall | Increased | Decreased | Price Decrease |

| New Product Launch (successful) | Stable | Significantly Increased | Sharp Price Increase |

| Economic Recession | Increased | Decreased | Significant Price Decrease |

Company Performance Metrics

A company’s financial health significantly influences its stock price. Key metrics such as earnings per share (EPS), revenue growth, and debt levels provide insights into a company’s profitability and stability.

Positive earnings reports, indicating strong profitability, typically boost investor confidence and drive up stock prices. Conversely, disappointing earnings or a significant increase in debt can negatively impact investor sentiment and lead to price declines.

The impact of various company announcements can be summarized as follows:

- New Product Launch: A successful launch can boost stock prices, while a failure can lead to declines.

- Merger or Acquisition: These events can positively or negatively impact stock prices depending on the strategic fit and market reaction.

- Leadership Changes: The appointment of a strong CEO can boost investor confidence, while the departure of a key executive can lead to uncertainty and price drops.

- Dividend Announcements: Increases in dividend payouts can attract investors seeking income, leading to higher stock prices.

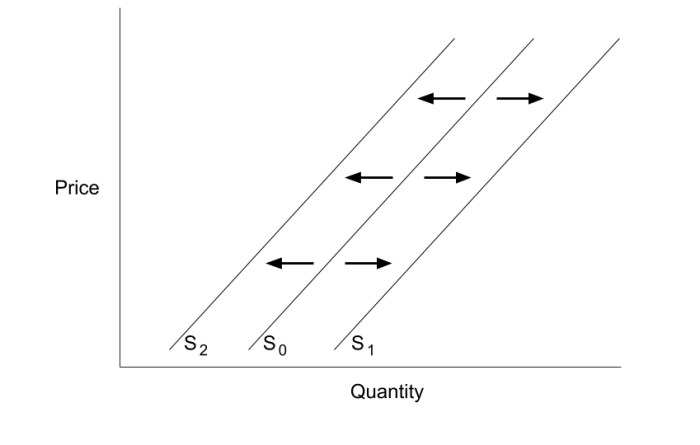

Macroeconomic Factors and Their Influence

Source: britannica.com

Broad economic conditions significantly impact stock market movements. Interest rates, inflation, and unemployment rates are among the key macroeconomic factors that influence stock valuations.

Higher interest rates generally lead to lower stock valuations, as investors may shift their investments towards higher-yielding bonds. Inflation erodes purchasing power and can impact stock prices differently across sectors. Some sectors, like energy, may benefit from inflation, while others, like consumer staples, may suffer.

| Economic Condition | Stock Market Impact | Example Sectors Affected | Reason |

|---|---|---|---|

| Recession | Generally Negative | Consumer Discretionary, Technology | Reduced consumer spending and business investment |

| Economic Boom | Generally Positive | Financials, Industrials | Increased consumer spending and business activity |

| High Inflation | Mixed | Energy (positive), Consumer Staples (negative) | Increased input costs for some, reduced consumer spending for others |

| Low Interest Rates | Generally Positive | Technology, Real Estate | Increased borrowing and investment |

Investor Sentiment and Market Psychology

Investor sentiment, a collective measure of investor confidence and optimism, plays a crucial role in shaping stock prices. News events, both real and perceived, can significantly influence market sentiment, leading to price fluctuations driven by fear and greed.

During bull markets, characterized by optimism and rising prices, investors tend to be more risk-tolerant, driving further price increases. Conversely, bear markets, marked by pessimism and falling prices, can lead to panic selling and amplified price declines.

Trading Volume and Volatility

Trading volume, the number of shares traded, often correlates with stock price movements. High trading volume can indicate significant price changes, either upward or downward, as a large number of investors are actively participating in the market.

Volatility, a measure of price fluctuation, reflects the risk associated with a particular stock. High volatility indicates significant price swings, while low volatility suggests more stable price movements.

High Volatility Scenario: The price chart would show sharp, dramatic peaks and troughs, with significant price swings within short periods. Trading volume would also be relatively high during these periods of intense price fluctuation.

Low Volatility Scenario: The price chart would display a relatively smooth trajectory, with smaller, less frequent price swings. Trading volume would be lower compared to the high volatility scenario.

Regulatory Actions and Government Policies, How does stock price change

Source: amazonaws.com

Government regulations and policies significantly impact stock prices. Changes in tax laws, for instance, can affect corporate profits and subsequently stock prices. Central bank actions, such as changes in monetary policy, also influence stock market performance.

Specific regulatory changes can have varied effects on different sectors. For example, stricter environmental regulations might negatively impact companies in polluting industries, while tax incentives for renewable energy companies could boost their stock prices.

Technological Advancements and Disruption

Technological innovation is a powerful force shaping stock prices. Disruptive technologies can revolutionize industries, leading to significant changes in the valuations of established companies and the emergence of new market leaders.

Case Study: The Impact of Smartphones on the Camera Industry

The rise of smartphones equipped with high-quality cameras significantly disrupted the traditional camera industry. Companies like Kodak, which failed to adapt to this technological shift, experienced dramatic stock price declines. Conversely, companies that successfully integrated camera technology into their smartphones, such as Apple, saw their stock prices soar.

Clarifying Questions

What is a stock split, and how does it affect the price?

A stock split increases the number of shares outstanding, proportionally reducing the price per share. The overall market capitalization remains unchanged.

How do dividends impact stock prices?

Dividends, while providing income to shareholders, typically cause a slight decrease in the stock price on the ex-dividend date, reflecting the distribution of funds.

What is the role of short selling in stock price fluctuations?

Short selling, the practice of borrowing and selling shares hoping to buy them back later at a lower price, can exert downward pressure on stock prices, particularly if widespread.

How do geopolitical events affect stock prices?

Geopolitical events, such as wars or trade disputes, can create uncertainty and volatility in the market, leading to significant price swings depending on the event’s perceived impact.