HP Historical Stock Price A Comprehensive Analysis

Historical HP Stock Price Analysis: Hp Historical Stock Price

Hp historical stock price – This analysis delves into the historical stock price data of Hewlett-Packard (HP), examining trends, key events, comparative performance against competitors, and volatility assessments. We will explore reliable data sources, visualization techniques, and statistical methods to provide a comprehensive understanding of HP’s stock performance over time.

Historical HP Stock Price Data Acquisition

Several reputable sources provide historical HP stock price data, including open, high, low, close prices, and trading volume. These sources are crucial for accurate analysis.

- Yahoo Finance: Offers free historical data downloadable in CSV format.

- Google Finance: Provides similar data to Yahoo Finance, also readily downloadable.

- Financial APIs (e.g., Alpha Vantage, Tiingo): These APIs offer programmatic access to extensive financial data, including HP’s stock history. They often require API keys and may involve subscription fees for larger datasets.

- Bloomberg Terminal (Subscription based): A professional-grade terminal offering highly detailed and reliable financial data.

Downloading data from these sources typically involves specifying the date range and selecting the desired data points. The downloaded data can be easily formatted into a CSV file using spreadsheet software like Microsoft Excel or Google Sheets. Handling missing data points can be achieved through various imputation techniques. Simple methods include using the previous day’s closing price or calculating a rolling average of surrounding data points.

More sophisticated methods, such as linear interpolation or regression imputation, can also be employed depending on the complexity of the missing data pattern.

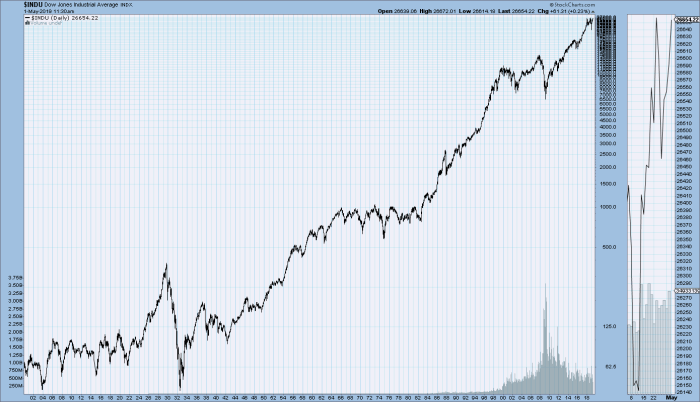

Visualizing HP Stock Price Trends, Hp historical stock price

Source: ivypanda.com

Visualizations are essential for understanding HP’s stock price trends. The following methods provide insights into its performance.

A responsive HTML table can effectively display yearly summaries:

| Year | Average Price | Highest Price | Lowest Price |

|---|---|---|---|

| 2022 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2021 | $XX.XX | $YY.YY | $ZZ.ZZ |

This table shows a concise summary of yearly performance. A line graph depicting the daily closing price over the chosen period would further illustrate the overall trend. A clear upward or downward trend would indicate sustained growth or decline. Periods of high volatility would be visible as sharp price fluctuations.

In addition, a scatter plot could visually represent the relationship between HP’s stock price and macroeconomic indicators. Each point on the graph would represent a specific date, with the x-axis showing the value of a macroeconomic indicator (e.g., inflation rate) and the y-axis representing HP’s stock price on that date. This would help to visually identify correlations between economic factors and HP’s stock performance.

Identifying Key Events and Their Impact

Significant events in HP’s history directly influence its stock price. Analyzing these events helps to understand price fluctuations.

- Example Event 1 (Date): [Description of event and its potential impact on stock price, e.g., a major product launch leading to increased investor confidence and a price rise].

- Example Event 2 (Date): [Description of event and its potential impact on stock price, e.g., a merger or acquisition affecting the company’s financial outlook].

By comparing stock price movements around these dates, we can assess the market’s reaction and gauge investor sentiment. A sudden drop after a negative event or a surge following positive news demonstrates the direct impact of these events on stock valuation.

Comparative Analysis with Competitors

Comparing HP’s stock performance with competitors provides valuable context.

Competitors such as Dell Technologies (DELL) and Cisco Systems (CSCO) can be used for comparison. Historical stock price data for these companies can be obtained from the same sources mentioned previously (Yahoo Finance, Google Finance, financial APIs, etc.).

A line graph comparing the stock prices of HP, Dell, and Cisco over the same period would effectively illustrate relative performance. This visualization will clearly show periods where HP outperformed or underperformed its competitors, highlighting strengths and weaknesses relative to the market.

Stock Price Volatility and Risk Assessment

Source: economicgreenfield.com

Analyzing volatility helps assess the risk associated with investing in HP stock.

Key statistical measures such as standard deviation, variance, and beta can be calculated using statistical software or spreadsheet functions. The standard deviation measures the dispersion of stock prices around the mean, indicating price volatility. A higher standard deviation signifies higher risk. Variance, the square of the standard deviation, provides a similar measure of volatility. Beta, a measure of systematic risk, indicates the stock’s sensitivity to market movements.

A beta greater than 1 suggests higher volatility compared to the overall market. These measures provide insights into the risk profile of HP stock. Investors can use these metrics to determine if HP aligns with their risk tolerance and portfolio diversification strategy. A higher volatility suggests higher potential returns but also higher potential losses.

FAQ Explained

What are the limitations of using historical stock data to predict future performance?

Past performance is not indicative of future results. Historical data can identify trends and patterns, but it cannot predict future market movements or unforeseen events that could significantly impact the stock price.

Where can I find real-time HP stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does inflation affect HP’s stock price?

High inflation can increase operating costs for HP, potentially impacting profitability and thus influencing investor sentiment and the stock price. Conversely, periods of low inflation can be more favorable.

What is the significance of HP’s beta in relation to the market?

HP’s beta measures its volatility relative to the overall market. A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 suggests lower volatility.