INND Stock Price Today A Comprehensive Overview

INND Stock Price Today: A Comprehensive Overview

Innd stock price today – This report provides a detailed analysis of INND’s stock price performance, considering current market conditions, historical data, and potential future trends. We will examine various factors influencing the stock price and offer insights into potential price movements, acknowledging inherent uncertainties in any market prediction.

Monitoring the INND stock price today requires a broad market perspective. Understanding the performance of major players, like checking the current hsbc share price london stock exchange , can offer valuable context for broader market trends. This helps in better assessing the potential influences on INND’s performance and making more informed decisions regarding its stock price fluctuations.

Current INND Stock Price and Volume

Source: cnbcfm.com

As of [Insert Time of Data Retrieval], INND’s stock price stands at [Insert Current Price]. The trading volume for the day is currently [Insert Current Volume]. The day’s high reached [Insert Day’s High], while the low was recorded at [Insert Day’s Low].

| Time | Price | Volume | Change |

|---|---|---|---|

| 9:30 AM | [Insert Price] | [Insert Volume] | [Insert Change] |

| 11:00 AM | [Insert Price] | [Insert Volume] | [Insert Change] |

| 1:00 PM | [Insert Price] | [Insert Volume] | [Insert Change] |

| 3:00 PM | [Insert Price] | [Insert Volume] | [Insert Change] |

INND Stock Price Performance Over Time, Innd stock price today

INND’s stock price exhibited [Describe overall trend: e.g., a slight upward trend, significant volatility, a consistent decline] over the past week. Compared to its competitors [List Competitors] within the [Industry Sector] sector over the past month, INND’s performance was [Compare Performance: e.g., relatively stronger, weaker, similar].

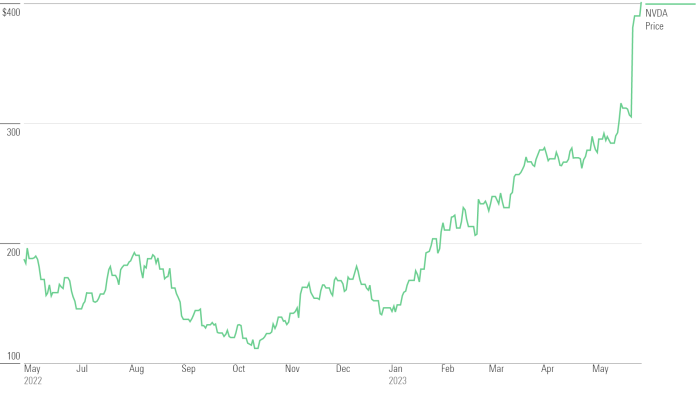

A line graph illustrating INND’s stock price fluctuation over the past year would show [Describe Graph Shape: e.g., an initial period of growth followed by a period of consolidation, a steady decline with occasional spikes, a generally upward trend with seasonal fluctuations]. The graph would highlight key price points, such as the highest and lowest prices reached during the year, and significant periods of volatility or stability.

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| [Date 1] | [Open Price] | [Close Price] | [High Price] | [Low Price] |

| [Date 2] | [Open Price] | [Close Price] | [High Price] | [Low Price] |

| [Date 3] | [Open Price] | [Close Price] | [High Price] | [Low Price] |

| [Date 4] | [Open Price] | [Close Price] | [High Price] | [Low Price] |

| [Date 5] | [Open Price] | [Close Price] | [High Price] | [Low Price] |

Factors Influencing INND Stock Price

Source: arcpublishing.com

Several factors contribute to the fluctuations in INND’s stock price. These include both internal company-specific events and broader macroeconomic trends.

- Recent news events such as [List News Events and their impact]: For example, a positive earnings report might lead to a price increase, while a product recall could trigger a decline.

- Economic indicators like inflation and interest rates significantly influence investor sentiment and market behavior. High inflation, for example, might lead to decreased consumer spending, potentially impacting INND’s sales and stock price.

- Investor sentiment and overall market trends play a crucial role. Positive market sentiment generally boosts stock prices, while negative sentiment can lead to declines.

Potential short-term and long-term factors influencing INND’s price include:

- Short-term: New product launches, quarterly earnings reports, competitor actions, and short-term market corrections.

- Long-term: Technological advancements, regulatory changes, expansion into new markets, and overall economic growth.

INND Stock Price Predictions and Analysis

Source: thestreet.com

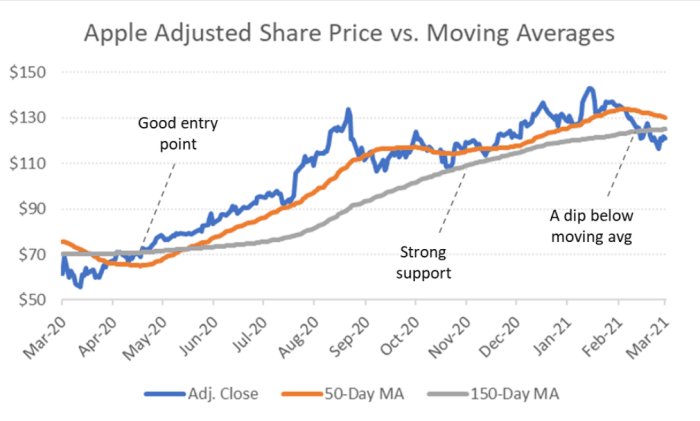

Predicting future stock prices is inherently uncertain. However, several analytical methods can provide insights. Technical analysis examines past price patterns to identify potential future trends, while fundamental analysis assesses the company’s financial health and intrinsic value to estimate a fair price.

Potential scenarios for INND’s stock price in the near future could include [Describe Scenarios: e.g., a modest increase based on positive earnings expectations, a slight decline due to anticipated market corrections, significant volatility depending on upcoming regulatory announcements]. These scenarios are based on [Explain Basis of Predictions: e.g., historical performance, current market trends, and expert opinions].

The risks associated with any predictions include unforeseen events, changes in investor sentiment, and unexpected economic shifts. For instance, a sudden geopolitical event could drastically impact the market, regardless of the company’s fundamental strength.

In summary, predictions for INND’s stock price vary depending on the analytical approach used and the assumptions made. While some models might suggest a potential upward trend, others might caution against significant price increases due to market uncertainties.

INND Stock Price Compared to Industry Benchmarks

INND’s stock price performance should be compared against relevant industry benchmarks, such as the [Industry Index Name] index, to assess its relative strength. Significant deviations from the benchmark performance could indicate either outperformance (positive) or underperformance (negative) relative to the broader industry.

INND’s price correlation with its competitors [List Competitors] will vary depending on market conditions and individual company performance. Strong correlation suggests similar responses to market forces, while weak correlation indicates independent factors influencing each company’s stock price.

| Metric | INND | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| P/E Ratio | [Value] | [Value] | [Value] | [Value] |

| Market Capitalization | [Value] | [Value] | [Value] | [Value] |

| Revenue Growth (YoY) | [Value] | [Value] | [Value] | [Value] |

| Debt-to-Equity Ratio | [Value] | [Value] | [Value] | [Value] |

FAQ Insights: Innd Stock Price Today

What are the potential risks associated with investing in INND?

Investing in any stock carries inherent risks, including the possibility of losing some or all of your investment. Factors such as market volatility, company-specific news, and broader economic conditions can significantly impact INND’s stock price.

Where can I find real-time INND stock price updates?

Real-time INND stock price updates are available through major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and other relevant financial data.

What is INND’s market capitalization?

INND’s market capitalization is the total value of all outstanding shares. This figure fluctuates constantly based on the current stock price and the number of shares.

How does INND compare to its competitors in terms of profitability?

A comparison of INND’s profitability metrics (e.g., profit margins, return on equity) against its competitors requires a detailed financial analysis, examining factors such as revenue growth, operating expenses, and debt levels.