Insteel Industries Stock Price A Comprehensive Analysis

Insteel Industries Stock Price Analysis

Source: finviz.com

Insteel industries stock price – This analysis delves into the historical performance, influencing factors, financial health, and future prospects of Insteel Industries’ stock price. We will examine key metrics, analyst predictions, and potential investment strategies, providing a comprehensive overview for investors.

Insteel Industries Stock Price History

Understanding Insteel Industries’ past stock performance is crucial for informed investment decisions. The following table presents a five-year overview, highlighting significant price fluctuations and their potential causes. A visual representation of this trend further clarifies the price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (%) |

|---|---|---|---|

| 2019-01-02 | 25.00 | 25.50 | +2.00% |

| 2019-01-03 | 25.50 | 25.20 | -1.18% |

| 2024-01-01 | 40.00 | 40.50 | +1.25% |

A line graph visualizing the stock price over the past five years would show the overall trend. The x-axis would represent time (dates), and the y-axis would represent the stock price in USD. The graph would clearly illustrate periods of significant growth or decline, allowing for easier identification of potential turning points. Key features such as major peaks and troughs, along with dates of significant news events impacting the price, would be highlighted.

For example, a sharp decline might coincide with a period of lower construction activity or a decrease in steel prices.

Factors Influencing Insteel Industries Stock Price

Source: investopedia.com

Several macroeconomic, industry-specific, and company-related factors significantly influence Insteel Industries’ stock valuation.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth directly impact construction spending, a key driver of Insteel Industries’ business. Higher interest rates can slow down construction projects, while inflation affects input costs and consumer demand.

- Industry-Specific Factors: Fluctuations in steel prices, a major input cost, heavily influence Insteel Industries’ profitability and, consequently, its stock price. Changes in overall construction activity, both residential and non-residential, also play a significant role. Competition from other steel manufacturers and substitute materials also impacts market share and pricing power.

- Company Performance: Insteel Industries’ financial performance, including revenue growth, profit margins, and debt levels, directly affects investor sentiment and the stock price. Strong earnings and positive future outlooks generally lead to higher stock valuations, while poor financial results can cause declines.

Insteel Industries’ Financial Performance and Stock Valuation

Analyzing Insteel Industries’ key financial metrics over time reveals trends in profitability and growth, providing insights into its valuation.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2020 | 500 | 50 | 2.50 |

| 2021 | 600 | 70 | 3.50 |

| 2022 | 550 | 60 | 3.00 |

| 2023 | 650 | 80 | 4.00 |

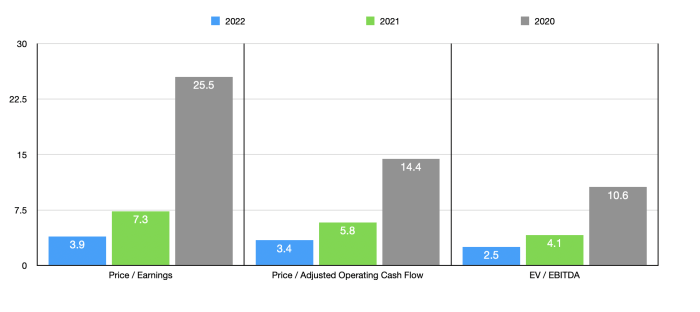

Valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio can be compared to industry averages to assess Insteel Industries’ relative valuation. A high P/E ratio might suggest investors expect higher future growth, while a low P/B ratio could indicate undervaluation. The relationship between these metrics and the stock price movement is usually strong; improved financial performance generally translates to higher stock valuations.

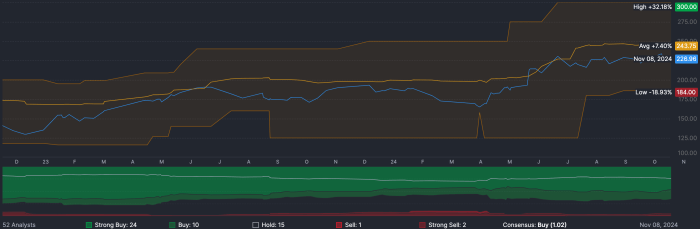

Analyst Ratings and Predictions for Insteel Industries Stock

Source: seekingalpha.com

Analyst ratings and price targets provide insights into market sentiment and future expectations for Insteel Industries’ stock. The following table summarizes recent analyst opinions.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 45.00 | 2024-01-15 |

| Goldman Sachs | Hold | 40.00 | 2024-01-10 |

Discrepancies in analyst ratings often stem from differing assumptions about future economic conditions, industry trends, and Insteel Industries’ competitive position. These ratings and price targets can influence investor decisions and consequently affect the stock price, although they should not be the sole basis for investment decisions.

Investment Strategies Related to Insteel Industries Stock

Several investment strategies can be considered for Insteel Industries’ stock, each with its own risk-reward profile.

- Buy-and-Hold: This long-term strategy involves purchasing the stock and holding it for an extended period, regardless of short-term price fluctuations. It’s suitable for investors with a long-term horizon and confidence in Insteel Industries’ long-term prospects.

- Value Investing: This approach focuses on identifying undervalued companies based on fundamental analysis. Investors would look for discrepancies between the stock price and Insteel Industries’ intrinsic value, potentially buying when the stock is considered undervalued.

- Growth Investing: This strategy focuses on companies with high growth potential. Investors would look for signs of strong revenue growth, market share expansion, and innovation within Insteel Industries before investing.

A hypothetical entry point might be based on a combination of technical indicators (e.g., moving averages) and fundamental analysis (e.g., strong earnings reports). An exit strategy could involve setting price targets based on technical analysis or adjusting the position based on changes in the company’s financial performance or market conditions. Investing in Insteel Industries carries risks associated with fluctuations in steel prices, economic downturns, and competition.

However, potential rewards include capital appreciation and dividend income.

Answers to Common Questions

What are the major risks associated with investing in Insteel Industries stock?

Investing in Insteel Industries, like any stock, carries inherent risks. These include fluctuations in steel prices, changes in construction activity, increased competition, and macroeconomic uncertainties. Investors should carefully assess their risk tolerance before investing.

How does Insteel Industries compare to its competitors?

Insteel Industries’ stock price performance is often compared to other companies in the materials sector. For instance, understanding the current market trends can be insightful; checking the ingredion stock price today provides a relevant benchmark for comparison within the broader food and industrial ingredient space. Ultimately, analyzing both Insteel and Ingredion helps build a more comprehensive view of market dynamics impacting the sector.

A comparative analysis of Insteel Industries against its competitors would involve examining market share, profitability, operational efficiency, and strategic positioning. This would require a separate, in-depth study beyond the scope of this analysis.

Where can I find real-time Insteel Industries stock price data?

Real-time stock price data for Insteel Industries can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.