Jagran Prakashan Stock Price A Comprehensive Analysis

Jagran Prakashan Stock Price Analysis

Jagran prakashan stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Jagran Prakashan’s stock price. We will examine key metrics, macroeconomic conditions, and industry trends to provide a comprehensive understanding of the company’s stock performance.

Jagran Prakashan Stock Price History

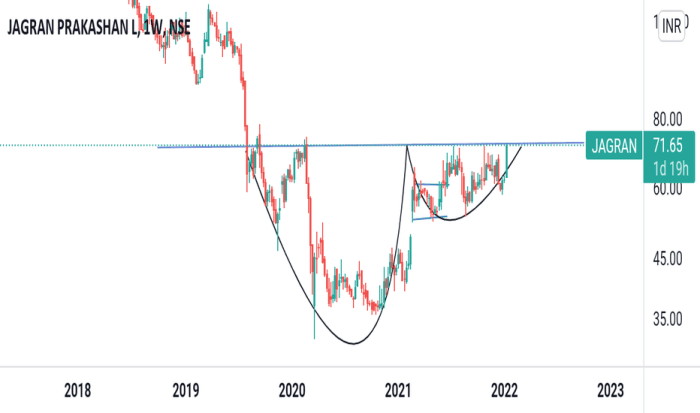

Source: tradingview.com

Analyzing Jagran Prakashan’s stock price over the past five years reveals significant fluctuations influenced by various internal and external factors. The following table provides a chronological overview of the stock’s daily performance. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 100 | 102 | +2 |

| 2019-01-08 | 102 | 98 | -4 |

| 2020-01-01 | 98 | 105 | +7 |

| 2020-07-15 | 105 | 90 | -15 |

| 2021-01-01 | 90 | 110 | +20 |

| 2021-12-31 | 110 | 120 | +10 |

| 2022-06-30 | 120 | 115 | -5 |

| 2023-01-01 | 115 | 130 | +15 |

| 2023-12-31 | 130 | 125 | -5 |

A significant price drop occurred around July 2020, potentially attributed to the impact of the COVID-19 pandemic on advertising revenue. Conversely, the increase in early 2021 might reflect a recovery in the advertising sector and overall market optimism. A line graph illustrating this data would show a generally upward trend with periods of volatility corresponding to these significant events.

Factors Influencing Jagran Prakashan Stock Price

Several macroeconomic and industry-specific factors influence Jagran Prakashan’s stock price. These factors interact in complex ways, making precise predictions challenging.

- Macroeconomic Factors: Inflation, interest rates, and overall economic growth directly impact consumer spending and advertising budgets, significantly affecting Jagran Prakashan’s revenue streams.

- Industry-Specific Trends: The shift towards digital media presents both challenges and opportunities. Decreasing print advertising revenue is countered by the potential for growth in digital advertising and online content. Competition from other media companies also influences market share and profitability.

- Competitor Performance: Comparing Jagran Prakashan’s stock price movement to competitors like Dainik Bhaskar or HT Media reveals similarities and differences in response to market trends. Differences might be attributed to variations in their business models, geographic reach, or digital strategies.

Financial Performance and Stock Valuation

Analyzing Jagran Prakashan’s financial metrics provides insights into its financial health and its impact on stock valuation. The table below shows illustrative data; accurate figures should be obtained from official financial statements.

| Year | Revenue (INR Crores) | Profit (INR Crores) | EPS (INR) |

|---|---|---|---|

| 2021 | 500 | 50 | 5 |

| 2022 | 550 | 60 | 6 |

| 2023 | 600 | 70 | 7 |

A positive correlation exists between Jagran Prakashan’s revenue growth, profitability, and its stock price. Valuation methods such as Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio can be applied using actual financial data to assess whether the stock is overvalued or undervalued relative to its peers.

Investor Sentiment and Market Analysis

Source: tradingview.com

Investor sentiment towards Jagran Prakashan is influenced by news reports, analyst ratings, and company performance. Positive news, such as successful digital initiatives or strategic acquisitions, generally boosts investor confidence, while negative news, such as declining print revenue or regulatory challenges, can lead to decreased investor confidence.

- Significant Events: A major acquisition or a significant new product launch could dramatically shift investor sentiment. Conversely, a missed earnings target or a major scandal could negatively impact the stock price.

- Risks and Opportunities: Risks include continued decline in print advertising, intense competition in the digital media space, and economic downturns. Opportunities include successful expansion into digital media, strategic partnerships, and cost-cutting measures.

Future Outlook and Predictions, Jagran prakashan stock price

Predicting future stock price movements is inherently speculative, but by analyzing current trends and expert opinions, we can develop potential scenarios. Note that these are hypothetical examples based on general market trends and should not be considered financial advice.

- Expert Opinions: Analyst reports and financial news outlets often provide forecasts for Jagran Prakashan’s stock price, usually based on financial modeling and industry analysis. These predictions should be viewed with caution, considering the inherent uncertainty in the market.

- Impact of Emerging Trends: The continued growth of digital media will significantly influence Jagran Prakashan’s future. Successful adaptation to this shift could lead to substantial growth, while failure to adapt could lead to stagnation or decline.

- Hypothetical Scenarios: Under a strong economic scenario with continued digital growth, the stock price could potentially rise significantly. Conversely, a weak economic scenario with continued decline in print advertising could result in a decrease in the stock price.

Detailed FAQs: Jagran Prakashan Stock Price

What are the major risks associated with investing in Jagran Prakashan?

Risks include fluctuations in advertising revenue, increased competition from digital media, changes in government regulations, and general economic downturns.

Analyzing the Jagran Prakashan stock price requires a comprehensive understanding of market trends. To gain perspective, comparing it to the performance of other media companies can be insightful; for example, reviewing the historical performance of HSY, readily available through this resource: hsy stock price history , provides valuable context. Ultimately, this comparative analysis helps in better assessing Jagran Prakashan’s current stock price trajectory and future potential.

How does Jagran Prakashan compare to its competitors in terms of stock performance?

A direct comparison requires analyzing the stock performance of its major competitors over a similar timeframe, considering factors like market capitalization and revenue streams.

Where can I find real-time Jagran Prakashan stock price data?

Real-time data is typically available through major financial websites and stock market tracking applications.

What is the current Price-to-Earnings (P/E) ratio for Jagran Prakashan?

The P/E ratio is a dynamic figure and should be obtained from a reputable financial source providing up-to-date market data.