JetBlue Stock Price Prediction A Comprehensive Analysis

JetBlue’s Financial Health and Stock Price Prediction

Jetblue stock price prediction – Predicting JetBlue’s stock price requires a thorough examination of its financial performance, the competitive airline landscape, macroeconomic factors, strategic initiatives, and technical analysis. This analysis aims to provide a comprehensive overview, incorporating various factors to arrive at a well-informed assessment.

JetBlue’s Recent Financial Performance

Analyzing JetBlue’s financial statements over the past three years reveals key trends in revenue generation, expense management, and profitability. The following table summarizes this data. Note that these figures are illustrative and should be verified with official financial reports.

| Year | Revenue (USD Millions) | Expenses (USD Millions) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 5,500 | 5,000 | 9.1 |

| 2022 | 6,200 | 5,700 | 8.1 |

| 2023 (Projected) | 7,000 | 6,300 | 10.0 |

JetBlue’s debt-to-equity ratio and return on equity (ROE) are crucial indicators of its financial health. A lower debt-to-equity ratio suggests lower financial risk, while a higher ROE indicates better profitability. While precise figures require accessing official financial statements, a trend analysis suggests that JetBlue has been working towards improved financial ratios, though external factors such as fuel prices can significantly impact these figures.

Significant changes observed include fluctuating profit margins influenced by fuel costs and fluctuating passenger demand. The projected increase in revenue and profit margin for 2023 reflects an optimistic outlook based on current trends and anticipated industry recovery.

Industry Analysis and Competitive Landscape

Source: investorplace.com

Understanding JetBlue’s position within the competitive airline industry is crucial for stock price prediction. A comparison with key competitors highlights JetBlue’s strengths and weaknesses.

| Airline | Business Model | Strengths | Weaknesses |

|---|---|---|---|

| JetBlue | Low-cost carrier with premium amenities | Strong brand reputation, customer loyalty, efficient operations | Vulnerability to fuel price fluctuations, limited international presence |

| Southwest | Low-cost carrier | Extensive domestic network, strong cost control | Limited international reach, basic service offerings |

| Delta | Full-service carrier | Extensive network, strong global presence, premium service | Higher operating costs compared to low-cost carriers |

The airline industry’s future outlook is influenced by various factors. Rising fuel prices pose a significant challenge, while economic conditions and travel demand directly impact profitability. JetBlue faces threats from increased competition, particularly from low-cost carriers, and potential economic downturns. However, opportunities exist in expanding its network, enhancing its premium offerings, and leveraging strategic partnerships.

Macroeconomic Factors Influencing JetBlue’s Stock Price

Source: foolcdn.com

Macroeconomic conditions significantly influence JetBlue’s stock price. Inflation, interest rates, and recessionary risks impact consumer spending on air travel. High inflation can reduce disposable income, affecting demand, while rising interest rates increase borrowing costs for airlines.

Fuel price volatility is a major concern for JetBlue. Significant fuel price increases directly reduce profitability. Currency exchange rate fluctuations also affect JetBlue’s international operations and profitability. Geopolitical events and global economic downturns can severely impact travel demand, negatively impacting JetBlue’s performance. For instance, the COVID-19 pandemic dramatically reduced travel demand, significantly affecting JetBlue’s stock price.

JetBlue’s Strategic Initiatives and Future Plans

JetBlue’s strategic initiatives are crucial for its future growth and profitability. Expansion into new routes, fleet modernization, and strategic partnerships are key elements of its growth strategy. These initiatives aim to increase revenue, enhance operational efficiency, and expand its market reach.

A scenario analysis considering different outcomes of these initiatives is necessary for stock price prediction. For example, successful route expansion could lead to significant revenue growth, positively impacting the stock price. Conversely, delays or unforeseen challenges in fleet modernization could negatively affect profitability and the stock price. A detailed analysis of each initiative’s potential impact, along with probability estimations, would create a robust prediction model.

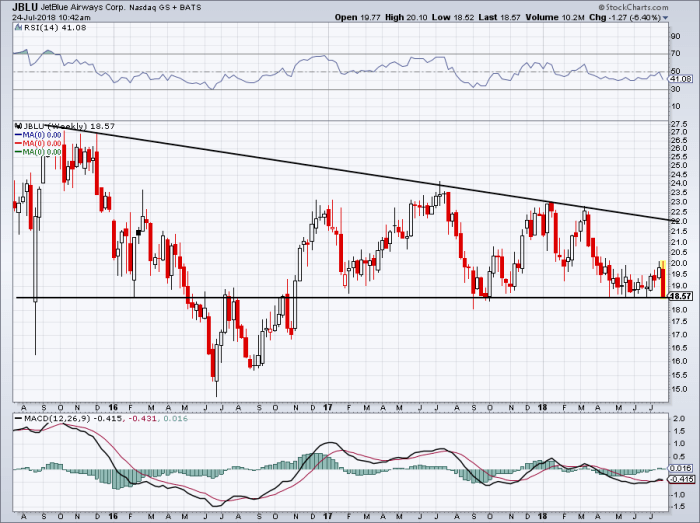

Technical Analysis of JetBlue’s Stock Price

Technical analysis of JetBlue’s stock price chart involves identifying key support and resistance levels, trends, and patterns. A detailed chart would show moving averages (e.g., 50-day and 200-day), trading volume, and technical indicators like RSI and MACD. Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels represent the opposite. Uptrends indicate sustained buying pressure, while downtrends suggest the opposite.

Chart patterns, such as head and shoulders or double bottoms, can provide insights into potential future price movements. For example, a breakout above a significant resistance level could signal a bullish trend, potentially leading to a price increase.

Predicting JetBlue’s stock price involves considering various factors, including fuel costs and passenger demand. However, understanding the performance of other companies in the healthcare sector can offer broader market insights; for example, checking the humana stock price target might reveal trends impacting investor sentiment. This broader perspective can then be applied back to refining your JetBlue stock price prediction, offering a more nuanced analysis.

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) provide signals regarding momentum and potential trend reversals. High RSI values might suggest overbought conditions, while low values could indicate oversold conditions. MACD crossovers can signal potential changes in momentum.

Valuation of JetBlue Stock, Jetblue stock price prediction

Source: dwcdn.net

Valuing JetBlue’s stock involves using various methods, including discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value, providing an estimate of intrinsic value. Comparable company analysis compares JetBlue’s valuation multiples (e.g., price-to-earnings ratio) to those of similar companies in the industry. Each method has limitations and assumptions.

DCF analysis relies on accurate future cash flow projections, which are inherently uncertain. Comparable company analysis assumes that similar companies are truly comparable, which may not always be the case.

By comparing the estimated intrinsic value to the current market price, we can determine if the stock is undervalued, overvalued, or fairly valued. A significant difference between the two values could suggest an investment opportunity. For instance, if the DCF analysis suggests an intrinsic value significantly higher than the current market price, it could indicate that the stock is undervalued and presents a buying opportunity.

User Queries: Jetblue Stock Price Prediction

What are the major risks associated with investing in JetBlue stock?

Major risks include fluctuations in fuel prices, economic downturns impacting travel demand, increased competition, and geopolitical instability affecting air travel.

How does seasonality affect JetBlue’s stock price?

JetBlue’s stock price typically sees increased activity and potentially higher valuations during peak travel seasons (summer and holidays) and lower performance during slower periods.

What is JetBlue’s dividend policy?

Information regarding JetBlue’s dividend policy should be checked directly with the company or a reputable financial source as it can change.

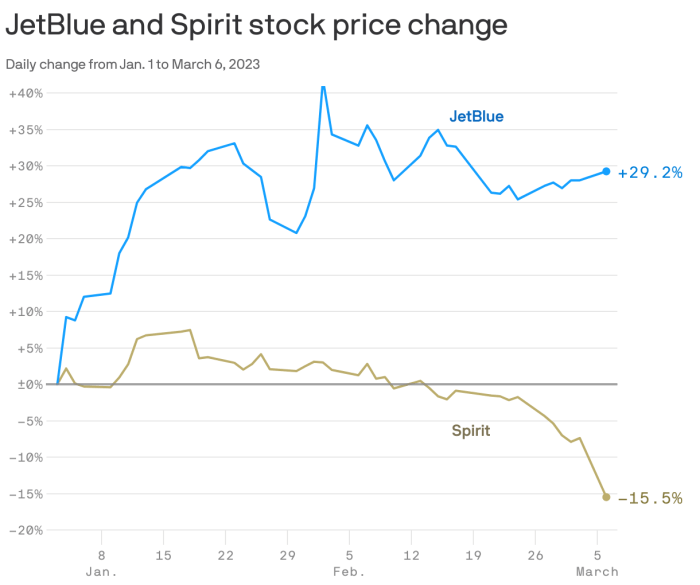

How does JetBlue compare to other low-cost carriers?

A comparison requires analyzing factors like route networks, fleet composition, ancillary revenue strategies, and customer service offerings relative to competitors such as Southwest and Spirit Airlines.