Jumbo Bag Stock Price Market Analysis

Jumbo Bag Market Overview

Jumbo bag stock price – The jumbo bag market, also known as flexible intermediate bulk containers (FIBCs) or big bags, is a significant segment within the packaging industry. This market is characterized by substantial volume, driven by the increasing demand for efficient and cost-effective bulk handling solutions across various sectors. This section provides an overview of the market size, growth, key players, trends, and factors influencing jumbo bag pricing.

Market Size and Growth

The global jumbo bag market is valued in the billions of dollars, experiencing steady growth driven by the expansion of industries like agriculture, chemicals, and construction. Annual growth rates typically fluctuate between 4% and 7%, influenced by economic conditions and global trade patterns. Specific figures require consultation of current market research reports from reputable firms.

Key Players and Market Share

Several multinational corporations and regional manufacturers dominate the jumbo bag market. Competition is intense, with companies vying for market share through innovation, cost optimization, and strategic partnerships. Below is a sample table illustrating market share, actual data requires consulting recent market analysis.

| Manufacturer | Market Share (%) | Key Strengths | Geographic Focus |

|---|---|---|---|

| Company A | 20 | Global reach, diverse product portfolio | Global |

| Company B | 18 | Strong regional presence, cost leadership | North America |

| Company C | 15 | Innovation in material science, specialized bags | Europe |

| Company D | 12 | Large production capacity, efficient supply chain | Asia |

| Company E | 10 | Focus on sustainable packaging solutions | Global |

Market Trends and Future Outlook

The jumbo bag market is witnessing a shift towards sustainable and eco-friendly materials, driven by increasing environmental concerns. Demand for customized and specialized jumbo bags is also rising, catering to the specific needs of various industries. The long-term outlook remains positive, with projected growth driven by industrial expansion and evolving packaging preferences.

Factors Influencing Jumbo Bag Prices

The price of jumbo bags is influenced by several factors, including raw material costs (polypropylene resin being a primary component), global supply chain dynamics, energy prices, and transportation costs. Fluctuations in these factors directly impact the profitability of jumbo bag manufacturers.

Stock Price Drivers for Jumbo Bag Companies

Several factors influence the stock prices of publicly traded jumbo bag companies. Understanding these drivers is crucial for investors seeking exposure to this market. This section analyzes key influences, including economic conditions and company-specific performance.

Economic Conditions and Stock Prices

Economic downturns, such as recessions, generally negatively impact the demand for jumbo bags, as industrial activity slows. Conversely, periods of economic growth often lead to increased demand and higher stock prices. Inflation also affects the cost of raw materials and production, influencing profitability and share prices.

Comparison of Stock Performance

Comparing the stock performance of two major jumbo bag companies (e.g., Company A and Company B) over the past five years requires accessing historical stock data. Analysis would involve comparing their price movements, returns, and volatility, considering factors like market capitalization and industry benchmarks.

Correlation Between News Events and Stock Price Fluctuations

A timeline demonstrating the correlation between major news events (e.g., changes in raw material prices, new product launches, regulatory changes, or significant contracts) and the stock price fluctuations of a specific company (e.g., Company X) would require access to company-specific data and news archives. Such an analysis would reveal the sensitivity of the stock price to various external and internal factors.

Financial Performance Analysis of a Jumbo Bag Company (Example: Company X)

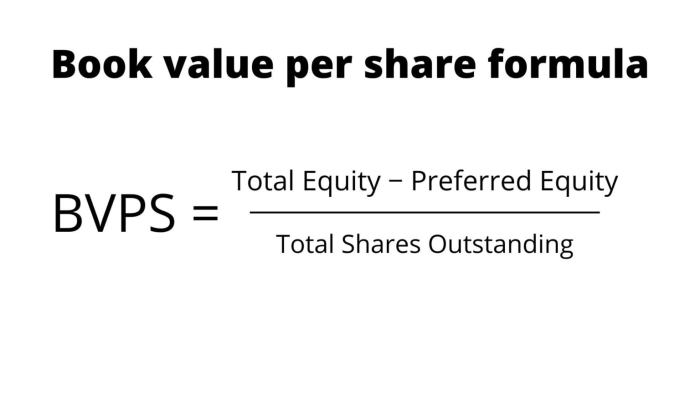

A comprehensive financial analysis of a hypothetical Company X would involve examining its income statement, balance sheet, and cash flow statement over the past three years. This analysis would assess revenue streams, profit margins, key financial ratios, and the impact of raw material price changes on profitability. Note that this is a hypothetical example; real data would need to be obtained from Company X’s financial reports.

Company X: Hypothetical Financial Overview

Source: walmartimages.com

Assuming Company X’s primary revenue stream is jumbo bag sales, analysis would focus on sales volume, average selling price, and cost of goods sold. Profit margins would be calculated, and key financial ratios like debt-to-equity ratio, return on assets (ROA), and return on equity (ROE) would be calculated and interpreted. The sensitivity of Company X’s profitability to changes in polypropylene resin prices would be determined through analysis of historical data and modeling.

Competitive Landscape and Industry Analysis

The jumbo bag industry is characterized by a mix of large multinational corporations and smaller regional players. Competitive strategies vary, with some companies focusing on cost leadership, others on product differentiation, and still others on niche market specialization. This section compares the strategies of three hypothetical companies.

Comparison of Business Strategies

Source: financialfalconet.com

Company A might focus on economies of scale and efficient production, Company B might emphasize innovation and specialized product offerings, while Company C might target a specific geographic region or industry segment. Each company would have its own unique competitive advantages and disadvantages, influenced by factors such as manufacturing capabilities, brand recognition, and distribution networks. Potential for mergers and acquisitions would be influenced by market consolidation trends and strategic fit between companies.

SWOT Analysis of Company X

A SWOT analysis of a hypothetical Company X would provide a structured overview of its internal strengths and weaknesses, and external opportunities and threats. This analysis is crucial for understanding the company’s competitive positioning and potential for future growth. Note that this is a hypothetical example and real data would be needed for an accurate SWOT analysis.

- Strengths: Established brand, efficient production, strong distribution network.

- Weaknesses: Limited product diversification, dependence on key suppliers.

- Opportunities: Expansion into new markets, development of sustainable products.

- Threats: Intense competition, fluctuations in raw material prices.

Risk Factors Affecting Jumbo Bag Stock Prices

Source: fortune.com

Tracking the jumbo bag stock price can be insightful for understanding market trends in flexible packaging. A related area to consider for comparative analysis is the performance of other packaging-related stocks, such as the hsdt stock price , which can offer a broader perspective on the sector’s overall health. Ultimately, understanding the dynamics of jumbo bag stock price requires a holistic view of the packaging industry’s performance.

Investing in jumbo bag companies involves various risks. Understanding these risks is essential for informed investment decisions. This section identifies key risks, including raw material price volatility, geopolitical events, and environmental concerns.

Raw Material Price Volatility and Competition

The price of polypropylene resin, a key raw material, can fluctuate significantly due to factors like oil prices and global supply chain disruptions. This volatility directly impacts the profitability of jumbo bag manufacturers and, consequently, their stock prices. Intense competition within the industry can also pressure profit margins.

Geopolitical Events and Regulatory Changes

Geopolitical instability, trade wars, and changes in import/export regulations can disrupt supply chains and impact the availability of raw materials, affecting production costs and stock prices. Environmental regulations and concerns regarding plastic waste can also lead to increased production costs and potential regulatory hurdles.

Environmental and Social Responsibility Concerns

Growing awareness of environmental issues is leading to increased scrutiny of the environmental impact of jumbo bag production. Companies failing to address sustainability concerns may face reputational damage and regulatory penalties, impacting their stock prices.

Supply Chain Disruptions

A major supply chain disruption, such as a natural disaster or geopolitical event affecting key suppliers, could severely impact production and lead to significant stock price declines.

Future Outlook and Investment Considerations: Jumbo Bag Stock Price

The future outlook for jumbo bag stocks depends on several factors, including continued industrial growth, technological advancements, and the evolution of packaging preferences. This section offers a perspective on future price forecasts and potential investment strategies.

Future Price Forecasts and Investment Strategies

Predicting future stock prices is inherently challenging. However, based on current market trends and industry projections, a positive outlook for the long-term growth of the jumbo bag market can be cautiously anticipated. Investment strategies might include diversification within the industry, focusing on companies with strong sustainability initiatives, and employing long-term investment horizons.

Buy/Sell Signals for Jumbo Bag Stocks

Buy signals might include strong financial performance, positive industry outlook, and evidence of innovation and market share growth. Sell signals might include declining profitability, negative industry trends, and heightened competitive pressures.

Growth and Innovation in the Jumbo Bag Sector, Jumbo bag stock price

The jumbo bag sector is likely to witness ongoing innovation in materials science, focusing on sustainable and biodegradable alternatives to traditional polypropylene. Advancements in automation and production efficiency will also shape the future of the industry, impacting the performance of companies that successfully adapt to these changes.

Expert Answers

What are the main types of jumbo bags?

Jumbo bags are categorized by material (polypropylene, polyethylene), construction (woven, tubular), and features (conductive, anti-static). Specific types cater to different industries and cargo needs.

How does environmental regulation impact jumbo bag stock prices?

Increasingly stringent environmental regulations can impact profitability by raising production costs and influencing demand for more sustainable materials, thus affecting stock prices.

What are the potential risks of investing in smaller jumbo bag companies?

Smaller companies may face higher financial risk due to limited resources, less diversification, and greater vulnerability to market fluctuations compared to larger, established players.

Are there any ETFs that focus on the packaging industry, including jumbo bags?

While no ETFs directly focus solely on jumbo bags, some broader packaging or materials industry ETFs might offer indirect exposure. Research is needed to find relevant ETFs.