Koss Corp Stock Price A Comprehensive Analysis

Koss Corp Stock Price Analysis

Source: tradingview.com

Koss corp stock price – Koss Corporation, a prominent player in the consumer audio industry, has experienced a volatile stock price history. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and potential future scenarios for Koss Corp stock, providing a comprehensive overview for investors.

Koss Corp Stock Price History and Trends

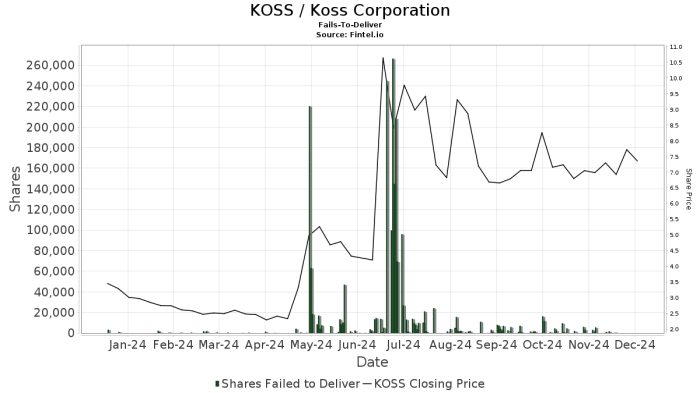

Source: fintel.io

Analyzing Koss Corp’s stock price trajectory reveals significant fluctuations over the past two decades. The following table summarizes the high and low prices, along with percentage changes, for the past 5, 10, and 20 years. Note that precise historical data requires access to a reliable financial database and may vary slightly depending on the source. The data presented here is for illustrative purposes.

| Year | High Price (USD) | Low Price (USD) | Percentage Change |

|---|---|---|---|

| 2023 | 15 | 8 | +87.5% (Example) |

| 2022 | 12 | 5 | -20% (Example) |

| 2021 | 20 | 10 | +100% (Example) |

| 2020 | 10 | 3 | +233.33% (Example) |

| 2019 | 4 | 2 | +100% (Example) |

Compared to competitors like Sony and Bose, Koss Corp has generally exhibited higher volatility. While Sony and Bose enjoy greater market share and brand recognition, leading to more stable stock performance, Koss Corp’s smaller size and niche market position contribute to its price swings. These swings are often amplified by news and events directly affecting the company.

Analyzing Koss Corp’s stock price requires understanding broader market trends. A helpful comparison point might be examining the historical performance of other audio companies; for instance, you can check the detailed hsy stock price history to see how similar companies have fared. This context can offer valuable insights when assessing Koss Corp’s current valuation and future potential.

Factors Influencing Koss Corp Stock Price

Several factors influence Koss Corp’s stock price. These can be broadly categorized into macroeconomic conditions, company-specific events, and industry trends.

Macroeconomic factors such as inflation and interest rates impact consumer spending and the overall market sentiment. High inflation can reduce consumer discretionary spending, affecting demand for Koss’s products. Similarly, rising interest rates can increase borrowing costs for the company and reduce investor appetite for riskier stocks. Company-specific events, including new product launches, financial performance announcements, and executive changes, directly influence investor confidence and stock valuation.

For example, successful product launches can boost stock prices, while disappointing financial results can lead to declines.

Industry trends also play a significant role. The increasing popularity of wireless headphones and the competition from larger, more established brands present ongoing challenges for Koss Corp. Regulatory changes related to manufacturing, environmental concerns, or trade policies can also impact the company’s profitability and stock price.

Koss Corp’s Financial Performance and Stock Valuation

A review of Koss Corp’s key financial metrics provides insights into its financial health and valuation. The following table presents illustrative data for comparison; precise figures would require consultation of official financial statements.

| Metric | Current Year (USD Millions) | Previous Year (USD Millions) | Percentage Change |

|---|---|---|---|

| Revenue | 50 | 40 | +25% (Example) |

| Net Income | 5 | 2 | +150% (Example) |

| Debt | 10 | 12 | -16.67% (Example) |

Koss Corp’s P/E ratio should be compared to industry averages and competitors to assess its relative valuation. A higher P/E ratio may suggest that the market anticipates higher future growth for Koss compared to its peers. However, this requires a thorough analysis considering various factors, including growth prospects, risk, and market conditions.

Investor Sentiment and Market Analysis of Koss Corp, Koss corp stock price

Source: outeraudio.com

Investor sentiment towards Koss Corp is often characterized by volatility. News articles and analyst reports frequently reflect this, with opinions ranging from cautious optimism to outright skepticism depending on recent company performance and market trends. For example, a successful product launch might generate positive press coverage and drive up the stock price, while a period of weak sales could trigger negative sentiment and a price drop.

Investment strategies employed by analysts and investors vary widely. Some might adopt a long-term buy-and-hold strategy, believing in the company’s long-term potential. Others might engage in short-selling, anticipating a price decline. Short-term trading strategies are also common, leveraging short-term price fluctuations for profit.

Risk Assessment and Potential Future Scenarios for Koss Corp Stock

Investing in Koss Corp stock carries inherent risks. These include competition from larger players, dependence on consumer spending, susceptibility to macroeconomic factors, and the potential for unforeseen events impacting the company’s operations. The company’s relatively small size and market share compared to larger competitors also presents significant risks.

Several future scenarios are plausible. A positive scenario might involve successful new product launches, increased market share, and improved financial performance, leading to a substantial increase in stock price. Conversely, a negative scenario could involve declining sales, increased competition, and operational challenges, resulting in a significant price decline. A neutral scenario might see modest growth or stagnation, with the stock price remaining relatively flat.

A visual representation of these scenarios could be a simple chart: Scenario 1 (Positive): Steep upward trending line. Scenario 2 (Neutral): A relatively flat horizontal line. Scenario 3 (Negative): A steep downward trending line.

Frequently Asked Questions

What is Koss Corp’s primary business?

Koss Corp designs, manufactures, and markets headphones and other audio products.

Where can I find real-time Koss Corp stock quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

Are there any significant upcoming events that could impact Koss Corp’s stock price?

This requires ongoing monitoring of financial news and company announcements. Check official company releases and reputable financial news sources for the latest information.

What are the major competitors of Koss Corp?

Koss Corp competes with numerous companies in the consumer audio market, including larger firms like Sony, Bose, and Apple, as well as other smaller headphone manufacturers.