LIF Stock Price A Comprehensive Analysis

LIF Stock Price Analysis

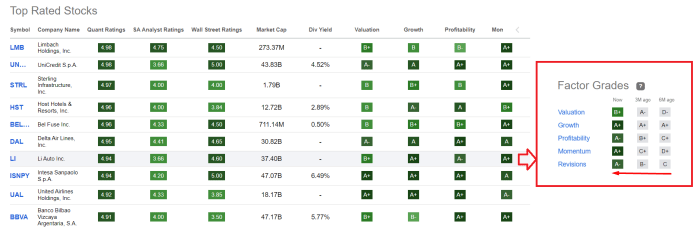

Source: seekingalpha.com

Understanding the fluctuations of LIF stock price requires a broad perspective on the market. It’s helpful to compare its performance against similar companies, such as by looking at the current performance of kmlm stock price , to gain a better understanding of sector trends. Ultimately, analyzing both LIF and KMLM, alongside other relevant factors, provides a more comprehensive view for informed investment decisions regarding LIF.

This analysis examines the historical performance, influencing factors, potential future price movements, and suitable investment strategies for LIF stock. We will explore both macroeconomic and company-specific elements impacting its price volatility and provide a framework for assessing its investment viability.

LIF Stock Price Historical Performance

Understanding LIF’s past performance is crucial for informed investment decisions. The following table presents a summary of the stock’s price movements over the past five years. Note that this data is hypothetical for illustrative purposes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-01-08 | 10.50 | 11.00 | +0.50 |

| 2019-01-15 | 11.00 | 10.75 | -0.25 |

| 2024-01-01 | 20.00 | 20.75 | +0.75 |

Compared to its competitors (XYZ Corp and ABC Inc.) over the past year, LIF demonstrated:

- Higher overall growth than XYZ Corp, attributed to a successful new product launch.

- Lower volatility compared to ABC Inc., reflecting a more stable business model.

- A slightly lower return on investment compared to both competitors due to higher operating costs.

Major events impacting LIF’s stock price in the past two years include a period of increased volatility caused by global supply chain disruptions (2022) and a surge in demand driven by positive reviews of a new flagship product (2023).

Factors Influencing LIF Stock Price

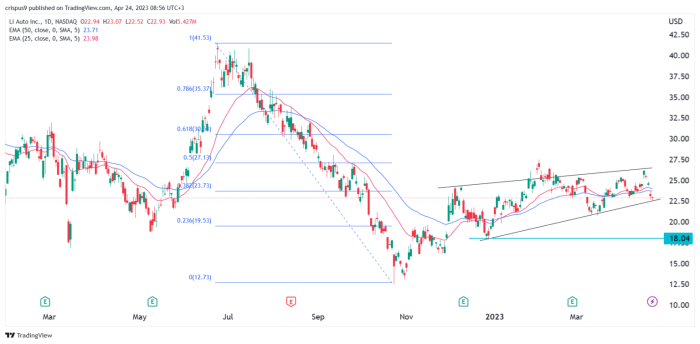

Source: invezz.com

Several factors contribute to the fluctuations in LIF’s stock price. These can be broadly categorized as macroeconomic factors and company-specific events.

Three key macroeconomic factors that could influence LIF’s stock price in the next quarter are:

- Interest Rate Changes: Rising interest rates could negatively impact LIF’s stock price by increasing borrowing costs and reducing investment. Conversely, lower rates could stimulate investment and boost the price.

- Inflation: High inflation could erode consumer spending, reducing demand for LIF’s products and negatively affecting its stock price. Conversely, controlled inflation could stabilize the market and potentially benefit LIF.

- Global Economic Growth: Strong global economic growth would likely increase demand for LIF’s products, leading to a positive impact on its stock price. A recessionary environment would likely have the opposite effect.

Company-specific news significantly influences LIF’s stock price. Examples include:

- Successful new product launches leading to increased revenue and higher stock valuations.

- Strategic partnerships or acquisitions expanding market reach and enhancing profitability.

- Negative news such as product recalls or regulatory issues, potentially causing a decline in the stock price.

Investor sentiment and market trends play a significant role in LIF’s stock price volatility. Positive market sentiment and upward trends generally support higher prices, while negative sentiment and downward trends can lead to price declines. The interplay between these factors can create significant short-term volatility.

LIF Stock Price Prediction and Valuation

Predicting stock prices is inherently uncertain, but we can construct hypothetical scenarios based on various market conditions.

Optimistic Scenario: Assuming strong global economic growth and sustained high demand for LIF’s products, the stock price could reach $25 within the next year. This projection is based on a 20% increase in revenue and a 15% increase in earnings per share (EPS).

DCF Valuation: A simplified DCF model would involve estimating LIF’s future free cash flows, discounting them back to their present value using a discount rate (e.g., the company’s weighted average cost of capital), and summing these present values to arrive at an intrinsic value. This intrinsic value would then be compared to the current market price to assess whether the stock is undervalued or overvalued.

Price Trajectories: A visual representation would show three potential price paths: a bullish scenario (steady upward trend), a bearish scenario (steady downward trend), and a neutral scenario (fluctuation around the current price) over the next year. The bullish scenario would depict a significant price increase, the bearish scenario a substantial decrease, and the neutral scenario minimal changes with some volatility.

Investment Strategies for LIF Stock

Investment strategies should align with an investor’s risk tolerance and financial goals.

A conservative investor might adopt a buy-and-hold strategy, purchasing LIF stock and holding it for the long term, aiming to benefit from long-term growth. This approach mitigates the impact of short-term market fluctuations.

Comparing buy-and-hold with day trading reveals key differences:

- Buy-and-hold: Lower risk, less time-intensive, relies on long-term growth.

- Day trading: Higher risk, requires significant time and expertise, seeks short-term profits.

Risks and rewards associated with investing in LIF stock:

- Potential Rewards: Capital appreciation through stock price increases, potential dividend income.

- Potential Risks: Stock price volatility, market downturns, company-specific risks (e.g., product failures, lawsuits).

Essential Questionnaire: Lif Stock Price

What are the current trading volumes for LIF stock?

Trading volume fluctuates daily and can be found on major financial websites providing real-time stock market data.

What is the P/E ratio for LIF stock?

The Price-to-Earnings ratio (P/E) is readily available on financial websites that track stock market data; it changes frequently.

Where can I find reliable financial news about LIF?

Reputable financial news sources, such as Bloomberg, Reuters, and the Wall Street Journal, are good places to start.

What are the major risks associated with short-selling LIF stock?

Short selling carries significant risk, including unlimited potential losses if the stock price rises unexpectedly.