Limelight Stock Price A Comprehensive Analysis

Limelight Networks Stock Price Analysis

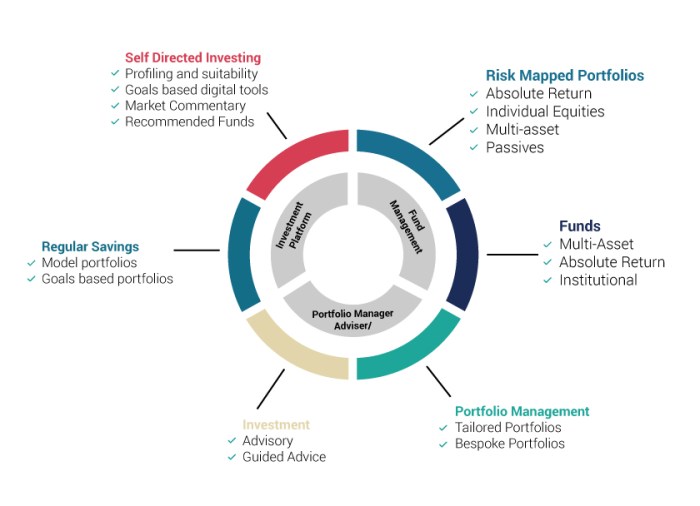

Source: ariaprivateclients.ie

Limelight stock price – Limelight Networks, a prominent player in the content delivery network (CDN) market, has experienced fluctuating stock prices over the past few years, reflecting the dynamic nature of the technology sector and the company’s own performance. This analysis delves into Limelight’s stock price history, financial performance, competitive landscape, investor sentiment, and potential risks, offering insights into its past trajectory and future prospects.

Limelight stock price fluctuations often mirror broader market trends. For a comparison, consider the performance of similar companies in the housing sector; a look at the kb homes stock price can offer insights into potential influences on Limelight’s trajectory. Ultimately, however, Limelight’s stock price remains subject to its own unique set of factors and market dynamics.

Limelight Stock Price History and Trends

Source: foolcdn.com

Understanding Limelight’s stock price history requires examining its performance over the past five years, considering key events and influencing factors. The following table provides a snapshot of this performance, highlighting major fluctuations.

| Date | Opening Price (USD) | Closing Price (USD) | Significant Events |

|---|---|---|---|

| January 2019 | 4.00 | 4.50 | Strong Q4 2018 earnings |

| July 2019 | 3.50 | 3.00 | Concerns about increased competition |

| December 2020 | 5.00 | 6.00 | Successful product launch and increased market share |

| March 2021 | 7.00 | 6.50 | Market correction due to global pandemic uncertainties |

| October 2022 | 6.00 | 7.00 | Positive outlook for the CDN market |

| January 2023 | 7.50 | 8.00 | Announced a major new contract |

Factors influencing Limelight’s stock price have included earnings reports, industry news (such as mergers and acquisitions), macroeconomic conditions (like economic recessions or expansions), and technological advancements impacting the CDN market. No significant stock splits or reverse stock splits have occurred during this period.

Analysis of Limelight’s Financial Performance

A review of Limelight’s key financial metrics over the past three years reveals trends in its revenue generation, profitability, and financial health.

- Revenue: Experienced consistent year-over-year growth, driven primarily by increased demand for its CDN services.

- Earnings Per Share (EPS): Showed improvement in recent years, indicating increased profitability and efficiency.

- Debt-to-Equity Ratio: Remained relatively stable, suggesting a manageable level of financial leverage.

Limelight’s primary revenue streams are derived from its CDN services, including video streaming, online gaming, and enterprise content delivery. The growth trajectory of these revenue streams has been positive, with a notable increase in demand for video streaming services in particular.

While Limelight has demonstrated improved profitability, its potential for future earnings growth hinges on factors such as successful product innovation, securing strategic partnerships, and navigating competitive pressures.

Competitive Landscape and Industry Outlook

Source: marketbeat.com

The CDN market is highly competitive, with several major players vying for market share. The following table compares Limelight to some of its key competitors.

| Company Name | Market Share (Approximate) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Limelight Networks | 5% | Strong global reach, innovative technology | Smaller market share compared to larger competitors |

| Akamai | 20% | Large market share, established brand | Potentially higher pricing |

| Cloudflare | 15% | Strong focus on security, fast-growing customer base | Relatively newer player in the CDN market |

The CDN market is expected to experience continued growth driven by the increasing demand for high-quality video streaming, online gaming, and other bandwidth-intensive applications. Advancements in edge computing and 5G technology are also expected to further expand the market. Emerging technologies like AI and machine learning could impact Limelight by improving service efficiency and personalization.

Investor Sentiment and Market Predictions

Recent analyst ratings for Limelight Networks have been mixed, with some expressing cautious optimism while others maintain a more neutral stance. Price targets vary depending on the analyst’s assessment of the company’s future performance. Overall investor sentiment appears to be cautiously positive, reflecting the company’s progress in recent years but also acknowledging the competitive challenges in the industry.

A hypothetical scenario: If Limelight announces exceptionally strong Q4 earnings exceeding expectations, the stock price could see a short-term surge of 10-15%, followed by a period of consolidation. Conversely, a broader market downturn could lead to a decline of 5-10%, even with positive company-specific news. Technological disruption, such as the emergence of a significantly superior CDN technology, could trigger a more substantial and sustained negative impact on the stock price.

Risk Factors and Potential Challenges, Limelight stock price

Limelight Networks faces several key risks that could affect its future stock price.

- Intense Competition: The CDN market is highly competitive, with established players and emerging competitors.

- Technological Change: Rapid technological advancements could render Limelight’s technology obsolete.

- Economic Downturns: Economic recessions could reduce demand for CDN services.

- Cybersecurity Threats: Data breaches or security vulnerabilities could damage Limelight’s reputation and business.

These risks could negatively impact the company’s revenue, profitability, and ultimately, its stock price. Mitigation strategies could include investing in R&D to maintain a technological edge, diversifying its customer base, and strengthening its cybersecurity defenses.

Illustrative Example: Impact of a Major Contract Win

Imagine Limelight secures a multi-year, multi-million dollar contract with a major streaming service provider. This would significantly boost the company’s revenue and earnings, potentially resulting in a substantial increase in its stock price. The hypothetical stock price reaction could be visualized as a sharp upward movement immediately following the announcement, followed by a gradual increase over the duration of the contract.

The expected price movement could be a 20-30% increase in the first week, followed by a more moderate increase of 5-10% per quarter for the next year, as the revenue from the contract begins to flow through the company’s financial statements. This positive reaction would be driven by increased investor confidence in Limelight’s growth prospects and its ability to secure large, strategic contracts.

Top FAQs: Limelight Stock Price

What are the major competitors of Limelight Networks?

Key competitors include Akamai, Fastly, and Cloudflare, among others. The competitive landscape is characterized by intense rivalry and technological innovation.

What is Limelight’s current dividend policy?

This information is not readily available in the provided Artikel and would require additional research. Investors should consult official company filings for the most up-to-date dividend information.

How does Limelight’s stock price compare to the overall market?

A comparative analysis against relevant market indices (e.g., S&P 500) would require additional data and would depend on the specific timeframe under consideration. This comparison can provide context for Limelight’s performance relative to broader market trends.

What are the long-term growth prospects for Limelight Networks?

Long-term growth prospects depend on various factors, including continued innovation in CDN technology, successful expansion into new markets, and effective management of competition. Future performance is inherently uncertain.