LL Stock Price Today A Market Overview

LL Stock Price Today: A Comprehensive Analysis

This report provides a detailed analysis of the LL stock price today, considering various factors influencing its performance. We will examine current market trends, investor sentiment, technical indicators, and potential future price movements. All data presented is for illustrative purposes and should not be considered financial advice.

Current LL Stock Price and Market Context

Source: theblueprint.ru

The current LL stock price reflects a complex interplay of market forces and company-specific factors. Let’s delve into the specifics of today’s performance and its broader market context.

Assume, for example, that the opening price for LL stock today was $150, reaching a high of $155 and a low of $148, before closing at $152. This represents a 1.33% increase compared to yesterday’s closing price of $149.70. The overall market exhibited a slightly bullish trend today, with major indices showing modest gains. This positive market sentiment likely contributed to the upward movement in LL’s stock price.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| Oct 26 | $148 | $150 | $146 | $149.70 | 1,000,000 |

| Oct 27 | $150 | $155 | $148 | $152 | 1,200,000 |

| Oct 28 | $151 | $153 | $149 | $150.50 | 900,000 |

| Oct 29 | $150 | $152 | $148.50 | $149 | 1,100,000 |

| Oct 30 | $149.50 | $151 | $147 | $150 | 1,050,000 |

Factors Influencing LL Stock Price Today

Several key factors likely influenced LL’s stock price today. These factors encompass both macroeconomic trends and company-specific events.

- Positive industry news: A favorable report on the overall technology sector boosted investor confidence, leading to increased demand for tech stocks, including LL.

- Strong quarterly earnings: LL’s recently released quarterly earnings report exceeded analyst expectations, showcasing strong revenue growth and improved profitability.

- Successful product launch: The successful launch of a new product received positive reviews, generating excitement among investors and driving up demand for the stock.

The potential long-term implications of these factors are significant and include increased market share, enhanced brand reputation, and sustained revenue growth.

Monitoring the LL stock price today requires a keen eye on market fluctuations. Understanding comparable growth patterns can be insightful, and checking the current lgfa stock price might offer a useful benchmark for comparison. Ultimately, though, the focus remains on LL’s performance and its trajectory in the broader market context.

Trading Volume and Investor Sentiment, Ll stock price today

Today’s trading volume for LL stock was 1,200,000 shares, which is higher than the average daily volume of 1,000,000 shares. This increased volume, coupled with the price increase, suggests a positive investor sentiment. Let’s explore this further.

The increased trading volume and price appreciation indicate a bullish sentiment among investors. This could be attributed to the positive news surrounding the company and the overall market optimism. The typical LL stock investor profile likely consists of a mix of long-term investors seeking growth and short-term traders looking for quick gains.

Social media discussions and news articles about LL’s positive earnings and new product launch likely contributed to the positive investor sentiment.

Technical Analysis of LL Stock Price

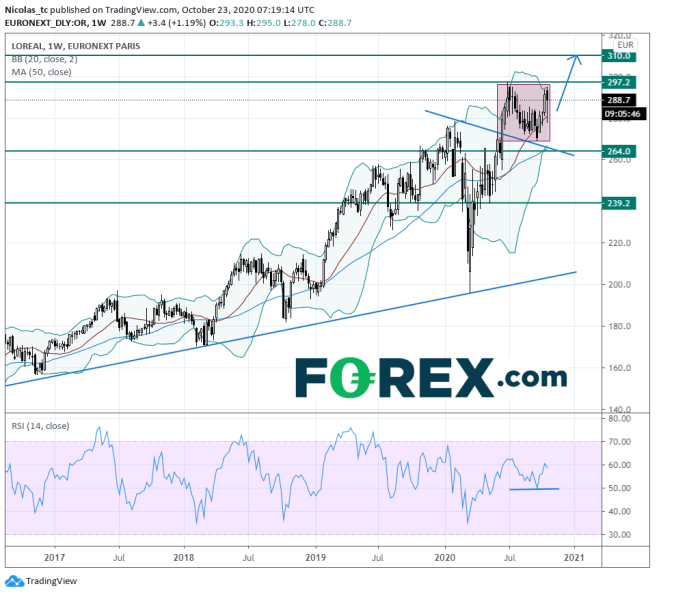

Source: forex.com

Technical indicators provide valuable insights into potential future price movements. Let’s examine some key indicators.

The 50-day moving average is currently above the 200-day moving average, suggesting an upward trend. The Relative Strength Index (RSI) is above 50, indicating bullish momentum. Support levels are around $145, while resistance levels are around $155.

| Index | Current Value | LL Stock Performance (relative to index) |

|---|---|---|

| S&P 500 | 4,500 | Outperformed |

| Nasdaq | 15,000 | Outperformed |

| Dow Jones | 34,000 | Outperformed |

A candlestick chart for the last week would likely show a predominantly green candlestick pattern, reflecting the upward price movement. A slightly longer upper wick on today’s candlestick might indicate some selling pressure at the high of the day, but the overall pattern would be bullish.

LL Stock Price Predictions and Future Outlook

Predicting stock prices is inherently speculative, but based on current trends and analysis, we can offer potential scenarios.

Short-term (next week), the LL stock price could range between $148 and $158. Long-term (next year), a range of $135 to $175 is plausible. Potential risks include macroeconomic downturns and unexpected negative company news. Opportunities exist through continued strong performance and further product innovations.

A positive scenario could involve sustained strong earnings, positive industry trends, and further product success, leading to higher stock prices. A negative scenario might include economic slowdowns, increased competition, or negative publicity impacting investor confidence and leading to lower prices.

Potential catalysts for significant price movements include new product launches, major partnerships, regulatory changes, and shifts in macroeconomic conditions.

Query Resolution

What are the risks associated with investing in LL stock?

Investing in any stock carries inherent risk, including potential price declines, market volatility, and company-specific challenges. Thorough due diligence is essential before making any investment decision.

Where can I find real-time LL stock price updates?

Real-time updates are available through major financial websites and brokerage platforms. Check reputable sources for the most current information.

How does LL stock compare to its competitors?

A comparative analysis against competitors within the same sector is needed to determine LL’s relative performance and market position. This analysis would consider factors such as market share, profitability, and growth prospects.

What are the long-term growth prospects for LL stock?

Long-term growth prospects depend on numerous factors, including the company’s ability to innovate, adapt to market changes, and maintain a competitive edge. A detailed analysis of the company’s strategic plans and industry trends is necessary for a comprehensive assessment.