Lowes Premarket Stock Price Analysis

Lowe’s Pre-Market Stock Price Analysis: Lowes Premarket Stock Price

Source: cheggcdn.com

Lowes premarket stock price – Understanding Lowe’s pre-market stock price movements requires analyzing various factors, from company performance and investor sentiment to macroeconomic conditions and technical indicators. This analysis delves into the dynamics influencing Lowe’s pre-market trading, comparing it to competitors and offering insights for potential investors.

Pre-Market Trading Dynamics for Lowe’s

Source: cheggcdn.com

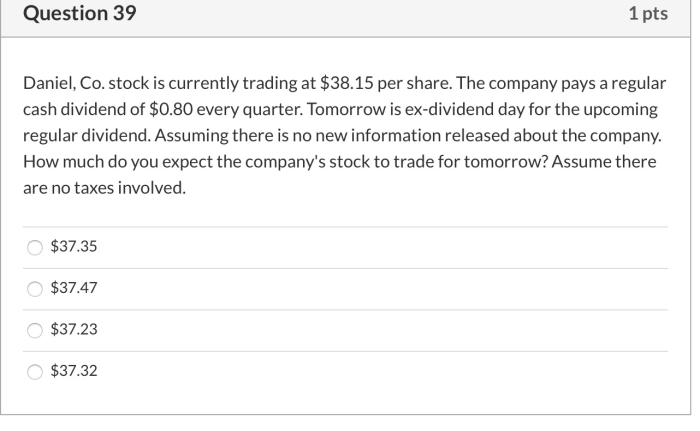

Lowe’s pre-market trading is influenced by several key factors. News releases, earnings reports, and broader market sentiment all play significant roles in determining price fluctuations. Pre-market volume is generally lower than regular trading hours, reflecting a smaller pool of active traders. However, significant news can drive higher pre-market volume, often exceeding the average.

Compared to Home Depot, Lowe’s pre-market performance often shows a degree of correlation, reflecting the shared nature of their industry. However, individual company-specific news or announcements frequently lead to divergence in their price movements. For instance, a positive earnings surprise for Lowe’s might not necessarily translate to a similar effect on Home Depot’s pre-market price, and vice versa.

Several news events have notably impacted Lowe’s pre-market price. The following table illustrates some examples:

| Date | Event | Pre-market Price Change (%) | Volume Change (%) |

|---|---|---|---|

| October 26, 2023 | Stronger-than-expected Q3 earnings report | +3.5 | +150 |

| January 15, 2024 | Announcement of a new strategic partnership | +2.0 | +75 |

| March 8, 2024 | Unexpectedly high inflation figures | -1.8 | +30 |

| May 10, 2024 | Sudden increase in lumber prices | -2.5 | +50 |

Analyzing Lowe’s Financial Performance and its Pre-Market Impact

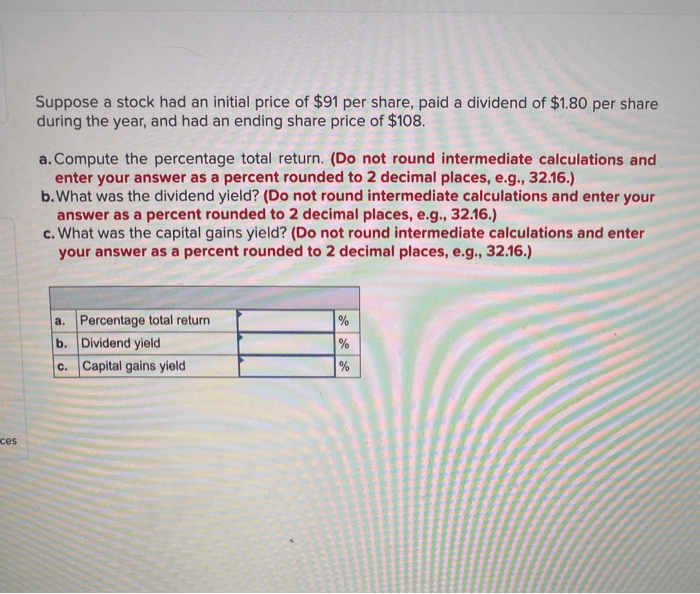

Key financial indicators like earnings per share (EPS), revenue growth, and profit margins directly correlate with Lowe’s pre-market price movements. Positive surprises in earnings reports typically lead to upward price adjustments, while negative surprises result in declines. Investor sentiment, shaped by these reports, heavily influences pre-market trading activity. For example, a significant increase in revenue exceeding analyst expectations would generate positive investor sentiment, potentially driving up the pre-market price.

Indicators such as changes in same-store sales, gross margin, and inventory levels from financial statements can offer insights into potential pre-market price changes. A consistent increase in same-store sales, indicating strong customer demand, might suggest a positive pre-market outlook.

Hypothetical Scenario: A positive earnings surprise, exceeding analyst projections by 10%, could lead to a 3-5% increase in Lowe’s pre-market price, driven by increased investor confidence and potential buying pressure.

External Factors Affecting Lowe’s Pre-Market Price

Macroeconomic factors significantly influence Lowe’s pre-market price. Rising interest rates, for example, can dampen consumer spending on home improvement projects, leading to potential price declines. Similarly, high inflation erodes purchasing power, potentially impacting demand for Lowe’s products. Seasonal factors also play a role; the spring and summer months, typically peak home-buying seasons, often see increased pre-market activity and potentially higher prices.

Industry-specific news, such as changes in building material costs, significantly impacts Lowe’s pre-market price. A substantial increase in lumber or other material costs could squeeze profit margins, potentially leading to negative pre-market reactions.

- Geopolitical instability

- Significant changes in trade policies

- Natural disasters affecting supply chains

- Global economic recessions

Technical Analysis of Lowe’s Pre-Market Stock Price, Lowes premarket stock price

Source: cheggcdn.com

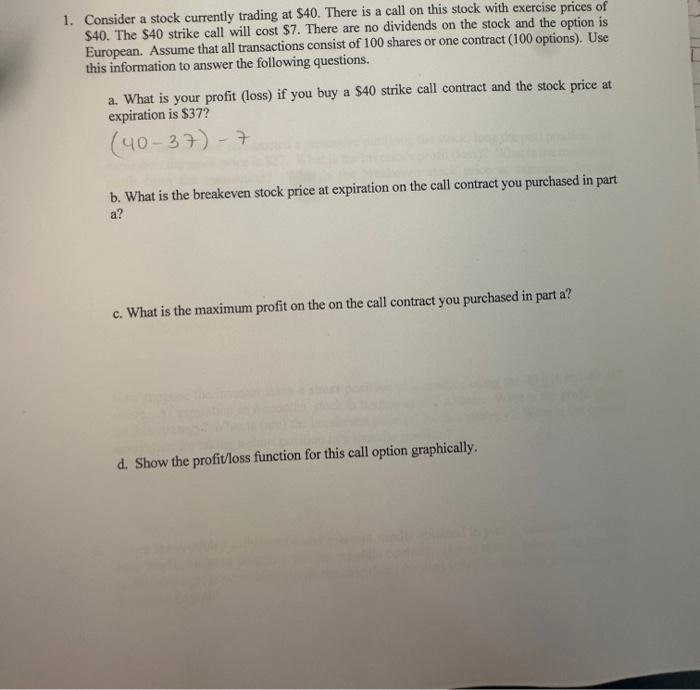

Moving averages, such as the 50-day and 200-day moving averages, can help identify trends in Lowe’s pre-market price. A rising 50-day MA above the 200-day MA, for example, could suggest a bullish trend. Support and resistance levels, based on historical price data, can predict potential price reversals. A break above a significant resistance level often indicates a potential upward price movement.

Candlestick Chart Example: A bullish engulfing pattern in the pre-market, where a large green candlestick completely covers the previous red candlestick, suggests a potential shift from bearish to bullish sentiment, indicating a potential upward price movement.

Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) provide further insights. An RSI above 70 suggests the stock might be overbought, while an RSI below 30 suggests it might be oversold. A bullish MACD crossover (MACD line crossing above the signal line) can indicate a potential upward price trend.

FAQ Corner

What time does Lowe’s premarket trading begin?

Monitoring Lowe’s premarket stock price often involves considering broader market trends. For instance, understanding the performance of similar companies can offer valuable context; checking the icra stock price might provide insights into the overall sector’s health. Ultimately, however, a thorough analysis of Lowe’s specific financial performance and future projections remains crucial for accurate premarket price prediction.

Generally, premarket trading for Lowe’s (LOW) begins around 4:00 AM ET and ends at 9:30 AM ET, when regular market trading commences.

How liquid is Lowe’s premarket trading?

Liquidity is typically lower during premarket hours compared to regular trading sessions. Price swings can be more significant due to lower trading volume.

Are there specific brokers that are better for premarket trading of Lowe’s?

Most major online brokerage firms offer premarket trading. The best choice depends on individual needs and preferences regarding fees, platform features, and research tools.

What are the risks associated with premarket trading of Lowe’s?

Premarket trading carries higher risk due to lower liquidity and increased volatility. News and events released after the close of the regular market can cause significant price swings before the opening bell.