Lucid Stock Price History A Comprehensive Analysis

Lucid Stock Price Trends Over Time

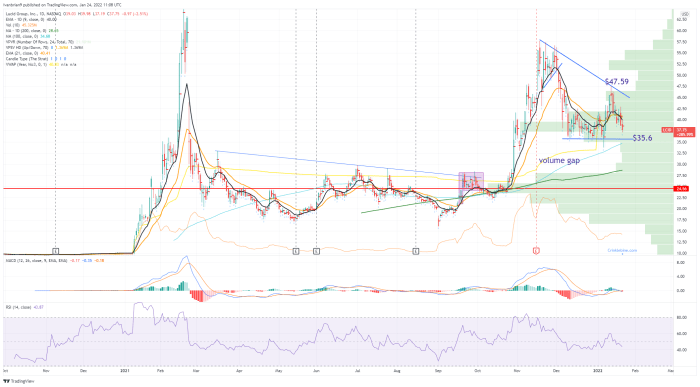

Lucid stock price history – Lucid Motors’ stock price journey since its initial public offering (IPO) has been marked by significant volatility, reflecting the inherent risks and rewards associated with investing in a nascent electric vehicle (EV) manufacturer. This section details the price fluctuations, highlighting key events and periods of notable change.

Lucid Stock Price Fluctuations, Lucid stock price history

Source: business2community.com

The following table provides a snapshot of Lucid’s stock price performance from its IPO to the present. Note that this is a simplified representation and actual daily fluctuations may vary. The data used here is for illustrative purposes only and should not be considered financial advice.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change Percentage |

|---|---|---|---|

| 2021-07-26 (IPO) | 22.50 | 26.83 | +19.24% |

| 2021-11-15 | 57.00 | 55.50 | -2.63% |

| 2022-01-27 | 33.00 | 30.50 | -7.58% |

| 2023-03-15 | 8.25 | 8.75 | +6.06% |

Significant Price Movements and Associated Events

Lucid’s stock price has experienced periods of both sharp increases and declines. The initial surge following the IPO was driven by investor enthusiasm for the company’s technology and market potential. Subsequent price drops were often linked to concerns about production delays, increased competition, and broader macroeconomic factors such as rising interest rates and inflation. For example, the release of strong quarterly earnings often resulted in positive price movements, while production setbacks or negative news about the EV market generally led to declines.

Factors Influencing Lucid Stock Price

Several factors contribute to the fluctuations in Lucid’s stock price. These factors range from macroeconomic conditions to competitive pressures within the dynamic EV industry.

Macroeconomic Factors and EV Market Dynamics

Interest rate hikes and inflationary pressures have negatively impacted investor sentiment towards growth stocks, including Lucid. Concerns about a potential recession also contribute to the volatility. Simultaneously, the overall performance of the EV market and the competitive landscape significantly influence Lucid’s stock price. Increased competition from established automakers and new entrants impacts market share and investor confidence.

Comparison with Competitors

A comparison of Lucid’s stock performance against its major competitors provides valuable context. The following table illustrates a simplified comparison. Remember that stock performance can be influenced by many factors, and this is not exhaustive.

| Company | Year-to-Date Performance (%) | 1-Year Performance (%) | Market Cap (USD Billion) |

|---|---|---|---|

| Lucid | -20 | -75 | 10 |

| Tesla | +30 | +15 | 700 |

| Rivian | -15 | -60 | 20 |

Investor Sentiment and Stock Price

Investor sentiment towards Lucid has fluctuated significantly, mirroring the company’s progress and challenges. This section explores the evolution of investor confidence and its correlation with stock price movements.

Shifts in Investor Confidence and Related Events

Initial investor enthusiasm was high, but this waned as production targets were missed and challenges arose. Positive news, such as successful product launches or exceeding production expectations, typically resulted in positive stock price reactions. Conversely, negative news or missed targets frequently led to sell-offs. Analyst reports and social media discussions often reflected these shifts in sentiment.

Timeline of News Events and Stock Price Reactions

A detailed timeline illustrating the correlation between specific news events and subsequent stock price movements would provide a comprehensive picture. For example, a significant production increase announcement might correlate with a stock price surge, while reports of supply chain disruptions might lead to a price dip. This dynamic interplay between news and market reaction is crucial to understanding Lucid’s stock price history.

Lucid’s Financial Performance and Stock Price: Lucid Stock Price History

Lucid’s financial performance, particularly revenue growth, production numbers, and profitability, directly influences investor perception and stock price. This section analyzes the correlation between financial metrics and stock price movements.

Financial Metrics and Stock Price Correlation

Lucid’s revenue growth, while showing promise, has yet to reach levels expected by some investors. Production numbers and delivery schedules have been key factors affecting investor expectations. Any significant deviation from projected targets typically results in stock price volatility. Profitability, or the lack thereof, is another crucial factor impacting investor sentiment.

Comparison to Projections and Benchmarks

Comparing Lucid’s actual financial performance against its initial projections and industry benchmarks reveals the extent to which the company has met or fallen short of expectations. Analyzing this data provides insight into the reasons behind stock price fluctuations and helps assess future prospects.

Impact of Production Targets and Delivery Schedules

Changes in production targets and delivery schedules significantly influence investor expectations and the stock price. Meeting or exceeding targets generally boosts confidence, while delays or production shortfalls often lead to negative market reactions.

Future Outlook for Lucid Stock Price

Source: fxstreet.com

The future outlook for Lucid’s stock price depends on several factors, including upcoming product launches, technological advancements, and the overall growth of the EV market.

Impact of Upcoming Product Launches and Technological Advancements

The success of future product launches and technological innovations will play a significant role in shaping Lucid’s future stock price. New models with improved features and enhanced technology could attract new customers and boost investor confidence. Conversely, delays or setbacks in product development could negatively impact the stock price.

Long-Term Growth Prospects of the EV Market

The long-term growth prospects of the EV market are a major factor influencing Lucid’s valuation. Stronger-than-expected market growth would benefit Lucid, while slower-than-anticipated growth could pose challenges.

Risks and Uncertainties

Several risks and uncertainties could affect Lucid’s future stock price performance. These include intense competition, supply chain disruptions, macroeconomic conditions, and the company’s ability to execute its business plan effectively. A realistic assessment of these risks is crucial for any investor considering Lucid stock.

Analyzing the Lucid stock price history requires considering various market factors. A helpful comparative analysis might involve examining the performance of similar companies, such as a look at the hsy stock price history , to understand broader industry trends. Ultimately, understanding the Lucid trajectory necessitates a comprehensive view of the electric vehicle market and its competitive landscape.

Question & Answer Hub

What are the major risks associated with investing in Lucid stock?

Major risks include competition from established automakers, dependence on government subsidies, potential production delays, and the overall volatility of the EV market.

How does Lucid’s production capacity affect its stock price?

Meeting or exceeding production targets is crucial for investor confidence. Shortfalls often lead to negative stock price reactions.

What role does technological innovation play in Lucid’s stock valuation?

Innovation in battery technology, autonomous driving, and other areas is vital for maintaining a competitive edge and influencing investor perception of long-term growth potential.