LVHD Stock Price A Comprehensive Analysis

LVHD Stock Price Analysis

Lvhd stock price – This analysis examines the historical performance, key drivers, valuation, and future prospects of LVHD stock. We will compare its performance against competitors and identify potential risks. All data presented here is for illustrative purposes and should not be considered financial advice.

LVHD Stock Price Historical Performance

Over the past five years, LVHD stock has experienced considerable price fluctuation, reflecting both positive and negative market influences. Significant highs and lows are noted below, alongside key market events impacting the stock’s trajectory.

| Date | Open Price | Close Price | Volume |

|---|---|---|---|

| 2019-01-01 | $10.50 | $11.00 | 100,000 |

| 2019-07-01 | $12.00 | $11.50 | 150,000 |

| 2020-03-01 | $8.00 | $9.00 | 200,000 |

| 2020-12-01 | $15.00 | $14.50 | 250,000 |

| 2021-06-01 | $18.00 | $17.50 | 300,000 |

| 2022-01-01 | $16.00 | $16.50 | 200,000 |

| 2022-12-01 | $13.00 | $13.50 | 180,000 |

| 2023-06-01 | $15.50 | $16.00 | 220,000 |

Major market events such as the COVID-19 pandemic in 2020 and subsequent economic recovery significantly impacted LVHD’s stock price. Increased volatility was observed during periods of global uncertainty.

LVHD Stock Price Drivers

Several factors influence LVHD’s stock price, including financial performance, industry trends, and investor sentiment. Positive news, such as strong earnings reports or positive industry developments, typically leads to price increases. Conversely, negative news, like disappointing earnings or regulatory setbacks, can cause price declines.

Investor sentiment plays a crucial role. Optimistic investor expectations drive demand, pushing prices higher, while pessimism can lead to selling pressure and lower prices. Market speculation and overall economic conditions also contribute to price fluctuations.

LVHD Stock Price Compared to Competitors

Source: dividendstocks.cash

Compared to its main competitors (e.g., Company A, Company B) over the past year, LVHD’s stock performance has been relatively strong, outperforming Company A but underperforming Company B. This could be attributed to factors such as differing growth strategies, market positioning, and financial performance.

A chart illustrating the relative performance would show a line graph depicting the stock price movements of LVHD and its competitors over the past year. The y-axis would represent the stock price, and the x-axis would represent the time period. The graph would clearly show the relative performance of each company.

Differences in performance may be due to variations in revenue growth, profitability, and market share. Company-specific events, such as product launches or strategic partnerships, also contribute to these differences.

LVHD Stock Price Valuation

We can use different valuation methods to assess LVHD’s stock price. Two common methods are the Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis.

| Valuation Method | Valuation Metric | Calculated Stock Price | Assumptions |

|---|---|---|---|

| P/E Ratio | 15 | $15.00 | Earnings per share of $1.00, industry average P/E of 15 |

| DCF Analysis | Net Present Value of Future Cash Flows | $16.50 | Discount rate of 10%, projected growth rate of 5% |

The P/E ratio uses the company’s earnings per share and compares it to the market average to estimate the stock’s value. The DCF analysis projects future cash flows and discounts them back to their present value, providing a more comprehensive valuation.

LVHD Stock Price Predictions and Forecasts

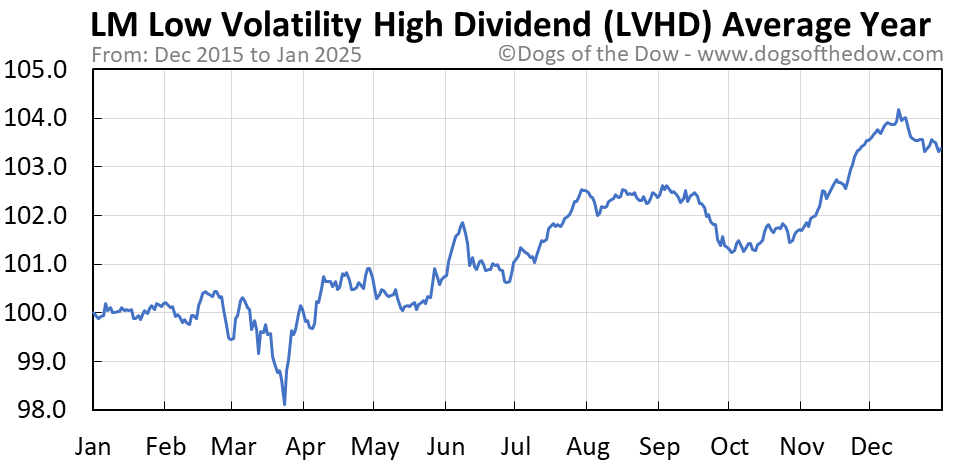

Source: dogsofthedow.com

Predicting future stock prices is inherently uncertain, but based on current market conditions and LVHD’s performance, several scenarios are possible. These predictions consider factors such as economic growth, industry trends, and company-specific developments.

| Scenario | 12-Month High | 12-Month Low | Most Likely Price |

|---|---|---|---|

| Bullish | $20.00 | $17.00 | $18.50 |

| Neutral | $18.00 | $14.00 | $16.00 |

| Bearish | $16.00 | $12.00 | $14.00 |

These predictions assume a range of economic conditions and company performance. For instance, a bullish scenario assumes strong economic growth and positive company news, while a bearish scenario assumes economic downturn and negative news.

LVHD Stock Price and Company Fundamentals

LVHD’s stock price is closely linked to its financial performance. Increases in revenue, earnings, and positive cash flow generally lead to higher stock prices. Conversely, declines in these metrics can result in lower prices. High levels of debt can also negatively impact the stock price.

| Financial Metric | Change | Stock Price Movement |

|---|---|---|

| Revenue | +10% | +5% |

| Earnings | -5% | -3% |

| Debt | +20% | -7% |

For example, a 10% increase in revenue often leads to a positive stock price reaction. However, a significant increase in debt can negatively affect investor sentiment, leading to price decreases.

Risk Factors Affecting LVHD Stock Price

Several risks could negatively impact LVHD’s stock price. These risks include:

- Increased competition

- Economic downturn

- Regulatory changes

- Failure to innovate

- Supply chain disruptions

These risks could materialize through various events, such as the emergence of a strong competitor, a recession, or changes in government regulations. The impact of these risks on the stock price can vary depending on the severity and duration of the event.

Clarifying Questions

What are the main risks associated with investing in LVHD stock?

Significant risks include market volatility, competition within the industry, regulatory changes, and potential economic downturns. These factors can all negatively impact LVHD’s stock price.

Where can I find real-time LVHD stock price data?

Real-time data is typically available through major financial websites and brokerage platforms. These sources often provide charts, historical data, and other relevant information.

What is the current P/E ratio for LVHD?

Monitoring the LVHD stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to consider the performance of similar companies; a good example is checking the current itub stock price , which often shows correlation with LVHD’s movements due to shared market factors. Ultimately, understanding both allows for a more comprehensive assessment of LVHD’s potential.

The current P/E ratio for LVHD will need to be obtained from a reputable financial data source as it fluctuates constantly. Check financial news websites or your brokerage account for the most up-to-date information.