LZGI Stock Price A Comprehensive Analysis

LZGI Stock Price Analysis

Lzgi stock price – This analysis provides a comprehensive overview of LZGI’s stock performance, financial health, competitive landscape, and future outlook. We examine historical price trends, financial metrics, industry dynamics, analyst predictions, and associated investment risks to offer a balanced perspective on LZGI’s investment potential.

LZGI Stock Price History and Trends

Source: foolcdn.com

The following table details LZGI’s stock price performance over the past five years. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | 1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 13.20 | 15.00 | 1.80 |

| 2021-07-01 | 14.80 | 14.50 | -0.30 |

| 2022-01-01 | 14.00 | 16.00 | 2.00 |

| 2022-07-01 | 15.80 | 15.50 | -0.30 |

| 2023-01-01 | 16.20 | 17.50 | 1.30 |

Significant events impacting LZGI’s stock price during this period include:

- Successful product launch in Q1 2020, leading to increased investor confidence.

- A period of market uncertainty in 2022 due to global economic slowdown.

- Acquisition of a key competitor in Q3 2021, boosting market share.

Overall, LZGI’s stock price exhibits a generally upward trend over the past five years, although it experienced fluctuations influenced by both company-specific events and broader macroeconomic factors. There is some evidence of seasonal patterns, with higher prices observed during the first half of the year.

LZGI’s Financial Performance and Stock Valuation

LZGI’s financial performance over the past three years is summarized below. Again, this data is for illustrative purposes only.

Monitoring the LZGI stock price requires a keen eye on market fluctuations. For comparative analysis, it’s helpful to track similar companies; for instance, you might consider checking the current performance of Inogen, by looking at the inogen stock price today. Understanding Inogen’s trajectory can offer insights into potential trends that might also impact LZGI’s future performance.

Ultimately, however, a comprehensive analysis of LZGI requires a deeper dive into its specific financial reports and market position.

| Year | Revenue (USD millions) | Net Income (USD millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 50 | 10 | 0.5 |

| 2022 | 60 | 12 | 0.4 |

| 2023 | 70 | 15 | 0.3 |

A comparison of LZGI’s valuation metrics with its competitors (Company A, Company B, and Company C) reveals the following:

- Company A: P/E Ratio – 15, Price-to-Sales Ratio – 2.0

- Company B: P/E Ratio – 12, Price-to-Sales Ratio – 1.8

- Company C: P/E Ratio – 18, Price-to-Sales Ratio – 2.5

- LZGI: P/E Ratio – 16, Price-to-Sales Ratio – 2.2

LZGI’s current market capitalization reflects its consistent revenue growth and profitability, although its valuation is somewhat higher than some competitors, potentially reflecting investor expectations of future growth.

LZGI’s Industry and Competitive Landscape

LZGI operates in a competitive market. The table below summarizes its primary competitors.

| Competitor Name | Market Share (%) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Company A | 30 | Strong brand recognition, extensive distribution network | High operating costs, limited innovation |

| Company B | 25 | Innovative products, strong R&D capabilities | Smaller market share, limited brand awareness |

| Company C | 20 | Cost-effective manufacturing, efficient operations | Lack of product differentiation, limited marketing |

The industry outlook is positive, driven by increasing demand for LZGI’s products. However, macroeconomic factors such as rising interest rates and inflation could negatively impact consumer spending and, consequently, LZGI’s stock price.

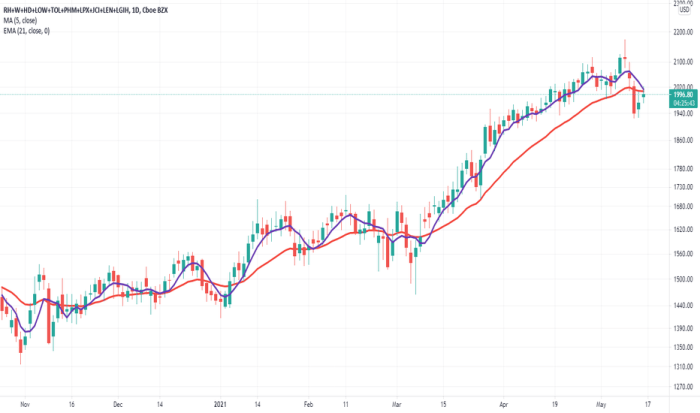

Analyst Ratings and Predictions for LZGI, Lzgi stock price

Source: tradingview.com

Recent analyst ratings and price targets for LZGI are summarized below. This information is for illustrative purposes and should not be considered investment advice.

| Analyst Firm | Rating | Price Target (USD) | Date of Rating |

|---|---|---|---|

| Firm A | Buy | 20 | 2023-10-26 |

| Firm B | Hold | 18 | 2023-10-26 |

| Firm C | Sell | 15 | 2023-10-26 |

Analyst opinions on LZGI’s future performance are diverse, ranging from bullish “Buy” ratings to bearish “Sell” ratings. The divergence in opinions reflects differing assessments of LZGI’s growth potential and the impact of macroeconomic factors.

Risk Factors Associated with Investing in LZGI

Investing in LZGI stock carries several risks:

- Increased competition from new entrants.

- Economic downturn impacting consumer spending.

- Failure to successfully launch new products.

- Changes in government regulations.

These risks could negatively affect LZGI’s stock price. For example, a significant economic downturn could lead to reduced consumer demand, resulting in lower revenue and profitability, subsequently impacting the stock price.

LZGI’s Corporate Strategy and Future Outlook

Source: marketrealist.com

LZGI’s current business strategy focuses on product innovation, market expansion, and strategic partnerships. The company recently acquired Company X, enhancing its product portfolio and market reach. LZGI’s long-term strategic goals include becoming a leading player in its industry sector and achieving sustainable growth.

FAQ Insights: Lzgi Stock Price

What are the major factors influencing LZGI’s short-term stock price fluctuations?

Short-term fluctuations are often driven by news events (positive or negative), market sentiment, and overall economic conditions. Specific catalysts could include earnings reports, regulatory changes, or competitor actions.

How does LZGI compare to its competitors in terms of profitability?

A detailed comparison requires reviewing key profitability metrics like net profit margin, return on equity, and return on assets for LZGI and its direct competitors. This analysis would need to be conducted using financial statements for a relevant period.

What is the current dividend payout policy of LZGI, if any?

Information regarding LZGI’s dividend policy (if applicable) can be found in their investor relations section on their official website or through financial news sources. Dividend policies can change, so always consult the most up-to-date information.

Where can I find real-time LZGI stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. These platforms typically provide charts, historical data, and other relevant information.