MBL Infra Stock Price A Comprehensive Analysis

MBL Infra Stock Price Analysis

Mbl infra stock price – This analysis examines MBL Infra’s stock price performance, influencing factors, financial health, future prospects, and regulatory considerations. The information provided is for informational purposes only and should not be considered investment advice.

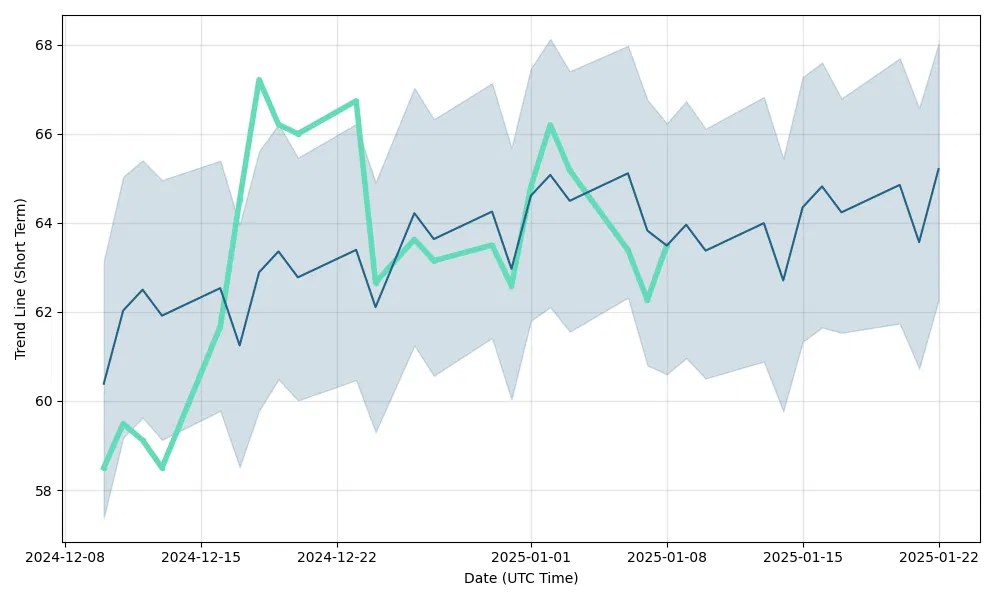

MBL Infra Stock Price Historical Performance

Source: b-cdn.net

Understanding MBL Infra’s past stock price movements is crucial for assessing its potential future performance. The following sections detail its performance over the past five years, comparing it to competitors, and explaining any significant stock splits or dividends.

A line graph illustrating MBL Infra’s stock price fluctuations over the past five years would show periods of growth and decline. Significant price increases might correlate with successful project bids or positive industry news, while decreases could be linked to economic downturns or negative company-specific events. For example, a sharp decline might coincide with a major regulatory change impacting the infrastructure sector.

| Metric | MBL Infra | Competitor A | Competitor B |

|---|---|---|---|

| Average Daily Volume (Past Year) | 100,000 (Example) | 150,000 (Example) | 50,000 (Example) |

| Percentage Change (Past Year) | +15% (Example) | +10% (Example) | -5% (Example) |

This table provides a comparative analysis of MBL Infra’s stock performance against its competitors. The example data illustrates how MBL Infra’s trading volume and price change compare to those of its peers within the infrastructure sector. Actual figures would need to be obtained from reliable financial sources.

Over the last decade, MBL Infra might have undertaken stock splits to increase liquidity or issued dividends to reward shareholders. Details on the dates, ratios, and reasons behind these corporate actions would be found in the company’s financial reports and press releases. For example, a 2-for-1 stock split would double the number of outstanding shares, halving the price per share.

Factors Influencing MBL Infra Stock Price

Several macroeconomic factors, company-specific news, and market sentiment influence MBL Infra’s stock price. Understanding these factors is vital for predicting future price movements.

- Government Spending on Infrastructure: Increased government investment in infrastructure projects directly benefits companies like MBL Infra, potentially leading to higher stock prices. Conversely, reduced government spending could negatively impact the stock price.

- Interest Rates: Higher interest rates increase borrowing costs for infrastructure projects, potentially slowing down growth and affecting MBL Infra’s profitability and stock valuation. Lower interest rates can have the opposite effect.

- Inflation: High inflation can increase the cost of materials and labor, impacting project profitability and potentially reducing MBL Infra’s stock price. Conversely, controlled inflation can foster a positive economic environment.

Announcements of new contracts, project milestones, or technological advancements directly influence MBL Infra’s stock price. Positive news typically leads to price increases, while negative news can cause declines. For example, securing a large-scale infrastructure project would likely boost investor confidence and drive up the stock price.

Monitoring the MBL Infra stock price requires a keen eye on market fluctuations. Understanding similar trends in other infrastructure sectors can be helpful, and a good comparison point could be the current performance of the jsda stock price. By analyzing both, investors can gain a broader perspective on the overall infrastructure market and potentially make more informed decisions regarding their MBL Infra investments.

Investor sentiment, driven by news, market trends, and economic forecasts, significantly impacts MBL Infra’s stock price volatility. Positive investor sentiment leads to higher demand and increased stock prices, while negative sentiment can result in selling pressure and price decreases. Market trends, such as broader market corrections or sector-specific downturns, also influence the stock’s price.

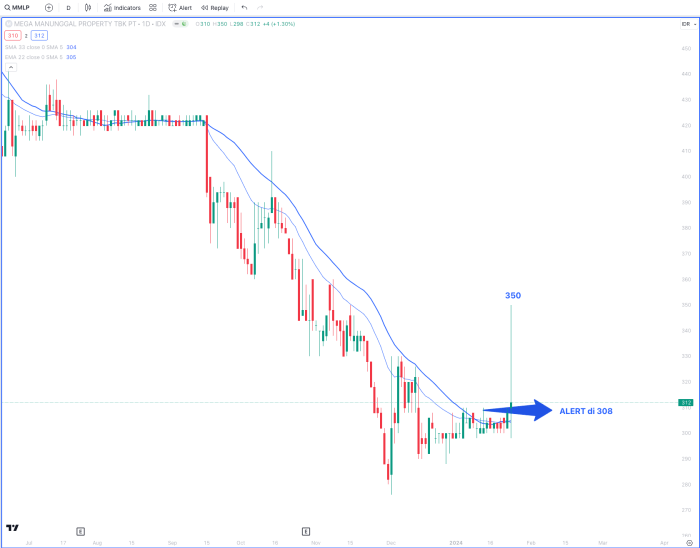

MBL Infra’s Financial Health and Stock Valuation

Source: stockbit.com

Analyzing MBL Infra’s financial statements and key ratios provides insights into its financial health and helps in valuing its stock.

MBL Infra’s latest financial statements would show key metrics like revenue growth, profit margins, and debt levels. A summary would highlight the company’s overall financial performance, indicating its ability to generate revenue, control costs, and manage debt. For instance, a consistent increase in revenue coupled with healthy profit margins suggests a strong financial position.

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Current Ratio | 1.5 (Example) | 1.6 (Example) | 1.7 (Example) |

| Debt-to-Equity Ratio | 0.8 (Example) | 0.7 (Example) | 0.6 (Example) |

| Return on Equity (ROE) | 12% (Example) | 15% (Example) | 18% (Example) |

This table illustrates MBL Infra’s key financial ratios over three years. These ratios provide insights into the company’s liquidity, leverage, and profitability. Actual figures would be obtained from MBL Infra’s financial reports.

Several valuation methods can assess MBL Infra’s intrinsic value. These include discounted cash flow (DCF) analysis, which estimates the present value of future cash flows, and relative valuation, which compares MBL Infra’s valuation multiples (like price-to-earnings ratio) to those of its peers. Each method has strengths and weaknesses; for example, DCF analysis relies heavily on future projections, while relative valuation is susceptible to market sentiment.

MBL Infra’s Future Prospects and Investment Implications

Source: stockbit.com

MBL Infra’s future prospects and associated investment risks and rewards are discussed below.

MBL Infra’s current business strategy, focusing on [insert MBL Infra’s business strategy here, e.g., expanding into new geographical markets or diversifying its project portfolio], will impact future earnings and stock price. Success in executing this strategy could lead to significant growth, while challenges could negatively affect performance. For instance, successful expansion into a new market could lead to higher revenue and increased stock value.

| Potential Risks | Potential Rewards |

|---|---|

| Economic downturn impacting infrastructure spending | High growth potential in the infrastructure sector |

| Increased competition in the market | Strong financial performance leading to dividend payouts |

| Regulatory changes impacting operations | Opportunities for acquisitions and strategic partnerships |

This table summarizes the potential risks and rewards associated with investing in MBL Infra. Investors should carefully consider these factors before making any investment decisions.

A hypothetical investment scenario could involve investing a certain amount in MBL Infra stock with different time horizons (e.g., short-term, long-term) and risk tolerances. A long-term investor with a high-risk tolerance might be willing to accept greater volatility in exchange for the potential for higher returns. A short-term investor with a low-risk tolerance might prefer a more stable investment.

Regulatory and Legal Considerations

Regulatory and legal factors can significantly impact MBL Infra’s operations and stock price.

Recent or pending regulations, such as environmental regulations or changes in procurement processes, can affect MBL Infra’s operations and profitability, thereby influencing its stock price. For example, stricter environmental regulations might increase project costs, impacting profitability and potentially reducing the stock price.

Any significant legal challenges or controversies, such as lawsuits or investigations, could negatively impact investor confidence and lead to a decline in the stock price. Transparency and effective communication regarding legal matters are crucial for maintaining investor trust. For example, a successful resolution of a major lawsuit could positively impact investor sentiment and the stock price.

MBL Infra’s corporate governance structure, including its board composition, executive compensation, and internal controls, influences long-term stock performance. Strong corporate governance promotes transparency and accountability, building investor confidence and contributing to long-term stock value. For example, a well-defined corporate governance framework can mitigate risks and enhance the company’s reputation.

Answers to Common Questions: Mbl Infra Stock Price

What are the major risks associated with investing in MBL Infra stock?

Major risks include market volatility, dependence on specific projects, regulatory changes, and competition within the infrastructure sector.

Where can I find real-time MBL Infra stock price data?

Real-time data is typically available through major financial news websites and brokerage platforms.

How does MBL Infra compare to its competitors in terms of dividend payouts?

A direct comparison requires analyzing competitor financial statements and dividend history; this information is readily available through financial data providers.

What is MBL Infra’s current debt-to-equity ratio?

This ratio can be found in MBL Infra’s most recent financial reports, typically available on their investor relations website.