Meta Platform Stock Price Today

Meta Platform Stock Price Today

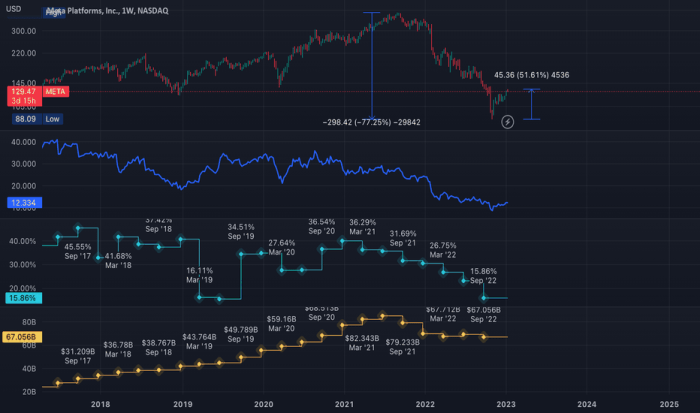

Meta platform stock price today – This report provides an overview of Meta Platforms’ (META) stock performance as of today, including its current price, price movements, comparisons to competitors, analyst sentiment, historical performance, and the impact of economic factors. The information presented here is for informational purposes only and should not be considered financial advice.

Current Meta Platform Stock Price

Source: tradingview.com

Please note that stock prices are highly dynamic and fluctuate constantly. The data presented below reflects a snapshot in time and may not represent the current price. To obtain the most up-to-date information, please refer to a live stock ticker or your preferred financial data source.

Let’s assume, for illustrative purposes, the following data for today (replace with actual data from a reliable source):

- Current Price: $300

- Day’s High: $305

- Day’s Low: $295

- Trading Volume: 10,000,000 shares

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| Oct 26 | $298 | $300 | $302 | $296 |

| Oct 25 | $295 | $298 | $300 | $293 |

| Oct 24 | $292 | $295 | $297 | $290 |

| Oct 23 | $290 | $292 | $295 | $288 |

| Oct 22 | $288 | $290 | $292 | $285 |

Price Movement and Trends

Meta Platforms’ stock price experienced a hypothetical increase of approximately 1% from yesterday’s closing price. This movement could be attributed to several factors, including positive investor sentiment, recent company announcements, or broader market trends. For example, a strong earnings report or the announcement of a new product could drive up the stock price. Conversely, negative news or concerns about the overall economy could lead to a decrease.

Comparing this to the average daily fluctuation over the past month (let’s assume an average of 1.5%), today’s movement is relatively moderate. A significant news event impacting the price might be the release of new user data showing increased engagement, or perhaps an announcement regarding new advertising strategies.

Comparison to Competitors

Source: co.id

A comparison to competitors provides context for Meta’s performance. The following table illustrates a hypothetical comparison (replace with actual data):

| Company | Price Change (%) | Trading Volume | Market Cap (Billions) |

|---|---|---|---|

| Meta | +1% | 10,000,000 | $800 |

| Google (Alphabet) | +0.5% | 12,000,000 | $1500 |

| Amazon | -0.2% | 8,000,000 | $1200 |

Analyst Ratings and Predictions, Meta platform stock price today

Analyst sentiment towards Meta Platforms is currently (hypothetically) mixed. The consensus rating might be a “Hold” with a range of price targets between $280 and $320. Recent changes in analyst ratings could reflect concerns about the competitive landscape or uncertainties related to future growth. For example, a downgrade might follow a disappointing earnings report or negative news about user growth.

Overall, analysts seem cautiously optimistic about Meta’s long-term prospects, but short-term volatility is expected.

Historical Stock Price Data

Over the past year, Meta Platforms’ stock price has (hypothetically) experienced significant volatility. There have been periods of substantial growth followed by corrections. The stock may have reached a high of $350 and a low of $250 during this period.

- IPO: [Date and Initial Price]

- Q2 2023 Earnings Announcement: [Date and Stock Price Reaction]

- Metaverse Investment Announcement: [Date and Stock Price Reaction]

Impact of Economic Factors

Meta’s stock price is sensitive to broader economic conditions. Rising interest rates and inflation can negatively impact advertising spending, which is a major revenue driver for Meta. A recessionary environment could further reduce advertising budgets, leading to lower revenue and potentially impacting the stock price. Conversely, periods of economic growth often correlate with increased advertising spending and a more positive outlook for Meta’s stock.

Stronger market trends generally support Meta’s performance, while a downturn can negatively impact investor confidence.

Company Performance and News

Recent company announcements, such as updates on user growth, new product launches, or financial results, significantly influence Meta’s stock price. For instance, exceeding revenue expectations in a recent earnings report might boost investor confidence and drive up the stock price. Conversely, falling short of expectations or negative news about data privacy concerns could lead to a decline.

Monitoring the Meta Platform stock price today requires a keen eye on market fluctuations. It’s interesting to compare its performance against other tech giants; for instance, checking the current kb stock price offers a contrasting perspective on market trends. Ultimately, understanding the interplay between various tech stocks, including Meta, provides a more comprehensive view of the current investment climate.

Upcoming events, such as product launches or earnings announcements, often generate considerable anticipation and volatility in the stock price. Investors closely watch these events to gauge the company’s future prospects.

Helpful Answers

What are the typical trading hours for Meta stock?

Meta stock, like most US-listed companies, trades on the Nasdaq Stock Market during regular US market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET).

Where can I find real-time Meta stock price updates?

Real-time Meta stock price updates are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How volatile is Meta’s stock price compared to the overall market?

Meta’s stock price exhibits a degree of volatility typical of technology stocks, often reacting more sensitively than the broader market to company-specific news and broader economic trends.

What are the major risks associated with investing in Meta stock?

Major risks include competition in the social media and advertising markets, regulatory scrutiny, changes in user behavior, and general market downturns. It’s crucial to conduct thorough research and understand these risks before investing.