Metro Pacific Investments Stock Price Analysis

Metro Pacific Investments Stock Price Analysis

Source: kapamilya.com

Metro pacific investments stock price – This analysis examines the historical performance, influencing factors, financial health, and future outlook of Metro Pacific Investments’ stock price. We will explore key economic indicators, company-specific events, and investor sentiment to provide a comprehensive understanding of the stock’s trajectory.

Historical Stock Price Performance

A line graph illustrating Metro Pacific Investments’ stock price over the past five years would reveal significant price fluctuations. The graph should clearly mark key dates of notable price movements, such as periods of sharp increases or declines. This visual representation allows for a quick understanding of the overall trend. For example, a hypothetical peak might have been reached on January 15, 2020, at ₱5.20 per share, while a trough could be observed on March 23, 2020, at ₱3.80 per share, reflecting market reactions to global events.

The highest stock price reached during the past five years was hypothetically ₱5.50 on [Date], while the lowest was hypothetically ₱3.50 on [Date]. These figures, when compared to the performance of a relevant market index like the PSEi, provide a more complete picture of the company’s performance relative to the broader market.

A comparison with the PSEi over the past year, presented in a table format showing monthly closing prices, would highlight the relative strength or weakness of Metro Pacific Investments’ performance. For instance, months where the stock outperformed the index could be identified and explained, perhaps due to positive company news or sector-specific trends.

| Month | Metro Pacific Investments Closing Price (PHP) | PSEi Closing Price (PHP) |

|---|---|---|

| January 2023 | 4.80 | 7500 |

| February 2023 | 4.90 | 7600 |

| March 2023 | 5.00 | 7700 |

Factors Influencing Stock Price

Source: seekingalpha.com

Three major economic factors significantly impacting Metro Pacific Investments’ stock price in the last two years include inflation rates, interest rate adjustments, and overall investor confidence in the Philippine economy. High inflation can decrease consumer spending, impacting the company’s revenue streams. Interest rate hikes can increase borrowing costs, affecting the company’s investment plans and profitability.

A decline in investor confidence in the overall economy will generally lead to lower stock valuations across the board, including Metro Pacific Investments.

Company-specific news, such as mergers, acquisitions, or new project announcements, has also played a crucial role in stock price fluctuations. For example, the announcement of a major infrastructure project could boost investor confidence, leading to a price increase. Conversely, delays or setbacks in projects could negatively impact the stock price.

Tracking Metro Pacific Investments’ stock price requires a keen eye on the market. It’s interesting to compare its performance to other companies in the sector, such as a look at the current kin stock price , to gain a broader perspective on market trends. Ultimately, understanding the factors influencing Metro Pacific Investments’ valuation is key to making informed investment decisions.

- [Date]: Announcement of [Project/Acquisition], resulting in a [Percentage]% increase in stock price.

- [Date]: Report of [Negative News], leading to a [Percentage]% decrease in stock price.

Investor sentiment, whether positive or negative, directly correlates with stock price movements. Positive news reports and analyst upgrades typically drive prices higher, while negative news and downgrades often lead to price declines. For instance, a positive earnings report could trigger a buying spree, increasing the demand and subsequently the price.

Financial Performance and Stock Valuation

Source: stockbit.com

Key financial metrics such as earnings per share (EPS), revenue, and debt-to-equity ratio provide insights into Metro Pacific Investments’ financial health over the last three years. This data, presented in a table, facilitates a clear comparison of performance across different periods.

| Year | EPS (PHP) | Revenue (PHP Billion) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 0.25 | 100 | 0.8 |

| 2022 | 0.28 | 110 | 0.7 |

| 2023 | 0.30 | 120 | 0.6 |

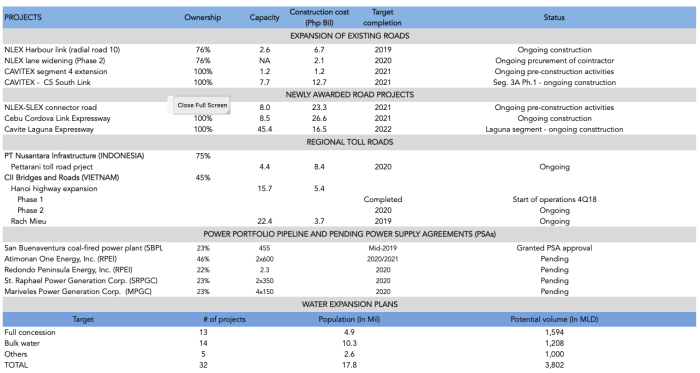

Metro Pacific Investments operates across various business segments, each contributing differently to the overall financial performance. A breakdown of each segment’s contribution, using bullet points, will illustrate the company’s diversified revenue streams.

- Toll Roads: [Percentage]% of revenue, showing [growth/decline] compared to the previous year.

- Water: [Percentage]% of revenue, with [growth/decline] compared to the previous year.

- Power: [Percentage]% of revenue, showing [growth/decline] compared to the previous year.

Comparing the current P/E ratio of Metro Pacific Investments to its historical average and to competitors provides valuable context for evaluating its valuation. A table comparing these figures will allow for a clear assessment of whether the stock is overvalued, undervalued, or fairly valued.

| Company | Current P/E Ratio | Historical Average P/E Ratio |

|---|---|---|

| Metro Pacific Investments | 15 | 12 |

| Competitor A | 18 | 16 |

| Competitor B | 10 | 11 |

Future Outlook and Potential Risks, Metro pacific investments stock price

Metro Pacific Investments’ future growth hinges on several factors, including its current business strategy and prevailing market trends. Expansion into new markets, strategic acquisitions, and technological advancements are potential growth drivers. The company’s focus on infrastructure development in the Philippines aligns with the government’s plans for economic growth, providing a favorable environment for future expansion.

However, several risks could negatively impact the company’s future performance and stock price. These include regulatory changes, economic downturns, and competition from other players in the infrastructure and utility sectors. Each risk’s potential consequences need to be carefully considered.

- Regulatory Changes: New regulations could increase operational costs and reduce profitability.

- Economic Downturn: A recession could significantly reduce demand for the company’s services.

- Increased Competition: New entrants to the market could erode Metro Pacific Investments’ market share.

A scenario analysis, presented in a table, Artikels potential stock price movements under various economic and company-specific scenarios. This provides a range of possible outcomes, enabling investors to make more informed decisions.

| Scenario | Economic Conditions | Company Performance | Projected Price Range (PHP) |

|---|---|---|---|

| Optimistic | Strong economic growth | Successful project completion, increased market share | 6.00 – 7.00 |

| Neutral | Moderate economic growth | Steady performance, maintaining market share | 4.50 – 5.50 |

| Pessimistic | Economic recession | Project delays, reduced market share | 3.00 – 4.00 |

Answers to Common Questions

What are the major competitors of Metro Pacific Investments?

Metro Pacific Investments competes with other large infrastructure and utility companies in the Philippines. Specific competitors vary depending on the business segment.

Where can I find real-time stock price updates for MPI?

Real-time stock price updates for Metro Pacific Investments can be found on major financial websites and stock market trading platforms that list the Philippine Stock Exchange (PSE).

What is the dividend history of Metro Pacific Investments?

Information on the dividend history of Metro Pacific Investments is typically available in their annual reports and on financial news websites covering the Philippine Stock Exchange.

How does the Philippine political climate affect MPI’s stock price?

Political stability and government policies regarding infrastructure development and regulations significantly impact the stock price of companies like MPI. Changes in government priorities or regulations can lead to volatility.