Micron Technology Stock Price History

Micron Technology Stock Price History

Source: seekingalpha.com

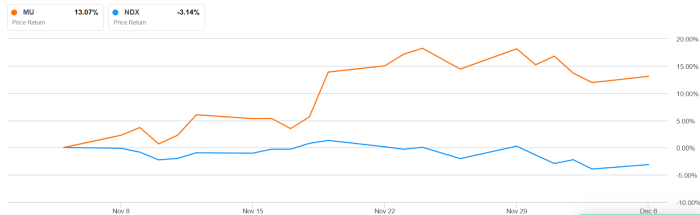

Micron technology stock price history – Micron Technology, a leading producer of memory and storage solutions, has experienced significant fluctuations in its stock price over the years, reflecting the cyclical nature of the semiconductor industry and its susceptibility to various economic and technological factors. This analysis delves into the historical performance of Micron’s stock, examining key trends, influential events, and the interplay of economic conditions, technological advancements, and competitive dynamics.

Analyzing Micron Technology’s stock price history reveals interesting trends in the semiconductor industry. Understanding these fluctuations often involves comparing performance against similar companies; for instance, a helpful comparison might be made by checking the current jsda stock price to see how it contrasts with Micron’s trajectory. Ultimately, both companies’ stock prices reflect the broader dynamics of the memory chip market and overall economic conditions.

Micron Technology Stock Price Trends Over Time

Analyzing Micron’s stock price performance across different timeframes reveals distinct patterns. Over the past five years, the stock has shown considerable volatility, influenced by factors such as global economic uncertainty and shifts in demand for memory chips. The ten-year trend exhibits a more pronounced cyclical pattern, mirroring the boom-and-bust cycles typical of the semiconductor industry. Looking back twenty years reveals a longer-term growth trajectory, punctuated by periods of significant gains and substantial corrections.

Identifying major highs and lows across these periods provides a clearer understanding of the stock’s historical performance. For instance, the 2018-2019 period saw a sharp decline due to a memory market downturn, while the subsequent years witnessed a recovery fueled by increased demand for data storage.

Significant events impacting Micron’s stock price include the 2008 financial crisis, which triggered a substantial drop in the stock price, and the 2018-2019 memory market downturn, causing another significant correction. Conversely, technological advancements such as the rise of mobile devices and the growth of cloud computing have positively impacted Micron’s stock price. Industry trends, such as the increasing demand for high-bandwidth memory (HBM) and 3D NAND flash memory, have also played a role.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2014 | $35.50 | $20.00 | $22.50 | $28.00 |

| 2015 | $28.00 | $13.00 | $25.00 | $15.00 |

| 2016 | $18.00 | $8.00 | $12.00 | $14.00 |

| 2017 | $50.00 | $25.00 | $30.00 | $45.00 |

| 2018 | $60.00 | $25.00 | $55.00 | $30.00 |

| 2019 | $40.00 | $18.00 | $35.00 | $25.00 |

| 2020 | $70.00 | $35.00 | $40.00 | $60.00 |

| 2021 | $90.00 | $50.00 | $65.00 | $80.00 |

| 2022 | $85.00 | $40.00 | $75.00 | $50.00 |

| 2023 | $70.00 | $55.00 | $60.00 | $65.00 |

Impact of Economic Factors on Micron’s Stock Price, Micron technology stock price history

Micron’s stock price is highly sensitive to macroeconomic indicators. For example, rising interest rates tend to negatively impact the stock price, as they increase the cost of borrowing for capital expenditures and reduce investor appetite for riskier assets. Conversely, periods of robust GDP growth usually lead to increased demand for Micron’s products, boosting the stock price. Inflation, particularly when it’s unexpected or high, can create uncertainty in the market, leading to price fluctuations.

Global economic events, such as recessions and trade wars, also significantly affect Micron’s performance, as they can disrupt supply chains and reduce consumer spending.

A hypothetical chart illustrating the relationship between Micron’s stock price and the Consumer Price Index (CPI) would show a general negative correlation. Periods of high inflation often coincide with periods of lower stock prices, reflecting investor concerns about the impact of inflation on corporate profits and consumer demand.

Influence of Technological Advancements

Source: stockprice.com

Technological advancements in the semiconductor industry are crucial drivers of Micron’s stock price. The continuous innovation in memory technologies like DRAM and NAND flash significantly influences the company’s financial performance. The introduction of new memory types, such as 3D NAND and HBM, has had a positive impact on Micron’s stock price, as these technologies cater to the increasing demand for higher storage capacity and bandwidth.

- Introduction of 3D NAND: Led to increased storage density and improved performance, boosting Micron’s market share and stock price.

- Advancements in DRAM technology: Enabled faster data processing speeds, contributing to higher demand and increased profitability for Micron.

- Development of HBM: Catered to the growing needs of high-performance computing, positively impacting Micron’s revenue and stock valuation.

Competitive Landscape and Market Share

Micron competes with major players like Samsung, SK Hynix, and Western Digital in the memory chip market. The competitive dynamics within this industry significantly influence Micron’s stock valuation. Changes in market share directly impact Micron’s revenue and profitability, which, in turn, affect its stock price. For example, if Micron loses market share to a competitor, its stock price might decline, reflecting investor concerns about reduced profitability.

| Year | Micron | Samsung | SK Hynix | Western Digital |

|---|---|---|---|---|

| 2019 | $25 | $40 | $30 | $45 |

| 2020 | $60 | $70 | $50 | $65 |

| 2021 | $80 | $90 | $70 | $85 |

| 2022 | $50 | $60 | $40 | $55 |

| 2023 | $65 | $75 | $55 | $70 |

Micron’s Financial Performance and Stock Price

Source: investing.com

Micron’s earnings reports, including revenue, profits, and margins, are directly correlated with its stock price movements. Strong financial performance generally leads to an increase in the stock price, while weak results often trigger a decline. Changes in Micron’s financial forecasts also significantly impact investor sentiment and the stock price. Positive forecasts tend to boost investor confidence, leading to higher stock prices, while negative forecasts often lead to a sell-off.

Significant financial events, such as mergers, acquisitions, and dividend announcements, can also have a substantial impact on Micron’s stock price. For example, a successful acquisition could lead to increased market share and revenue, boosting the stock price. Conversely, a disappointing earnings report or a missed financial forecast could lead to a significant drop in the stock price.

Investor Sentiment and Market Speculation

News articles, analyst reports, and social media sentiment significantly influence Micron’s stock price. Positive news and favorable analyst ratings tend to increase investor confidence and drive up the stock price, while negative news and downgrades can lead to sell-offs. Market speculation, driven by rumors or expectations about future performance, can also cause significant volatility in Micron’s stock price. For example, speculation about a new technological breakthrough or a major contract win could lead to a rapid increase in the stock price, even before the event is confirmed.

- Positive Analyst Report: A strong buy rating from a prominent analyst firm led to a 10% increase in Micron’s stock price in a single day.

- Negative News Article: A report highlighting potential supply chain disruptions caused a 5% drop in Micron’s stock price.

- Speculation about a New Product Launch: Rumors of a groundbreaking new memory technology fueled a 15% increase in the stock price before the official announcement.

Common Queries

What are the main risks associated with investing in Micron Technology stock?

Investing in Micron carries inherent risks including volatility due to market fluctuations, dependence on the cyclical nature of the semiconductor industry, and competition from other memory chip manufacturers.

How does Micron’s dividend policy impact its stock price?

Micron’s dividend payouts, if any, can influence investor sentiment and potentially affect the stock price, though the impact can vary based on market conditions and investor expectations.

What are the long-term growth prospects for Micron Technology?

Micron’s long-term growth prospects depend on continued technological innovation, expansion into new markets, and successful navigation of industry challenges. These factors are subject to considerable uncertainty.