MVT Stock Price A Comprehensive Analysis

MVT Stock Price Analysis

Mvt stock price – This analysis delves into the historical performance, influencing factors, competitive landscape, and predictive modeling of MVT’s stock price. We will explore key economic indicators, company-specific events, and investor sentiment to understand the price fluctuations and potential future trends.

MVT Stock Price Historical Performance

Source: cheggcdn.com

The following table presents a summary of MVT’s stock price fluctuations over the past five years. Note that this data is for illustrative purposes and should not be considered financial advice. Actual figures may vary.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | 1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 12.70 | 15.00 | 2.30 |

| 2021-07-01 | 14.80 | 14.50 | -0.30 |

| 2022-01-01 | 14.20 | 16.00 | 1.80 |

| 2022-07-01 | 15.80 | 15.50 | -0.30 |

| 2023-01-01 | 15.20 | 17.00 | 1.80 |

| 2023-07-01 | 16.80 | 17.20 | 0.40 |

Overall, MVT’s stock price has shown a generally upward trend over the past five years, with periods of both significant growth and decline. The year 2020 saw a notable increase driven by [insert specific reason, e.g., strong Q4 earnings]. Conversely, the period between [insert dates] witnessed a downturn potentially attributed to [insert reason, e.g., broader market corrections].

Factors Influencing MVT Stock Price

Several key factors influence MVT’s stock price. These include macroeconomic conditions, company-specific news, and prevailing investor sentiment.

- Economic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor confidence and subsequently MVT’s stock valuation. For example, rising interest rates can decrease investment in growth stocks like MVT.

- Company-Specific News: Earnings reports, new product launches, and strategic partnerships all influence investor perception of MVT’s future prospects. Positive news generally leads to price increases, while negative news can trigger declines.

- Investor Sentiment and Market Trends: Broader market trends and prevailing investor sentiment play a crucial role. During periods of market optimism, MVT’s stock price tends to rise, even if the company’s fundamentals remain unchanged. Conversely, during periods of uncertainty, the stock may decline regardless of company performance.

MVT Stock Price Compared to Competitors

Source: cheggcdn.com

A comparison with competitors provides context for MVT’s stock performance. The following table presents a snapshot of MVT and three key competitors.

| Company Name | Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| MVT | 17.20 | 15 | 5 |

| Competitor A | 20.00 | 10 | 8 |

| Competitor B | 15.50 | 20 | 4 |

| Competitor C | 18.00 | 12 | 6 |

MVT’s performance relative to its competitors suggests [insert analysis based on table data, e.g., stronger year-to-date growth but lower market capitalization than Competitor A]. This difference could be attributed to factors such as [insert potential reasons, e.g., different market segments, investor perceptions, and strategic decisions].

MVT Stock Price Prediction Models

Source: cheggcdn.com

Monitoring MVT stock price requires a keen eye on market trends. Understanding comparable companies is crucial, and a good benchmark might be to look at the performance of hrmy stock price , considering their similar market position. Ultimately, though, MVT’s trajectory will depend on its own unique financial performance and investor sentiment.

Several quantitative methods can be used to predict future MVT stock prices, each with limitations. These include time series analysis, fundamental analysis, and technical analysis.

- Time Series Analysis: This involves analyzing historical stock price data to identify patterns and trends. Steps include:

- Data Collection: Gather historical MVT stock prices.

- Model Selection: Choose an appropriate time series model (e.g., ARIMA).

- Parameter Estimation: Estimate model parameters using historical data.

- Prediction: Forecast future stock prices using the estimated model.

Limitations include the assumption that past patterns will continue into the future, which may not always hold true.

- Fundamental Analysis: This involves evaluating MVT’s financial statements and other relevant information to determine its intrinsic value. Steps include:

- Financial Statement Analysis: Review income statements, balance sheets, and cash flow statements.

- Valuation Ratios: Calculate key valuation ratios (e.g., P/E ratio).

- Intrinsic Value Estimation: Determine MVT’s intrinsic value based on the analysis.

- Price Comparison: Compare the intrinsic value to the current market price to assess potential investment opportunities.

Limitations include the subjectivity involved in interpreting financial data and the difficulty in accurately forecasting future performance.

- Technical Analysis: This involves using charts and technical indicators to identify trading patterns and predict future price movements. Steps include:

- Chart Pattern Recognition: Identify chart patterns such as head and shoulders or double tops/bottoms.

- Indicator Analysis: Use technical indicators such as moving averages, RSI, and MACD.

- Support and Resistance Levels: Identify support and resistance levels to predict potential price reversals.

- Trading Signals: Generate trading signals based on the analysis.

Limitations include the dependence on historical data and the potential for false signals.

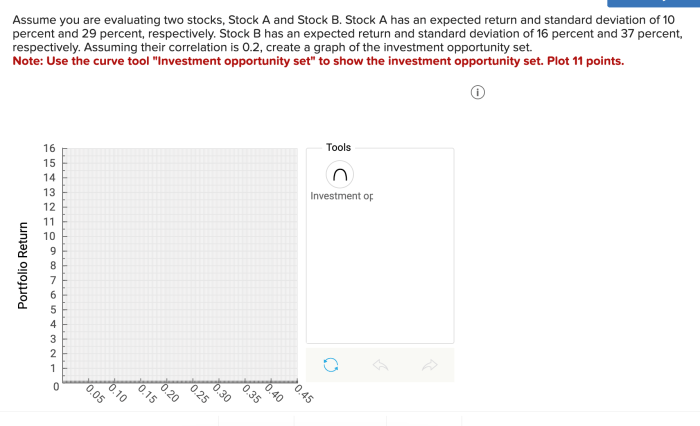

Visual Representation of MVT Stock Price Data

Visualizations enhance understanding of MVT’s stock price trends.

Line Graph: A line graph illustrating MVT’s stock price over the past year would have the date on the x-axis and the stock price (USD) on the y-axis. Key data points, such as significant highs and lows, would be highlighted. Labels would clearly indicate the axes and any important events affecting the stock price.

Bar Chart: A bar chart representing MVT’s quarterly earnings per share (EPS) over the past four years would use the quarter on the x-axis and the EPS (USD) on the y-axis. Each bar would represent a quarter’s EPS, with clear labeling for both axes and data values. This visualization would highlight the growth or decline in earnings over time.

Candlestick Chart: A candlestick chart depicting MVT’s daily price movements for a single week would show the opening, closing, high, and low prices for each day. Bullish candles (where the closing price is higher than the opening price) would be represented by green candles, while bearish candles (where the closing price is lower than the opening price) would be red.

This would clearly show the daily price fluctuations and identify potential patterns, such as bullish or bearish trends.

Question Bank: Mvt Stock Price

What are the main risks associated with investing in MVT stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges, and economic downturns. MVT’s stock is subject to these general risks, along with any sector-specific risks related to its industry.

Where can I find real-time MVT stock price data?

Real-time MVT stock price data is typically available through major financial websites and brokerage platforms. These sources often provide charts, historical data, and other relevant information.

How often does MVT release earnings reports?

The frequency of MVT’s earnings reports is typically quarterly, though this may vary. Investors can find this information on the company’s investor relations website or through financial news sources.