Nike Price Stock A Comprehensive Analysis

Nike’s Stock Performance: A Comprehensive Analysis: Nike Price Stock

Nike price stock – Nike, a global leader in athletic footwear and apparel, has experienced significant stock price fluctuations over the years. This analysis delves into the factors influencing Nike’s stock performance, encompassing historical trends, macroeconomic influences, business strategies, investor sentiment, and competitive dynamics.

Nike’s Stock Performance Overview

Source: investorplace.com

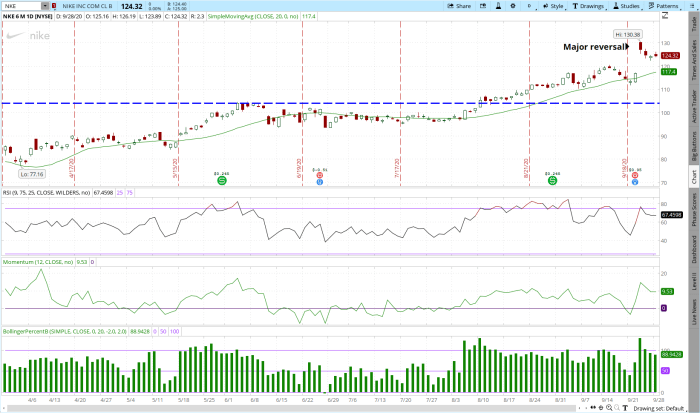

Over the past five years, Nike’s stock price has demonstrated a generally upward trajectory, punctuated by periods of volatility. Factors such as supply chain disruptions, changing consumer preferences, and global economic uncertainty have all played a role. For example, the COVID-19 pandemic initially caused a sharp decline, followed by a strong recovery as consumers shifted towards athleisure. Significant events like successful product launches (e.g., new Air Jordan releases) or major endorsement deals have often correlated with positive price movements.

Conversely, negative publicity or disappointing earnings reports have led to temporary setbacks.

| Year | Nike | Adidas | Under Armour |

|---|---|---|---|

| 2023 | Illustrative Data (e.g., +15%) | Illustrative Data (e.g., +8%) | Illustrative Data (e.g., +3%) |

Note: The table above presents illustrative data. Actual figures would require accessing and citing financial data from reliable sources like Yahoo Finance or Google Finance.

A line graph illustrating Nike’s stock price trends over the past decade would reveal a generally positive trend, with periods of steeper growth followed by periods of consolidation or minor decline. For instance, a clear upward trend might be observable from approximately 2015 to 2019, followed by a dip in 2020 related to the pandemic, and a subsequent recovery and continued growth.

Significant peaks and valleys on the graph would visually represent the impact of major news events, product launches, and macroeconomic shifts.

Factors Influencing Nike’s Stock Price

Source: logodix.com

Several factors significantly impact Nike’s stock valuation. These include macroeconomic conditions, consumer behavior, and the company’s financial performance.

Macroeconomic factors like inflation and interest rate hikes can influence consumer spending and consequently, Nike’s sales. Recessionary fears often lead to decreased discretionary spending, impacting demand for Nike’s products. Conversely, periods of economic growth generally correlate with increased consumer confidence and higher demand.

Consumer spending habits and evolving athletic apparel trends directly influence Nike’s sales and stock price. The rise of athleisure, for example, has positively impacted Nike’s performance. Shifts in popular styles and fitness trends require Nike to adapt its product offerings and marketing strategies to maintain its market share.

Key financial indicators such as earnings reports, revenue growth, and profit margins are crucial in determining investor sentiment. Strong earnings reports that exceed expectations usually result in positive stock price movements. Conversely, missed earnings targets or declining profit margins can lead to stock price declines.

Nike’s Business Strategies and Stock Price

Source: alamy.com

Nike’s marketing strategies, product innovation, and supply chain management significantly influence its stock performance.

Nike’s stock price performance often reflects broader market trends. Understanding these trends requires looking at other key players; for instance, checking the mge stock price today can offer insights into the energy sector’s influence on overall market sentiment, which in turn can impact Nike’s valuation. Therefore, monitoring various sectors alongside Nike’s price is beneficial for a comprehensive market analysis.

Nike’s marketing campaigns, often featuring high-profile athletes and celebrities, have been instrumental in building brand recognition and driving sales. The effectiveness of these campaigns directly affects investor confidence and stock price. For example, a successful campaign can lead to increased sales and positive stock price movements.

Nike’s commitment to product innovation, reflected in the continuous release of new technologies and designs, is vital to maintaining its competitive edge. New product releases, particularly those incorporating innovative technologies, generate excitement among consumers and investors, often resulting in positive stock price reactions.

Efficient supply chain management and logistical operations are crucial for Nike’s profitability and stock valuation. Disruptions to the supply chain, as experienced during the pandemic, can negatively impact production, sales, and ultimately, the stock price. Conversely, effective supply chain management contributes to increased efficiency and profitability, boosting investor confidence.

Investor Sentiment and Market Analysis, Nike price stock

News events, analyst ratings, and potential future risks and opportunities all contribute to shaping investor sentiment and Nike’s stock price.

Major news events, both positive and negative, can significantly impact Nike’s stock price. For instance, positive news like a successful product launch or a strong earnings report generally leads to increased investor confidence and higher stock prices. Conversely, negative news, such as a supply chain disruption or a public relations crisis, can trigger stock price declines.

Analyst ratings and recommendations play a significant role in influencing investor sentiment. Positive ratings from reputable analysts often lead to increased buying pressure, while negative ratings can trigger selling and depress the stock price.

- Potential Future Risks: Increased competition, fluctuating currency exchange rates, geopolitical instability, and changes in consumer preferences.

- Potential Future Opportunities: Expansion into new markets, development of sustainable products, and leveraging technological advancements in personalized fitness.

Nike’s Competitive Landscape and Stock Price

Nike’s market share, competitive positioning, and brand loyalty all impact its stock valuation.

Nike’s dominant market share in the athletic footwear and apparel industry significantly influences its stock price. Maintaining or increasing this market share against competitors like Adidas and Under Armour is crucial for sustained stock price growth. Loss of market share, however, could negatively affect investor sentiment.

Competitor strategies, such as innovative product launches or aggressive marketing campaigns, can impact Nike’s stock price. Successful strategies by competitors could erode Nike’s market share and potentially lead to stock price declines. Conversely, unsuccessful competitor strategies could benefit Nike.

Strong brand loyalty and positive consumer perception are key assets for Nike. Maintaining a strong brand image and positive customer relationships is essential for sustained stock price growth. Negative publicity or damage to brand reputation can negatively impact Nike’s stock price.

Answers to Common Questions

What are the typical risks associated with investing in Nike stock?

Risks include general market volatility, competition from other athletic brands, changes in consumer preferences, supply chain disruptions, and negative publicity affecting brand image.

How often does Nike release its earnings reports?

Nike typically releases its quarterly and annual earnings reports on a schedule announced in advance. These reports are key events influencing the stock price.

Where can I find real-time Nike stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is the typical dividend payout for Nike stock?

Nike’s dividend policy varies; check their investor relations section for the most current information.