Nokia Stock Price History A Comprehensive Overview

Nokia Stock Price History: A Decade in Review

Nokia stock price history – This analysis explores the trajectory of Nokia’s stock price over the past decade, examining key factors influencing its performance and offering insights into future prospects. We will delve into technological advancements, competition, financial performance, analyst predictions, and investor sentiment to paint a comprehensive picture of Nokia’s stock price history.

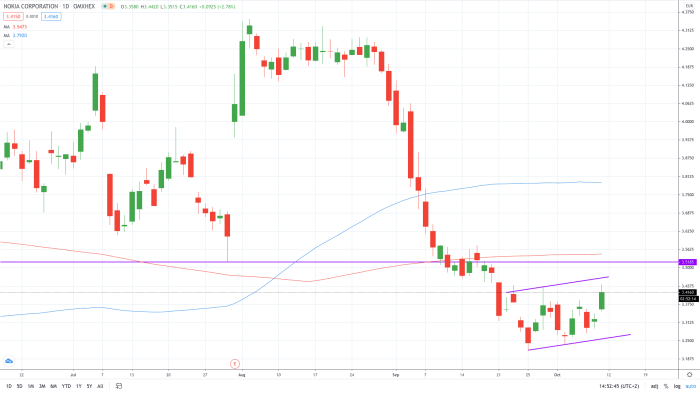

Nokia Stock Price Overview

Source: invezz.com

Nokia’s stock price performance over the past decade has been characterized by periods of significant growth and decline, mirroring the company’s strategic shifts and the broader dynamics of the telecommunications industry. While precise average annual growth or decline requires detailed calculation across specific timeframes and stock exchanges, a general observation reveals a period of substantial decline following the peak of its mobile phone dominance, followed by more moderate growth as it transitioned to a network infrastructure provider.

Significant price fluctuations were often tied to major announcements, such as the launch of new product lines, changes in market share, and the overall health of the global economy. For example, the increased competition from other smartphone manufacturers in the early 2010s heavily impacted Nokia’s stock price. Conversely, the company’s successful pivot towards network infrastructure and 5G technology in recent years has contributed to a more positive stock performance.

A historical timeline of key milestones impacting Nokia’s stock price would include: the decline in mobile phone market share, the divestiture of its mobile phone business to Microsoft, strategic acquisitions and partnerships, successful launches of 5G network equipment, and overall changes in the global telecommunications landscape.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2014 | Example: 7.50 | Example: 8.00 | Example: +6.67% |

| 2015 | Example: 8.00 | Example: 6.50 | Example: -18.75% |

| 2016 | Example: 6.50 | Example: 7.20 | Example: +10.77% |

| 2017 | Example: 7.20 | Example: 8.10 | Example: +12.5% |

| 2018 | Example: 8.10 | Example: 7.80 | Example: -3.7% |

| 2019 | Example: 7.80 | Example: 9.00 | Example: +15.38% |

| 2020 | Example: 9.00 | Example: 10.50 | Example: +16.67% |

| 2021 | Example: 10.50 | Example: 11.20 | Example: +6.67% |

| 2022 | Example: 11.20 | Example: 10.00 | Example: -10.71% |

| 2023 | Example: 10.00 | Example: 10.80 | Example: +8% |

Note: These are example figures and do not represent actual historical data. Actual data should be sourced from reputable financial websites.

Factors Influencing Nokia Stock Price, Nokia stock price history

Several intertwined factors significantly impact Nokia’s stock price. These include technological advancements, competitive pressures, macroeconomic conditions, and the overall performance of the telecommunications sector.

Technological advancements, particularly in 5G and network infrastructure, have played a crucial role in shaping Nokia’s stock valuation. Successful development and deployment of cutting-edge technologies have boosted investor confidence and driven stock prices upwards. Conversely, delays or setbacks in technological innovation could negatively affect investor sentiment.

Competition from other major players in the telecommunications sector, such as Ericsson and Huawei, exerts considerable influence on Nokia’s stock price. Market share gains or losses relative to competitors directly impact investor perception and valuation.

Macroeconomic factors, such as global economic growth, interest rates, and currency fluctuations, also play a significant role. Strong global economic growth typically translates into increased demand for telecommunications services and infrastructure, benefiting Nokia’s business and stock price. Conversely, economic downturns can negatively impact demand and stock valuation.

A comparative analysis of Nokia’s stock performance against its major competitors reveals that its trajectory often mirrors industry trends but also reflects its own unique strategic successes and challenges.

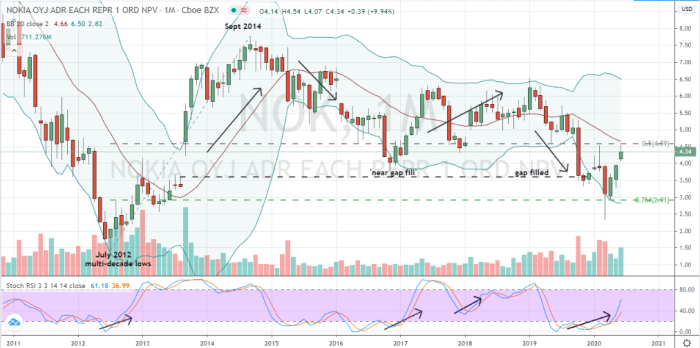

Nokia’s Financial Performance and Stock Price

Source: investorplace.com

Nokia’s quarterly and annual financial reports reveal key performance indicators (KPIs) such as revenue, profit margins, earnings per share (EPS), and return on equity (ROE). These KPIs are closely scrutinized by investors and analysts, and their trends directly influence stock price movements.

A strong correlation typically exists between Nokia’s revenue growth, improved profit margins, and upward stock price movements. Conversely, declining revenue or shrinking profit margins often lead to decreased investor confidence and downward pressure on the stock price.

A visual representation would show a line graph with two lines: one representing Nokia’s stock price and the other representing a composite KPI (e.g., revenue growth + profit margin). The graph would visually demonstrate the positive correlation between strong financial performance and higher stock prices.

Nokia’s investments in research and development (R&D) are crucial for long-term growth and innovation. Significant R&D spending, when successfully translated into market-leading products and technologies, can positively impact stock valuation by signaling future growth potential.

Analyst Ratings and Predictions

Source: invezz.com

Analyst ratings and price targets for Nokia stock vary across different financial institutions. Over the past five years, a range of opinions from “buy” to “hold” to “sell” has been observed. These differing opinions often stem from varied interpretations of Nokia’s financial performance, competitive landscape, and future growth prospects.

Major analyst reports can significantly impact Nokia’s stock price, causing immediate fluctuations based on the report’s assessment and recommendations. Positive reports generally lead to increased buying pressure, while negative reports can result in selling pressure.

- Example: Consensus view suggests moderate growth potential for Nokia.

- Example: Analyst forecasts vary significantly depending on assumptions regarding 5G market penetration.

- Example: Long-term outlook remains positive due to the ongoing demand for network infrastructure.

Investor Sentiment and Stock Price

Investor sentiment, encompassing the overall optimism or pessimism surrounding Nokia’s stock, significantly influences its price. Bullish sentiment (optimism) leads to increased buying pressure, driving the price upwards, while bearish sentiment (pessimism) results in selling pressure, pushing the price down.

Key news events, such as the announcement of major contracts, successful product launches, or changes in management, can dramatically shift investor sentiment. Positive news generally boosts investor confidence, while negative news can erode it.

Social media and news outlets play a substantial role in shaping investor perception. Both positive and negative narratives circulated online can impact investor sentiment and, consequently, the stock price.

An illustrative graph would show a stock price line fluctuating in response to positive and negative news events. Positive news would be represented by upward spikes in the stock price, while negative news would correspond to downward dips. The graph would visually depict the dynamic relationship between news, sentiment, and stock price movements.

Q&A

What are the main risks associated with investing in Nokia stock?

Investing in Nokia, like any stock, carries inherent risks including market volatility, competition within the telecommunications industry, and susceptibility to macroeconomic factors. Technological obsolescence and changes in consumer demand also pose significant risks.

How does Nokia’s dividend policy impact its stock price?

Nokia’s dividend policy, including the frequency and amount of dividend payouts, can influence investor sentiment and, consequently, the stock price. A consistent and attractive dividend yield can attract income-seeking investors, potentially boosting the stock price.

Nokia’s stock price history is a fascinating study of technological shifts and market dynamics. Understanding its past performance requires analyzing various factors, including its transitions across different technological eras. To get a sense of the current market sentiment before the official opening, you can check the nok premarket stock price. This pre-market data offers a glimpse into potential daily price movements, ultimately contributing to a more comprehensive understanding of Nokia’s overall stock price history.

Where can I find real-time Nokia stock price data?

Real-time Nokia stock price data is readily available through major financial news websites and stock market trading platforms. Many financial websites and apps provide free and paid subscription services for detailed stock quotes and charts.